Michael Kitces is among the brightest minds and most prolific thought leaders for the financial planning profession, but his perennial endorsement of the CFP Board of Standards and his willingness to advance the board’s public misinformation campaign are decidedly enigmatic. This is most recently illustrated by Kitces’ puff piece for the CFP Board —

The piece begins with a case for the CFP designation becoming a requirement for all financial planners because there are currently no competency standards for the profession. He writes: “This low barrier for entry has meant that even licensed insurance sales people who technically can’t be paid for dispensing advice can call themselves advisors.”

On the surface, Kitces appears to have a legitimate point. It is true that there is currently no academic requirement for becoming an SEC-registered financial planner or investment advisor. However, as Kitces is well aware, all SEC-registered financial planners must provide a copy of

This plain-English document begins with a disclosure of the planner’s educational background and experience. If the planner has no formal academic training in finance, it will be immediately obvious to the reader. As a practical matter, the public disclosure requirements of SEC-registered financial planners actually create a barrier for would-be planners with no academic qualifications or professional training.

Paradoxically, professional designations, such as the CFP mark, offer a path to perceived credibility for those who have no related academic experience. As Kitces describes

As such, it should not be terribly surprising that consumers express confusion over who is a real financial planner and who is not.

Despite its endorsement by the American College of Financial Services (formerly known as the

-

Jack Brod, the chair-elect of the board of directors, plans to heighten enforcement efforts to ensure CFPs are consistently acting as fiduciaries.

July 23 -

Creation of the blue-ribbon body draws praise and confusion from CFPs who question its utility.

June 28 -

The certification could stop being the gold standard and become the requirement, if only the regulatory path were clearer.

December 26 -

The good, the bad and the downright inexplicable in the suggested changes.

February 12

Additionally, while the CFP Board proclaims to be the “Highest Standard” for the financial planning profession, its self-defined “fiduciary standard” is far weaker than the SEC’s standard. Specifically, as presented in the

In contrast, the SEC’s fiduciary standard, as articulated in its publication

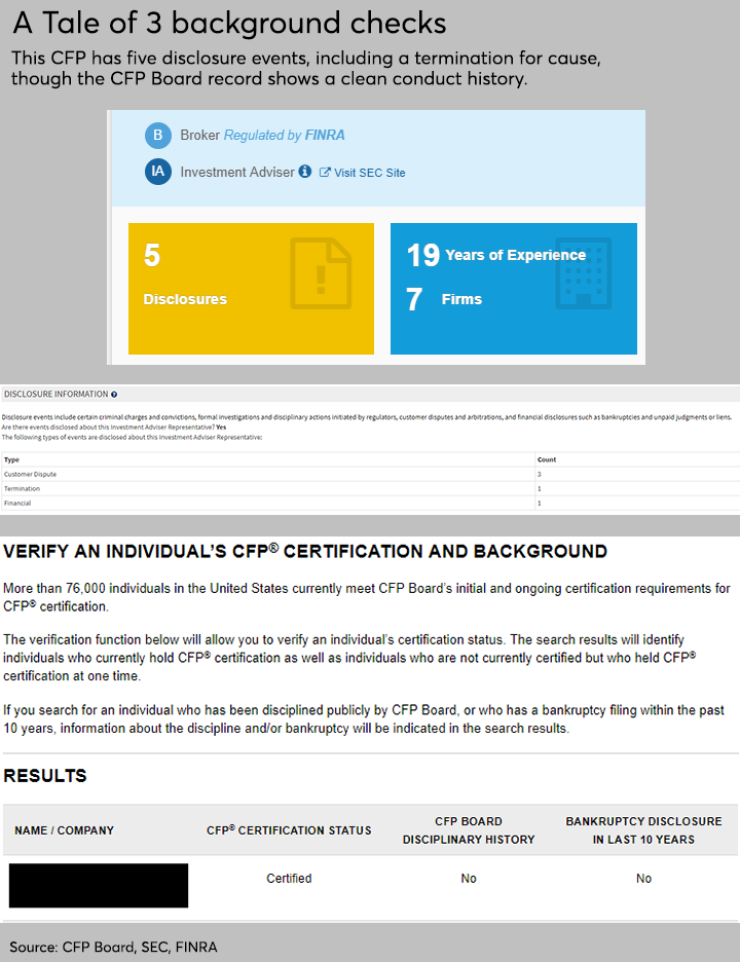

For all of the misperceptions that Kitces spins in his narrative, perhaps the most egregious is his suggestion that the CFP Board is somehow more qualified to handle enforcement than the SEC. As he states in the second paragraph: "… given the SEC’s lax enforcement of the Investment Advisers Act of 1940, there’s not a strong regulatory partner in this fight." The absurdity of this suggestion is demonstrated anecdotally in

The CFP-certified advisor referenced in the graphic has five disclosure events, as revealed by

The tagline from the CFP Boards’ widely syndicated, multi-million dollar “

Per the example above, so much for “thoroughly vetted.” So much for “the highest standard.” Perhaps it is time for the financial planning community at large and the regulators to wake up to the self-serving, anti-consumer misinformation campaign that is being waged by the CFP Board and its acolytes, including Mr. Kitces.

For further reference, see also: