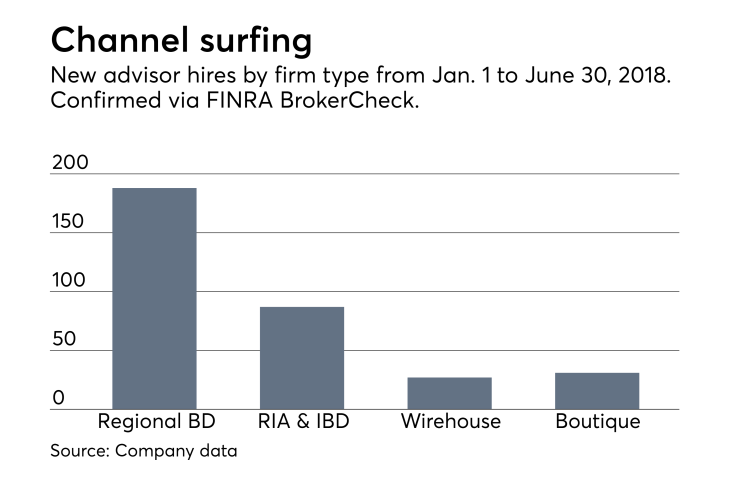

Regional firms are red hot. They've become a favored destination for high-end wirehouse advisors. Companies like Raymond James, Janney, Ameriprise and Stifel have all recently racked up some impressive hires.

It's easy to understand why.

To be sure, regional firms offer a quality-of-life move for many wirehouse advisors who are frustrated with unpredictable policy changes and who want to feel connected to home-office people and senior management in a way that's often difficult at larger firms.

While many advisors favor the turnkey wirehouse model with its household name branding, there are many compelling reasons that explain the appeal of regionals.

Wirehouses regularly monkey with their compensation programs every November. While most firms are reluctant to alter the grid itself, it's common for wirehouses to shift more of the cash payout into deferred compensation or announce new and complex schemes each year for earning deferred compensation or growth awards. Wirehouse advisors are often left feeling frustrated and without a basic sense of control over their work environment. Payout grids at regionals are rarely changed, so when you join, what you see is what you get.

-

If wirehouses decided to adopt a salary-plus-bonus compensation model, how would they do it?

June 4 -

Thinking of leaving a big broker-dealer? Answer these three questions first, recruiter Mark Elzweig writes.

April 2 -

The firm achieved a record 7,719 independent and employee advisors in the second quarter.

July 26

Many advisors value the ease of access and the heightened sense of connection at regional firms. An advisor that I recently placed at a regional broker-dealer appreciates the fact that she can call her firm’s traders directly and that it's easy for her to build personal relationships with them. She's a new recruit, and one trader just spent time helping her get acclimated to the new technology.

Another plus on the side of regionals is that wirehouse advisors don't need to change their business models. Advisors who opt for independence must learn the ins and outs of the various independent business models so that they can choose properly. That's a process that requires a considerable investment of time.

Unlike independents, regional firms pay hefty signing bonuses. These can reach 150% or more for top advisors in addition to back-end bonuses.

The withdrawals of Morgan Stanley and UBS from the Broker Protocol have also boosted the appeal of regionals, which have lots of experience onboarding advisors from non-protocol firms. Advisors who join regionals can take comfort in the fact that if they carefully follow their new firm's instructions, the departing firm usually will not be able to prevail in any legal action.

Plus, regionals typically pick up the legal bills and defend their new hires as long as they adhere to their transition instructions. Especially this year, that's made many advisors feel that it's much safer to join a regional firm than to go independent.

Advisors who set up their own RIA, for example, are on the hook for any legal battles with their former firm. Custodians and independent broker-dealers may advise them on proper transition strategies, but they don't pay for their legal defense. That's a responsibility of the independent business owner. Wirehouses who ditched the protocol to slow down the movement to independence have thus far achieved their goal.

The good news is that the code has been cracked on how to successfully exit a non-protocol firm. Advisor moves from both Morgan Stanley and UBS are accelerating.

As the method to properly leave these firms becomes more widely known, more advisors who want independence will have the confidence to make their own moves.

Independence offers its own compelling rationale. Older advisors don't have to sign a nine-year contract with a new firm. Deals offered by independent broker-deals are typically for a shorter duration, only five years. Net payouts after expenses for independent advisors are usually in the 60% to 65% range. Most importantly, independent advisors can craft the sale price of their practices and realize that amount as a capital gain as long as they've owned their practice for more than one year. This is the pot of gold at the end of the independent rainbow.

Once the lawsuit fear factor is removed from the equation, independence will become a more popular destination. Competition between the two channels will heat up. I think that regionals will retain their favored status.

But while regional broker-dealers will likely remain in the catbird seat, soon enough they'll have more competition from their independent firm brethren.