Campaign promises are more often made than kept, yet the first hundred days in office for Donald Trump will surely answer some of the unsettling questions regarding taxes and money. I see two areas where financial planners could feel a direct impact from this election very quickly.

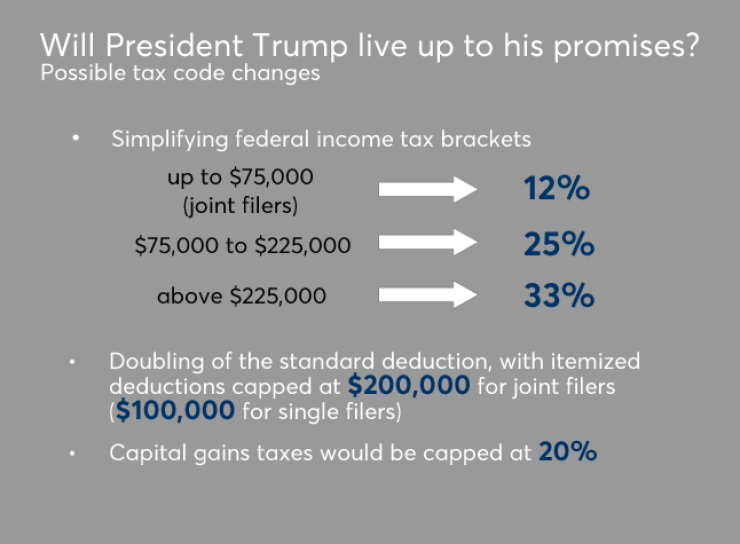

The first is taxes. Many of candidate Trump’s proposals were made off-the-cuff and some are contradictory, but you can expect President Trump to make an effort to change our tax code. He has proposed simplifying our federal income tax to three brackets for ordinary income: 12% (up to $75,000 for joint filers), 25% ($75,000 to $225,000) and 33% (above $225,000). The wish list includes a doubling of the standard deduction, with itemized deductions capped at $200,000 for joint filers ($100,000 for single filers). Capital gains taxes would be capped at 20%.

Under President Trump working with a Republican Congress, federal estate and gift taxes might be eliminated. But the candidate had also proposed to eliminate the step-up in basis for estates over $10 million.

Remember that these proposals were made before anyone imagined that Americans would elect an undivided government, with the presidency, the House and Senate all under the control of one party. The next four years – indeed, the first 100 days of the new presidency – represent an opportunity to do something much more ambitious than simply tinker with our nation’s tax rules. Influential Republican leaders, including House Speaker Paul Ryan, reportedly plan to introduce a comprehensive tax overhaul. The goal would be tax simplification, but the bet here is that whatever form this takes will add thousands of pages to the current law.

The other change advisers are sure to see wasn’t mentioned by candidate Trump, but is even more certain than a tax overhaul. President Trump is unlikely to support the Department of Labor’s fiduciary rule; I suspect that as of about midnight last night, the planning and broker-dealer community ceased all preparations for changing their policies and procedures to conform to the rule’s best interest contract exemption.

-

The Republican's hostility to all things Obama sets the stage for dramatic departures on financial regulation.

November 30 -

An index of SourceMedia's comprehensive election analysis for professionals in financial services, health care and technology. With coverage of more than 50 contests and ballot initiatives.

November 9 -

We have the most expensive and fragmented health care in the world, so now what?

November 7

I expect Trump’s head of the Department of Labor will immediately unravel the work of eight long years, and we can expect a new SEC commissioner to be more sympathetic to Wall Street code words like “harmonization” and “level playing field” than a strict fiduciary standard for asset gatherers and sales people.

The rapid, evolutionary shift from sales to true fiduciary and professionalism in the planning realm has been halted, and it will be hard to pick up those pieces once President Trump leaves office in four or eight years.

There might be a silver lining for the profession: Any shift in tax rates, particularly if there is comprehensive “reform,” would create a great deal of confusion among affluent taxpayers. It is not hard to imagine an environment where many people would be knocking on your doors asking how the changes in tax law will impact them.

But for many of us in the advisory world, this is small consolation for losing the progress toward a fiduciary standard (read: professionalism) and away from sales. We could be facing a very tough four years for those lobbying on behalf of fiduciary financial planners – a setback that will affect the true planning profession for a decade at least.