-

OSHA supports ex-broker Johnny Burris’ firing because he allegedly faked company letterhead. Burris says the bank approved the altered letter years before.

January 12 -

The decision vindicates ex-broker Johnny Burris, but also supports the move to fire him. However, a bank document obtained by Financial Planning casts doubts on the reason for his termination.

January 12 -

The advisor paid $50,000 to a widow's lawyer to refer her $100 million account to him – a fact he failed to disclose to the client, the agency claims.

January 10 -

With a deep résumé representing Wall Street firms, Jay Clayton is seen as a business-friendly choice not expected to push major new regulations or ramp up RIA exams.

January 4 -

Jay Clayton represented the bank in connection with the $10 billion bailout it received in 2008 as part of the government’s $700 billion rescue of banks during the financial crisis.

January 4 -

Charles J. Dushek allegedly made trades without designating in advance whether he was trading personal money or client assets.

December 21 -

The firm was accused of using transactions with an affiliate to reduce the amount it was required to keep in its customer reserve account.

December 21 -

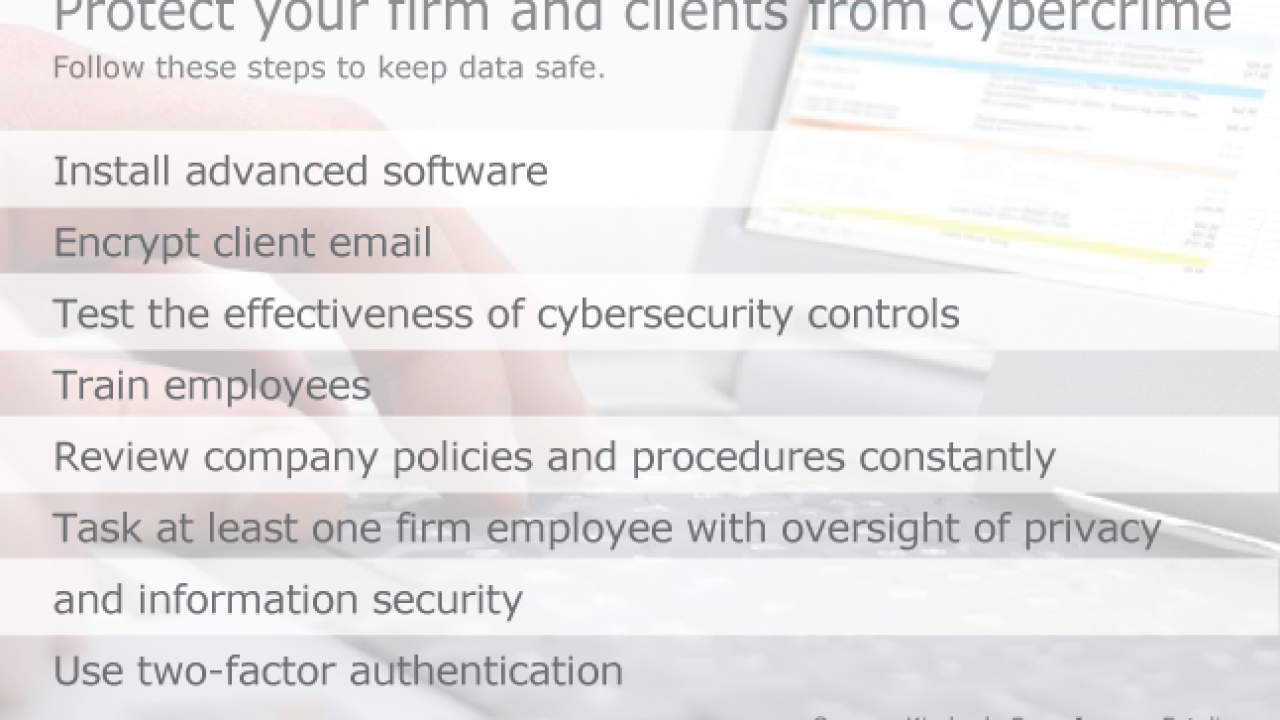

With cybercrime an increasing threat to small financial firms, it’s important to have a comprehensive defensive program in place.

December 21 -

Dan Moisand's firm joins the Institute for the Fiduciary Standard's new listing. Moisand is a former CFP Board official and ex-president of the FPA.

December 19 -

The allegations come a year after the firm paid over $300 million to resolve regulators' claims that it failed to tell wealthy clients it was steering them into its own funds.

December 16 -

Ex-RIA Richard G. Cody gave false reports to retirees for more than a decade, the SEC says. Many lost most of their life savings.

December 14 -

Advisers and experts offer insights about the changes and issues the industry will face next year.

December 13 -

Former Department of Labor officials allege systemic breakdown of whistleblower protection; two also handled Wells Fargo cases that went nowhere.

December 9 -

There's another approach to crafting a regulation that would benefit advisers and clients, RBC Wealth Management's former CEO says.

November 30 Baird

Baird -

The Republican's hostility to all things Obama sets the stage for dramatic departures on financial regulation.

November 30 -

The firm also asked for the suits filed in federal court to be thrown out.

November 28 -

The regulator, in a proposed final judgement, wants the former planner held liable for $123,000 spent on golf outings, shopping and cruises.

November 23 -

After more than three-and-a-half years at the helm, Mary Jo White made incremental moves to expand advisor exams, but did not move on structural reform or implement a uniform fiduciary standard, as many advocates had hoped.

November 16 -

The legal heads of both firms challenge arguments made against the ability of robo advisers to serve their clients.

November 15 -

While it’s early in the process, a number of names are being floated as possible contenders.

November 14