Keeping investment costs low may be David Zuckerman’s most important job as an adviser. Over the last few years, he’s shifted client assets out of pricier mutual funds and into lower cost exchange-traded funds – he now has 70% of his client’s equity investments in ETFs.

Naturally, he’s been excited to see that fees on numerous ETFs have come down even further over the last few months. “I’ve embraced my role as a cost controller,” says the founder of Los Angeles-based Zuckerman Capital Management. “It’s good to see that fees keep falling.”

In October, the ETF fee wars began heating up yet again. BlackRock cut costs on a number of its products, including its iShares Core S&P ETF, which went from 0.07% to 0.04%. Charles Schwab slashed its fees soon after, reducing its small-cap and mid-cap ETF funds from 0.07% to 0.06%. BlackRock then cut fees on several smart-beta products, while Fidelity lowered its costs, too. In February, ETF giant Vanguard began trimming fees on 124 of its fund shares, including on its S&P 500 fund, which fell by one basis point to 0.04%.

For cost-conscious advisers like Zuckerman, anytime a client can pay less on an investment the better, but with costs already so low on so many ETFs, many are asking themselves whether it’s worth switching to a new provider, just to save a basis point or two.

It’s a something Zuckerman has wondered about himself. “I haven’t changed any of my holdings this year in response to a change in fees,” he says. “But if I wasn’t as confident that my ETF lineup was as low cost as it could be, then I would re-evaluate."

FEES KEEP FALLING

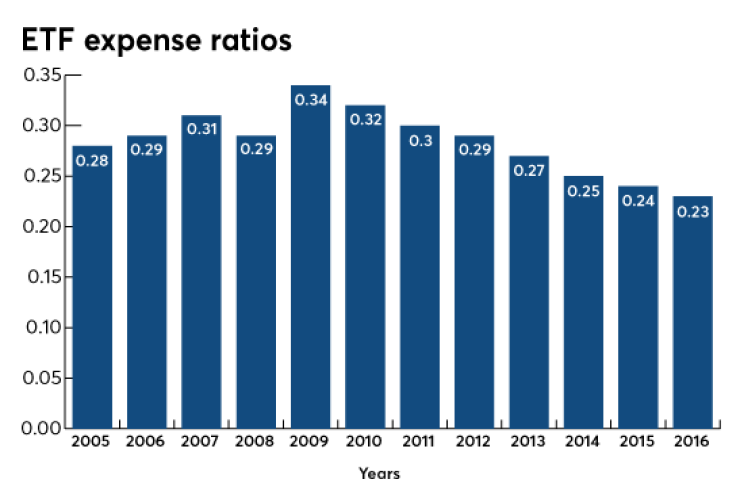

Fee cuts are nothing new in the ETF world. According to the Investment Company Institute, the average expense ratio on index equity ETFs was 0.23% in 2016, down from 0.34% in 2009.

At one time, Vanguard was the only major retail-focused player in the ETF space, but that changed in 2009 when BlackRock purchased Barclays Global Investors, which started the iShares brand. Soon after the sale, BlackRock began chopping fees to get more market share.

“They decided to do more of a smash and grab and go for a ‘take as much share as we can’ approach,” says Greggory Warren, an equity analyst with Morningstar. “That’s more or less been their modus operandi for the past seven years.”

They’re doing it partly to attract new investors – and rising ETF inflows have allowed these companies to afford the fee cuts – but it’s mostly because they don’t want to lose the ones they have. “It’s all about maintaining share,” says Warren. Indeed, even some core products, such as IVV, iShares’ S&P 500 ETF, and VOO, Vanguard’s S&P 500 fund, have seen fees cut by several basis points over the last few years.

However, a company like State Street, which runs the SPDR S&P 500 fund, the largest S&P 500 ETF, hasn’t entered the fee war fray, opting to keep its fee on that fund at 0.09%. “If I were State Street, I would be more nervous if the other guys are selling at 4 basis points when you’re selling at 9.”

MORE TO ETFs THAN FEES

If the fee wars have done one thing besides allowing clients to keep more of their return, it’s that it’s made advisers think harder about other factors that go into product selection. If every fund comes with about the same ultra-low price, then expenses stop becoming a differentiator.

Marty Reid, president of Lincolnton, North Carolina’s Reid Financial Consulting, says that costs have always played a part in ETF selection, he is putting even more emphasis on other factors now that costs are so low. He looks at sector weights, returns, dividends, valuations and more when deciding what to put in client portfolios.

“Cost is important, but it’s not the only factor we consider, especially if we’re talking a couple of basis points between funds,” he says.

Zuckerman agrees. All else being equal, he’d buy the fund with the lowest cost. But at these prices, he can base decisions on other factors, like downside capture and risk-adjusted returns, and still be able to carry out his fiduciary duties.

Still, Zuckerman is keeping an eye on where the fee wars go next. In theory, costs could drop to zero, but it’s unlikely as it would cost providers a lot of to give away their products. Economies of scale could allow BlackRock and Vanguard to cut a little more, but Warren thinks we’re nearing a bottom.

Some funds, though, do have room to move. International equities and other specialty funds still charge 40 to 60 basis points and if those expenses dropped to 15 basis points, then Zuckerman would be quick to shift assets to a competing product.

In any case, the fee wars are good for clients, he says, and if one of his funds starts to look less attractive than another, he will make the switch. “I have made changes in years past based on lower fees,” he says. “And it’s definitely something I’ll take into account in the future.”