-

David Bahnsen told the president that that Milken’s prosecution was a result of “a period of class envy run amok.”

August 30 -

The loss comes even as the firm has been acquiring new breakaway teams and RIAs.

August 22 -

The move is HighTower's 22nd transaction this year ― making 2017 the firm's busiest year ever.

August 21 -

The Northeast prevails, but there's a surprise in the rankings revealed by this interactive infographic.

August 10 -

"At least 50% of our assets are three generations or more," explains Bob White of HighTower.

August 8 -

"I probably spent the first three years in the business not opening my mouth with clients and just learning from him," says J.R. Gondeck of HighTower.

August 7 -

Michael LaMena's exit continues the management shake-up at the Chicago-based RIA.

July 31 -

Former AMG executives buy stake in three regional wealth managers for use as aggregation vehicles.

July 10 -

The firm isn't the only one benefiting from a still strong breakaway movement.

July 7 -

Two large RIAs cut ties with HighTower but new hires include a branding strategist who created Jim Cramer's 'Mad Money.'

July 6 -

The group opted to join HighTower, which has added nine teams so far this year.

May 22 -

"It's always nice when one poker player folds and it's down to two or three players," one recruiter says.

May 12 -

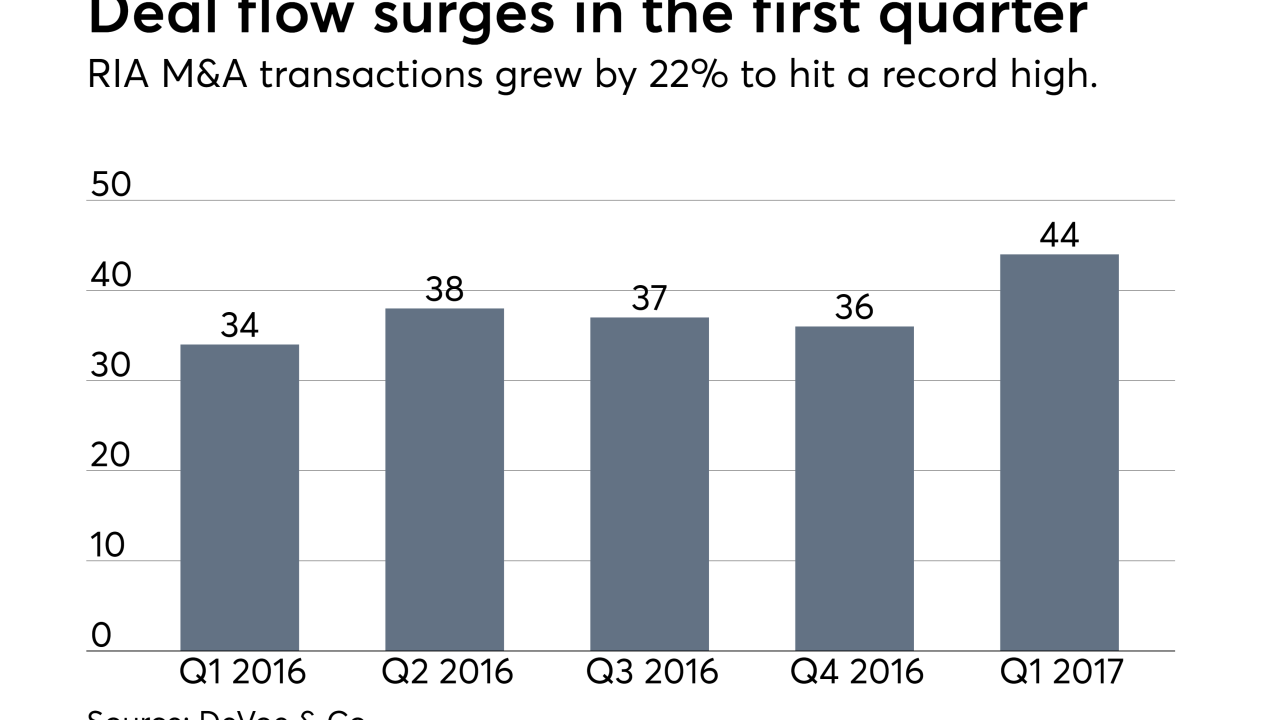

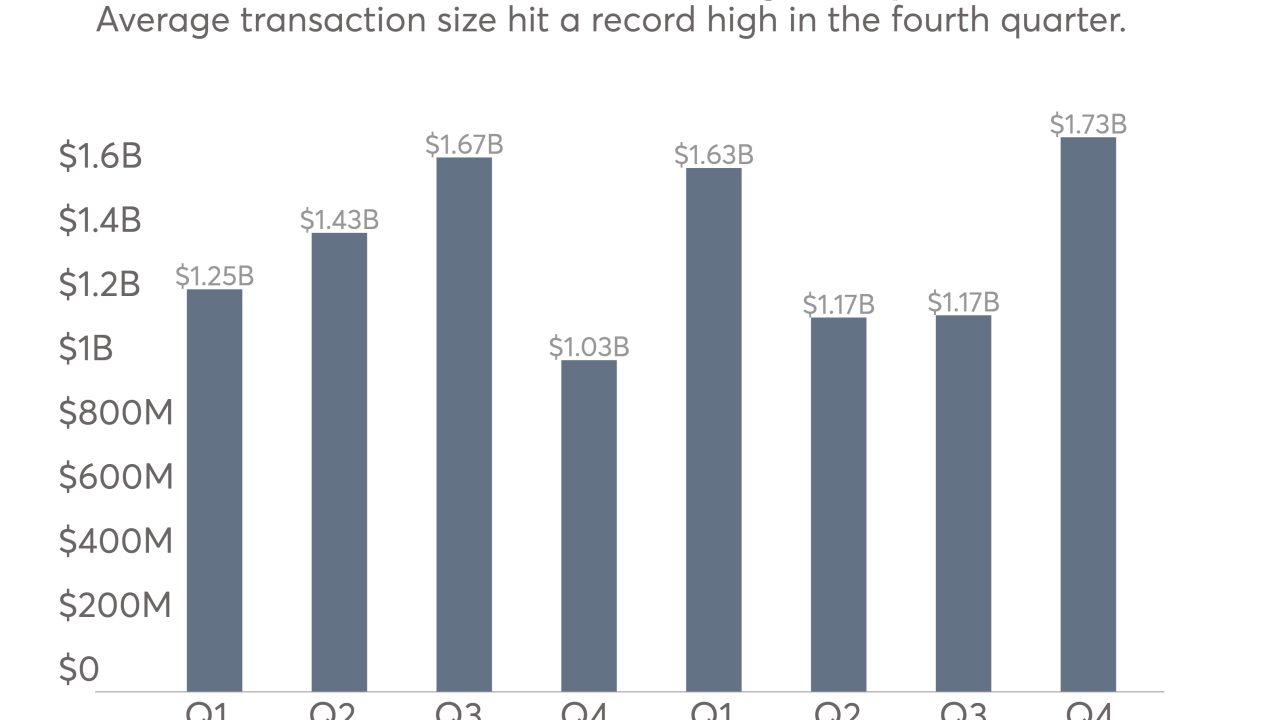

Sales of smaller firms dominated transactions and banks re-emerged as buyers during the first quarter.

May 9 -

The platform provider will now offer to buy a percentage of an advisory firm's revenue.

May 3 -

UBS and Merrill lose four advisers in HighTower's seventh deal of the year.

April 25 -

The RIA's parent company is set to buy a very large adviser aggregator. If completed, it would be the biggest transaction of the year.

April 13 -

HighTower and Dynasty added big platform clients as wirehouse brokers continued to flee.

April 10 -

The RIA is negotiating to buy a portion of Wealth Trust. It may also be facing the loss of a second top executive.

April 7 -

A close look at what's driven the advisers at the top of this year's ranking.

April 6 -

The advisers oversaw nearly $900 million in combined AUM, and moved to Morgan Stanley, Raymond James and HighTower.

April 5