Two large RIAs managing nearly $3 billion have cut ties with HighTower Advisors, but the Chicago-based RIA mitigated the losses by adding several high-profile executives, including a television producer who helped create "Mad Money with Jim Cramer" on CNBC.

Kelly Wealth Management, a $2 billion team that was a HighTower partner, has formed a new firm, Verdence Capital Advisors, in Hunt Valley, Maryland. In Columbus, Ohio, Joel Guth left HighTower's platform business and registered Gryphon Financial Partners, which has almost $1 billion in AUM, as an independent firm.

Both partings were amicable, according to the principals of both firms and HighTower.

"I think HighTower was a great partner for us and gave us the opportunity to learn the independent world," says Verdence CEO Leo J. Kelly III, who has been with HighTower since leaving Merrill Lynch in 2012. "Now we want to take it to the next level."

Gryphon's transition away from HighTower "couldn't have been better," according to Guth. "As the business continued to mature, the flexibility of being completely independent was right for us," he says. Guth's team joined HighTower's platform in 2014.

While the departures may have been on good terms, the losses represent a stumble for HighTower, which has been on a roll for most of the year.

AGGRESSIVE STRATEGY

HighTower, which was founded in 2008 on a business model of offering equity stakes to breakaway brokers, has shifted to a

The RIA has been locked in a fierce recruiting rivalry with Dynasty Financial Partners for securing the platform business of breakaway brokers and existing independent firms.

It completed 21 transactions through June, including its largest deal to date, the acquisition of

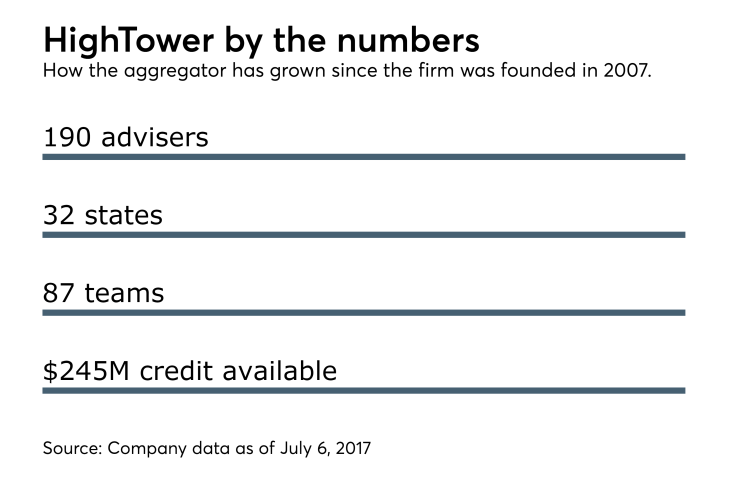

HighTower now has 87 advisory team and 23 firms on its platform. It has acquired six independent firms so far this year.

To support the rapid expansion, HighTower said in a statement that it is "investing in top talent at the executive level."

AIMING FOR CONSUMERS

Perhaps the most intriguing hire is Susan Krakower as chief brand strategist to increase awareness of HighTower among consumer audiences. Krakower spent a decade at CNBC, where she created "Fast Money," as well as "Mad Money."

Prior to joining HighTower, Krakower was chief creative officer for SkyBridge Capital, where she helped build the brand for the high-powered Las Vegas-based SALT conference, reporting directly to former SkyBridge head Anthony Scaramucci.

HighTower and Dynasty added big platform clients as wirehouse brokers continued to flee.

George Fischer, a 10-year E*Trade veteran who ran the firm's wealth management business, joins HighTower as managing director, operations and service. Kyle Okimoto, former head of marketing at E*Trade and co-head of strategy and business development for Merrill Lynch Global Wealth Management will become a strategic consultant for HighTower, charged with growing the firm's platform business.

LONG-TERM VIEW

All the new executives will report directly to HighTower CEO Elliot Weissbluth.

A recapitalization by a financial investor or an IPO are the most likely exit scenarios for HighTower, though he did not rule out a sale to a strategic player, Weissbluth told MergerMarket last month.

In April, HighTower increased its credit facility by $75 million to $245 million in a recapitalization led by BMO Harris and lenders Regions Bank, Fifth Third Bank and KeyBank.

In an interview with Financial Planning in March, Weissbluth also noted that HighTower's value could also be realized from a capital infusion from private equity or a strategic partnership, citing the hypothetical example of a European bank that wants a footprint in the U.S.