-

Many owners of privately held businesses are planning to sell at least part of their interests in the firm in the next five to 10 years, a Raymond James study found.

January 20 -

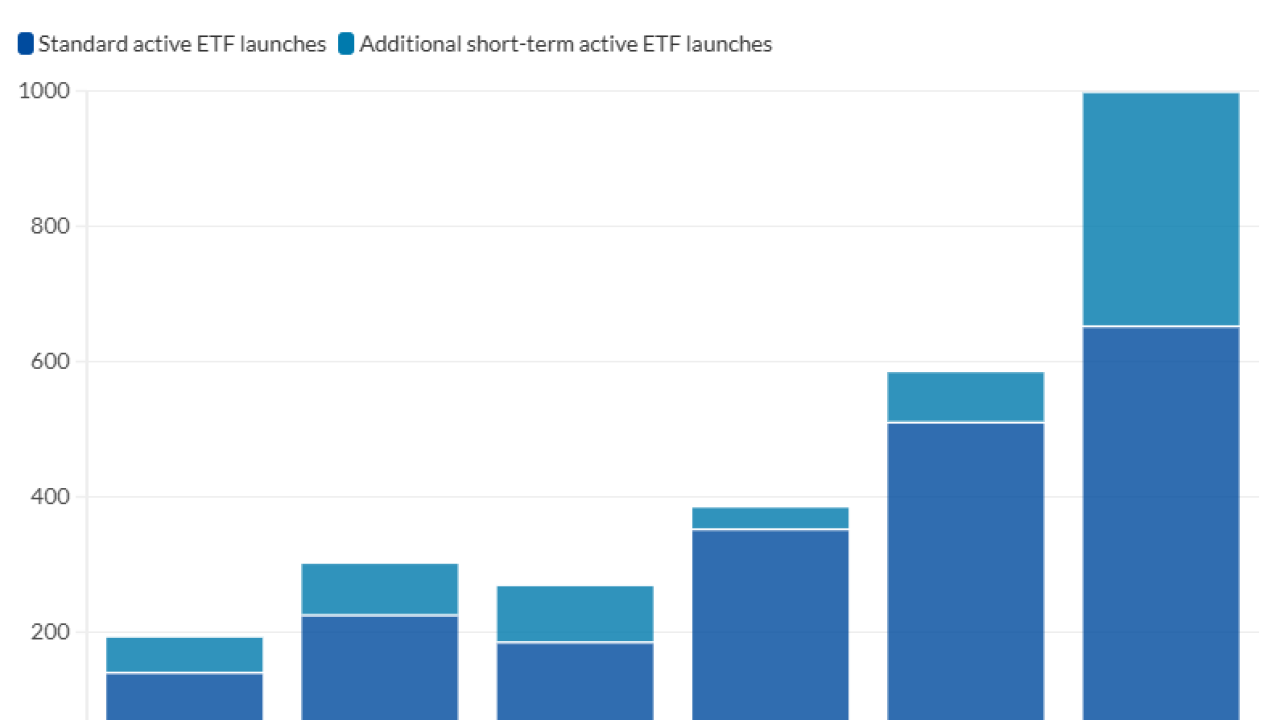

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

Goldman Sachs shattered expectations with a record $4.31 billion in fourth-quarter equities trading revenue, topping its own Wall Street high set just months earlier.

January 15 -

The wealth management giant capped off 2025 by pressing ever closer to the asset and wealth management target set by former CEO James Gorman.

January 15 -

An organic growth technology firm launched out of Fidelity Investment's incubator spoke with 18 big RIAs about their marketing. The results speak for themselves.

January 14 -

A sharp fourth-quarter decline in net new investment assets weighed on Citi's wealth division, tempering full-year growth despite revenue gains.

January 14 -

Bank of America's wealth management businesses suffered a blow last year when principals of a team that managed $130 billion in AUM left for independence. Merrill executives are now looking to the future with ambitious recruiting and cross-selling plans.

January 14 -

The massive intake preceded the BNY-owned custodian's rollout of a new financial advisor matchmaking service aimed at conversions from institutional clients.

January 13 -

The megabank sees its asset inflows swell by 14% while reporting greater numbers of client advisors and private bank advisors.

January 13 -

Wells Fargo stands out among wirehouses with FiNet, its dedicated channel for independent advisors. Wells Fargo Advisors head Sol Gindi says this structure gives the firm a competitive advantage rivals will find difficult to replicate.

January 13 -

The justices are scheduled to resolve disagreement among lower courts over whether market regulators can order fraudsters to repay ill-gotten gains to victims.

January 12 -

A new proposal would allow firms to tack three additional months onto the amount of time they can place holds on the accounts of clients 65 and older in cases of suspected financial exploitation.

January 9 -

The regulator considers raising the AUM threshold it uses when considering how newly proposed rules are likely to affect small RIAs.

January 8 -

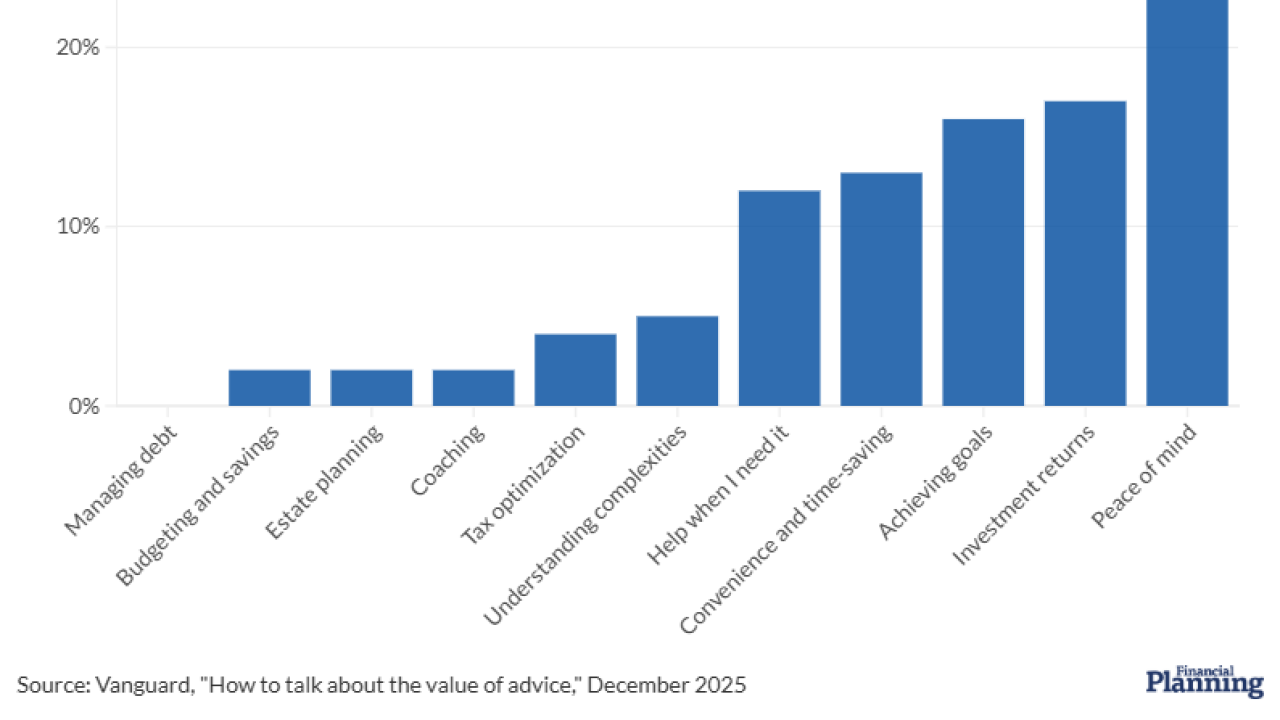

Vanguard's latest poll and analysis offers a multifaceted explanation into how financial advisors should talk about their value to clients and prospective customers.

January 8 -

Fewer U.S. adults have non-retirement investment accounts than three years earlier, and many retail investors struggle with understanding fees and fraud risk.

January 7 -

Under a new proposal, clients would have to opt in to receiving account statements and other documents in paper form.

January 5 -

The U.S. and more than 100 other countries finalized an agreement that would exempt American companies from some foreign taxes.

January 5 -

A FINRA arbitration panel finds a "pattern" in JPMorgan's attempts to blacken the regulatory records of advisors moving to rival firms.

January 2 -

American Portfolios Financial Services, a formerly independent brokerage now under the Osaic umbrella, was accused of not being forthright about its handling of clients' uninvested cash.

December 31 -

A detailed to-do list for SEC-registered firms to build a foundation for compliant and effective anti-money laundering protocols.

December 31 Flagright

Flagright