-

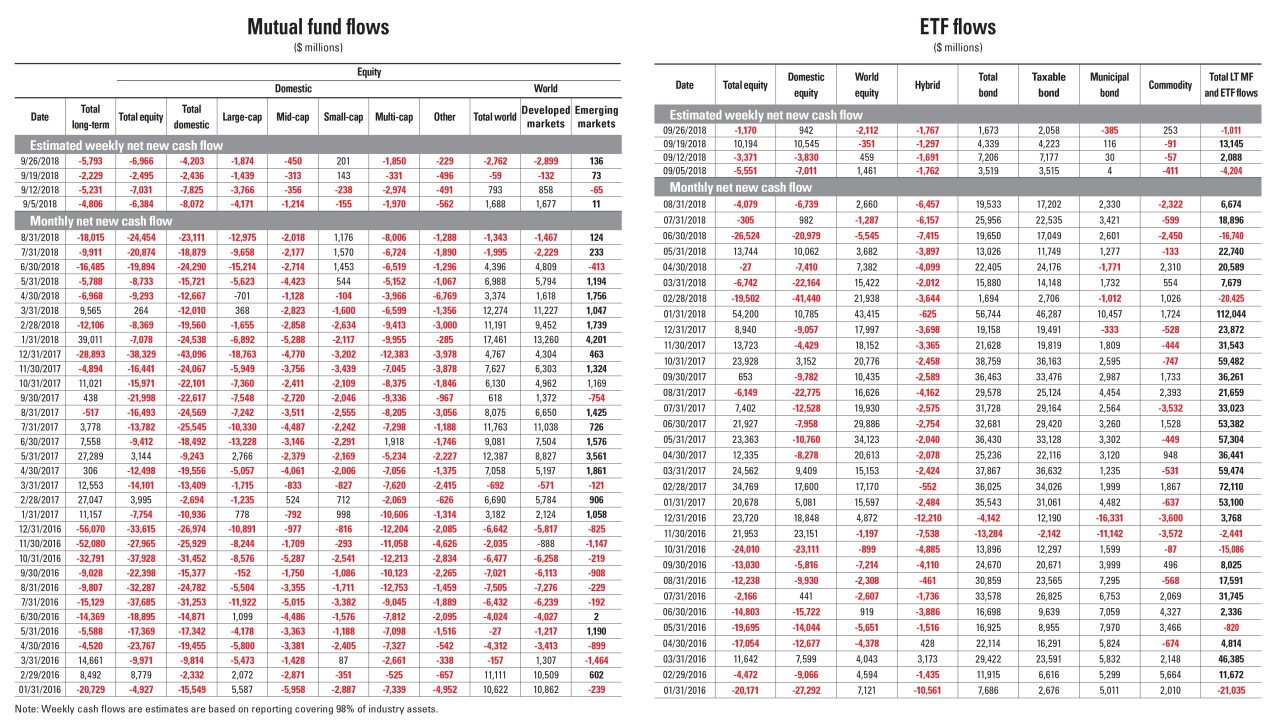

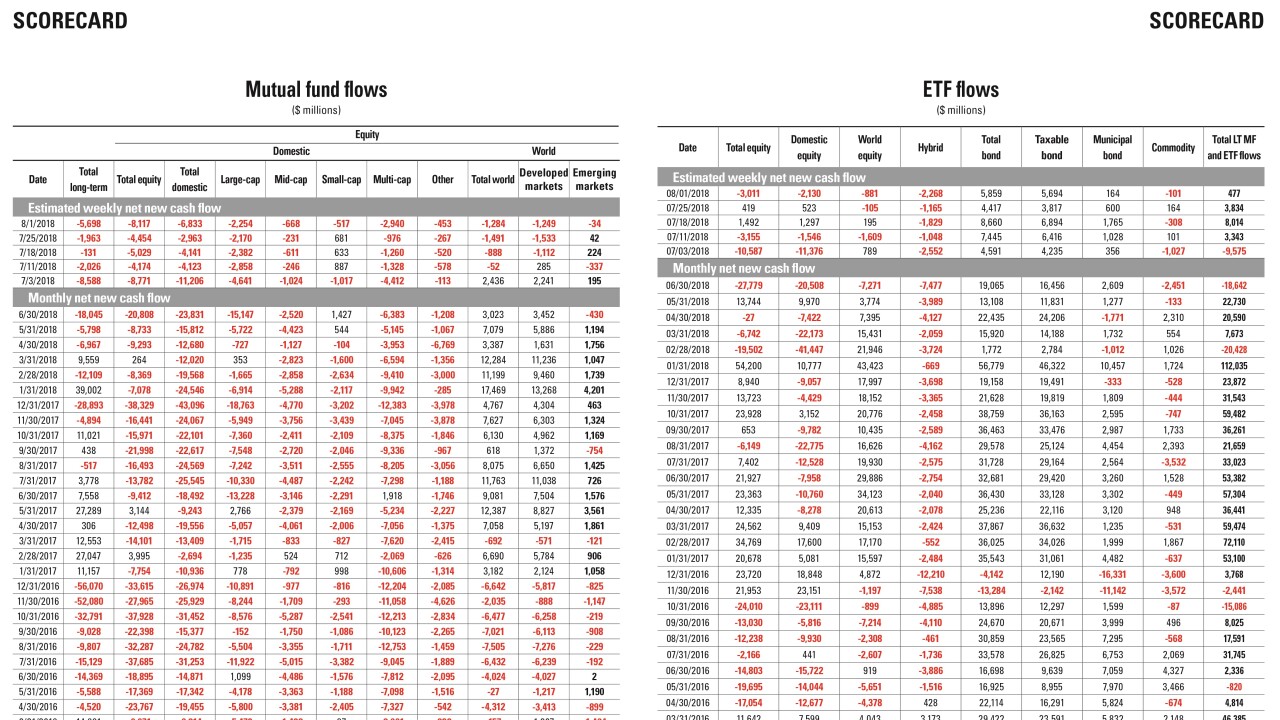

Data reported by the Investment Company Institute.

March 28 -

Direxion’s Rob Nestor and David Mazza weigh in on hiring and compensation strategies, ETF space developments and the rise of robos.

March 28 -

After expanding into a $7 trillion industry, index funds are facing slower asset growth and declining fee revenue.

March 20 -

The Labor Department is investigating the firm’s fee disclosures, which are also a focus of a lawsuit filed by an investor in T-Mobile USA's 401(k) plan.

March 5 -

Data reported by the Investment Company Institute.

March 1 -

Industry veterans and newcomers provide insight on the year’s leading challenges in regulations, technology and operations.

March 1 -

Data reported by the Investment Company Institute.

February 6 -

Data reported by the Investment Company Institute.

January 10 -

A record number of fund openings and closures were reported last year. What does this mean for the future of the industry?

January 4 -

Executives are focused on fresh products, emerging technology and the increasing prominence of ESG.

December 7 -

Data reported by the Investment Company Institute.

November 20 -

Data reported by the Investment Company Institute.

October 5 -

It’s the first U.S.-domiciled index ETF of ETFs with access to the global investment-grade credit universe, the firm said.

September 12 -

These expense ratios were closer to the average fund fee in 1996.

August 15 -

Data reported by the Investment Company Institute.

August 10 -

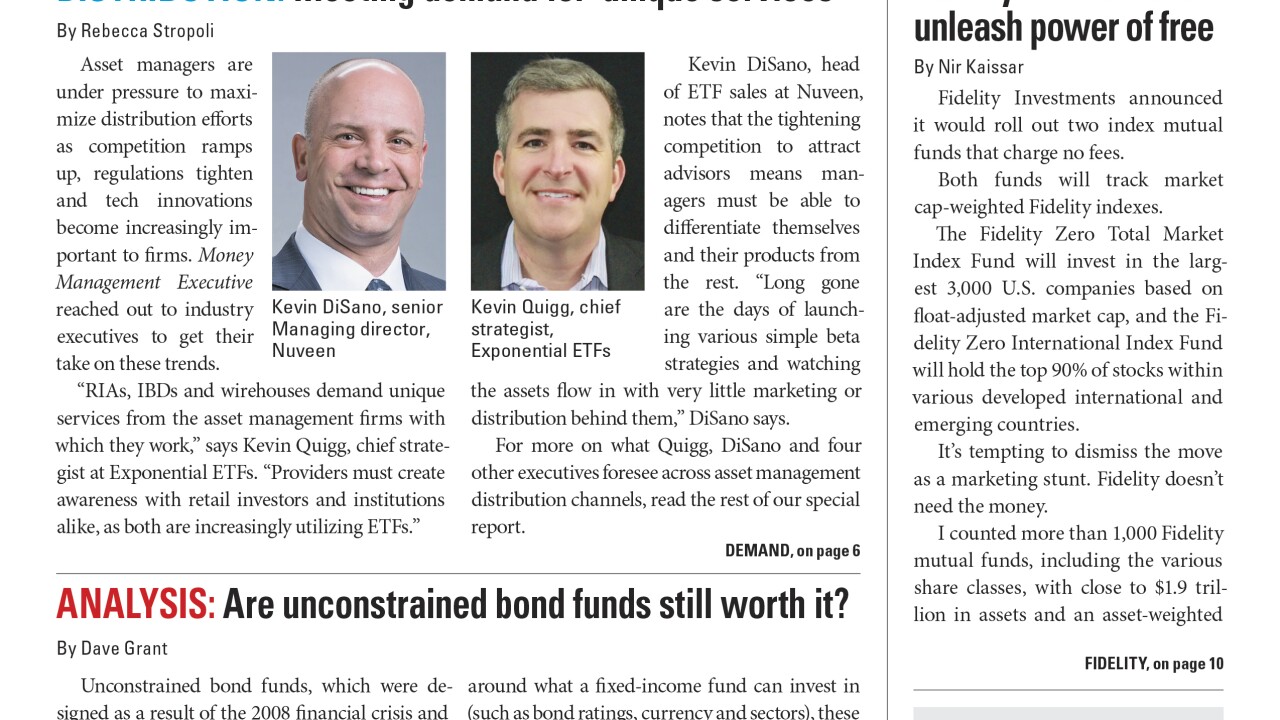

Asset managers are under pressure to maximize distribution efforts amid tightening regulations and tech innovations.

August 10 -

Many sectors have rallied the past decade, but tech and health care outperformed.

August 8 -

Data reported by the Investment Company Institute.

July 13 -

Rapid developments in financial technology are among the industry’s top operational challenges, asset managers say.

July 13 -

Data reported by the Investment Company Institute.

June 8