-

The SEC's decision marks a startling reversal from the full-court press it had mounted against Commonwealth Financial Network in 2019 over alleged failures to disclose conflicts of interest in its brokers' mutual fund recommendations.

February 3 -

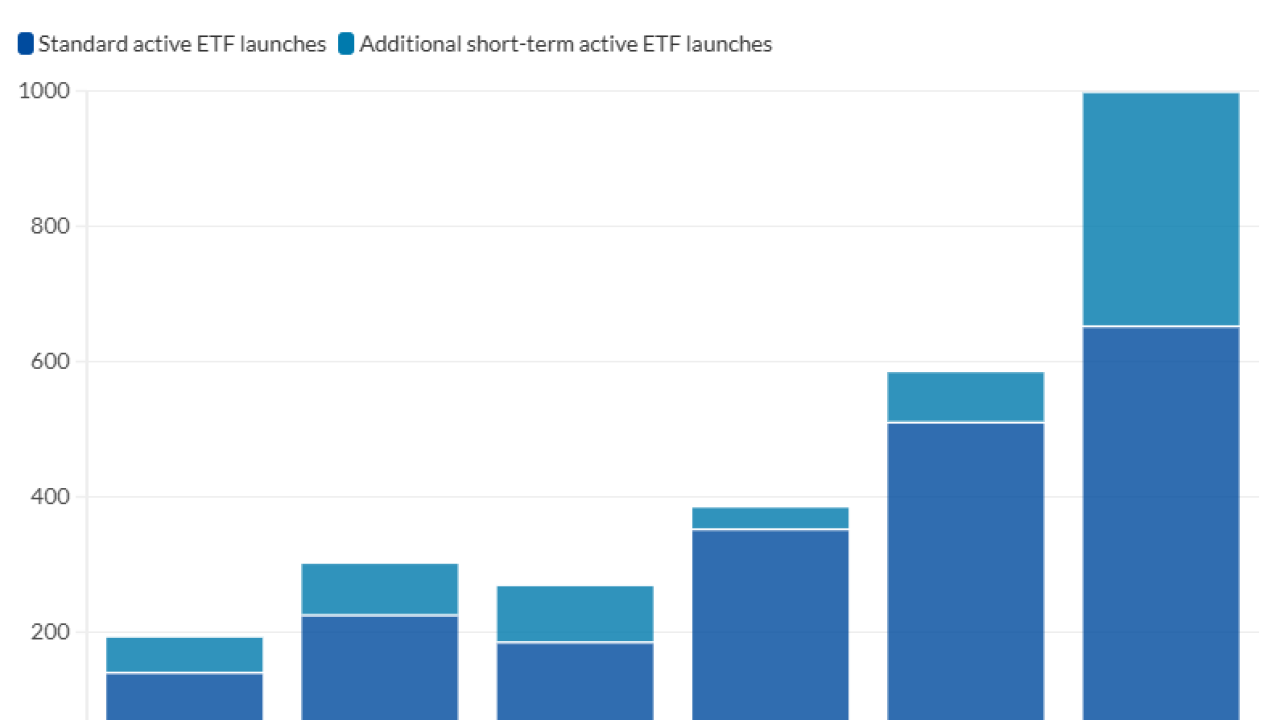

Regulators officially approved 30 more funds last month, with more expected authorizations in 2026. Will financial advisors and their clients bite?

January 15 -

The justices are scheduled to resolve disagreement among lower courts over whether market regulators can order fraudsters to repay ill-gotten gains to victims.

January 12 -

The regulator considers raising the AUM threshold it uses when considering how newly proposed rules are likely to affect small RIAs.

January 8 -

A detailed to-do list for SEC-registered firms to build a foundation for compliant and effective anti-money laundering protocols.

December 31 Flagright

Flagright -

A new risk alert calls out firms for improperly disclosing relationships with outside promoters brought in to provide a testimonial or endorsement.

December 19 -

The GENIUS and Clarity Acts and SEC guidance on custody clear a path for advisors recommending digital asset strategies, albeit with expanded diligence protocols.

December 19 Gemini

Gemini -

Nearly all the brokers who dropped their FINRA registration in the wake of tougher rules kept their insurance licenses, according to newly published research.

December 4 -

The fund manager, convicted of fraud by a New York federal jury in August 2024 and sentence to seven years, spent less than two weeks in prison before being released.

December 2 -

After the newly crypto-friendly Donald Trump won reelection, bitcoin jumped over $100,000. Many advisors and even more clients remain skeptical, though.

December 1 -

The latest SEC Enforcement Activity report finds that the watchdog agency has only started four regulatory cases against public companies under the current presidential administration.

November 25 -

Fiduciary laws trace their roots to ancient times, but the terms of the Investment Company Act of 1940 and the Investment Advisers Act are still evolving today.

November 18 -

The Financial Services Institute is pressing the Securities and Exchange Commission to adopt formal procedures to prevent what it deems the sometimes capricious enforcement of industry rules.

November 12 -

A credit scare last month could have been a momentary blip, but financial advisors have always known there are a lot of risks in private investments.

November 5 -

In an ever-expanding and constantly shifting profession marked by messy but important debates, can one of the field's most important organizations keep up with the times?

November 3 -

The model they want to follow creates an exchange-traded fund as one of the share classes of a mutual fund, a move that ports the famous tax efficiency of the younger structure to the older vehicle.

October 3 -

Compliance and former SEC lawyers say remaining industry regulators will prioritize preventing imminent investor harm while putting off some paperwork and routine tasks.

October 2 -

Co-founded by four Orion veterans, new wealthtech startup Hamachi.ai seeks to embed AI-powered compliance into client communications.

October 2 -

A government shutdown disrupts federal agencies and markets. Here's what advisors need to know to guide clients through the uncertainty.

October 1 -

The plan to issue shares on the NASDAQ stock exchange comes three years after UBS abandoned plans to acquire Wealthfront.

September 30