-

From digital-tool adoption to changing client conversations, industry insiders discuss the pandemic’s impact on wealth management.

March 15 -

Citing strong client demand, the nation's largest custody bank is building infrastructure and a team that can help clients store and manage bitcoin and many other types of virtual currency and tokenized assets.

February 23 -

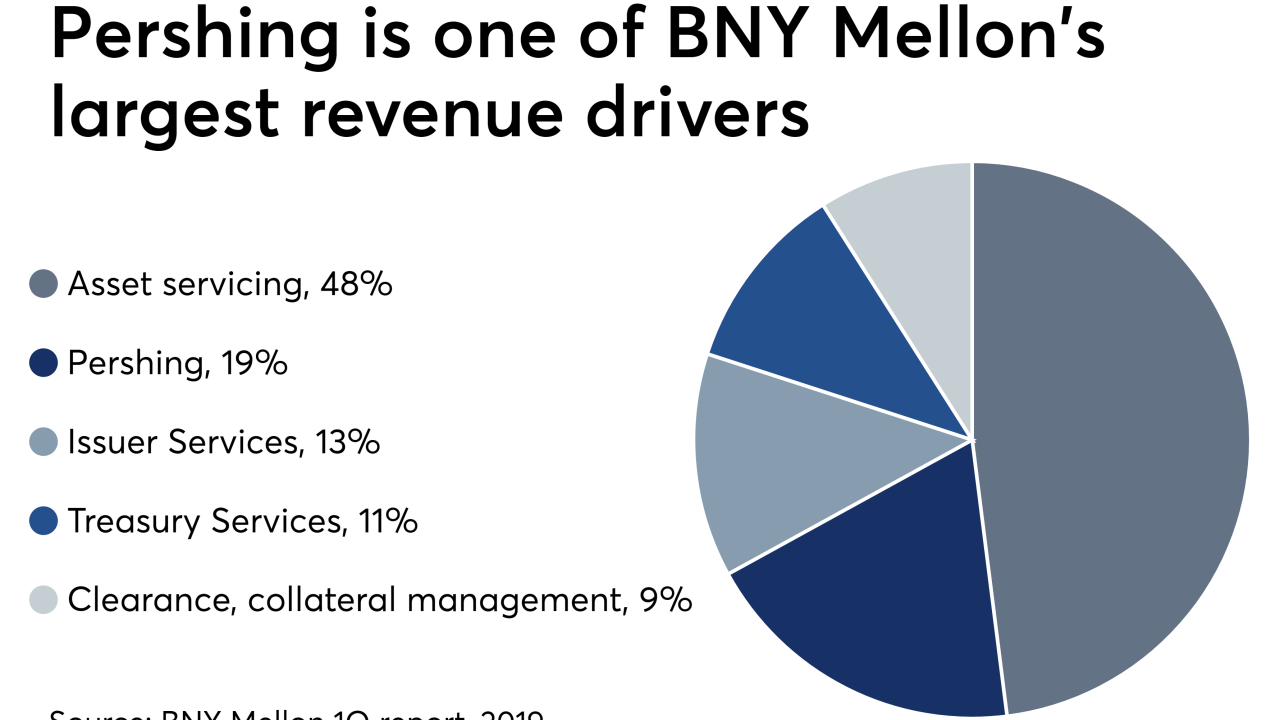

BNY Mellon’s custodian is growing, even as it loses some major clients amid industry consolidation.

January 21 -

The bank allegedly made “hundreds of millions of dollars” by investing client assets in underperforming proprietary and affiliated funds without disclosing conflicts to clients.

December 30 -

BNY Mellon’s CEO also sees a distribution opportunity for the company’s proprietary funds.

October 20 -

The custodian’s NetX360 desktop now supports biometric authentication.

September 2 -

New digital integrations with CAIS and iCapital make it easier for independent advisors to access private equity and hedge funds.

August 26 -

The firm's new suite of eight low-cost ETFs include two funds that are no-fee.

June 5 -

The clearing and custody giant isn’t saying which company paid it a notable breakage fee this quarter.

April 23 -

The ETF’s debut marks the first big entrant into the zero-cost space with the potential to shake up products from BlackRock, State Street and Vanguard.

March 6 -

The major custodian lost its second arbitration case — with even more filings likely — over the services it provided to a brokerage later proved to be engaged in massive fraud.

February 27 -

Charlie Scharf’s most immediate priorities include mending fences with regulators and getting the bank out from under a Fed-imposed asset cap.

September 27 -

Charles Scharf will replace interim chief Allen Parker at the bank.

September 27 -

Some banks are setting up their own parallel digital banks, while others form innovation labs. Roman Regelman says BNY Mellon is transforming the entire institution.

June 24 -

Shannon Kennedy will lead a global expansion of the unit, with a team of more than 200 people.

June 21 -

After a reboot in its tech strategy, the RIA custodian is “redesigning every aspect of the advisor experience,” it says.

June 17 -

Revisiting his predictions from 2017, he doubles down on the importance of firms adapting to embrace industry trends — and offers some new forecasts.

June 13

-

The mutual funds and ETFs that ranked at the bottom of the sector still benefited from a “long-running bull market,” an expert says.

May 1 -

The fund aims to undercut its cheapest competitor by 1 basis point.

April 17 -

Name changes are coming to 94 of the firm’s long-term mutual funds.

March 29