Wells Fargo

Wells Fargo

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company is split into four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management.

-

Wirehouses have made some recruiting mistakes in recent years. Meanwhile some aspects of corporate strategy are being done right in certain pockets of the industry. Danny Sarch offers his insight as we continue the dialogue from our Recruiters Roundtable.

June 4 -

A client's alleged complaint sparked a dispute between the wirehouse and its former advisors.

June 4 -

Wells Fargo’s advisor headcount continues to fall in the second quarter.

June 1 -

The team joins a slew of others leaving the troubled bank, but says it’s running to SunTrust more than running away from Wells Fargo.

June 1 -

The firm has spent the last two years working to overcome various scandals.

May 31 -

The reps join a slew of others who chose not to cooperate with FINRA investigations — at least 21 since 2017 — and therefore agreed to an automatic ban.

May 30 -

Most of the new hires came from Wells Fargo, which has suffered from advisor attrition over the past year.

May 30 -

Kestra Private Wealth Services CEO Rob Bartenstein says the new practice makes the fourth new office added this year by the hybrid RIA.

May 29 -

The wirehouse has lost a steady stream of brokers over the past year and a half.

May 29 -

By the end of June, the Raymond James-affiliated firm says it will surpass its new partner additions for all of 2017.

May 29 -

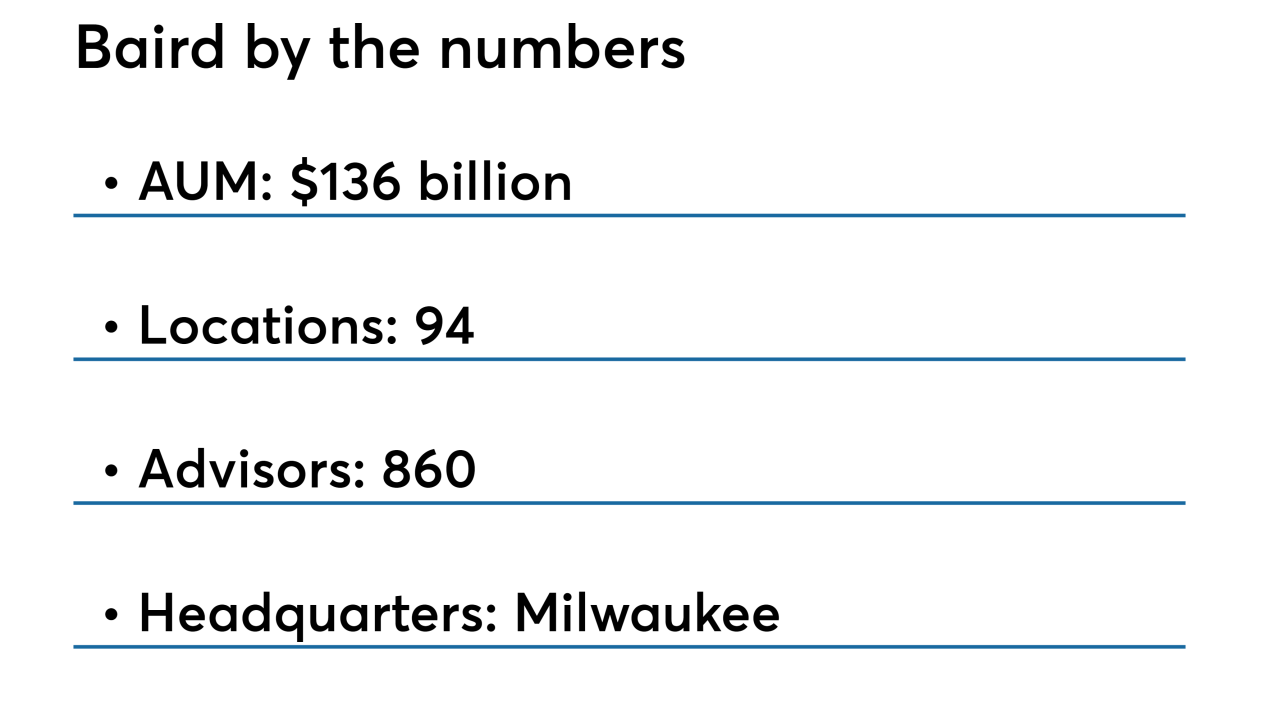

The regional broker-dealer posted record revenue for the eighth year in a row.

May 25 -

The firm’s asset management arm, along with Franklin Templeton, supplied Remington with a $100 million loan to carry it out of the Chapter 11 process.

May 25 -

How can the industry find organic growth again? And where will the next generation of advisors come from? Bill Willis tackles both challenges, and discusses how they will affect compensation, as we elaborate on the issues discussed at our Recruiters Roundtable.

May 22 -

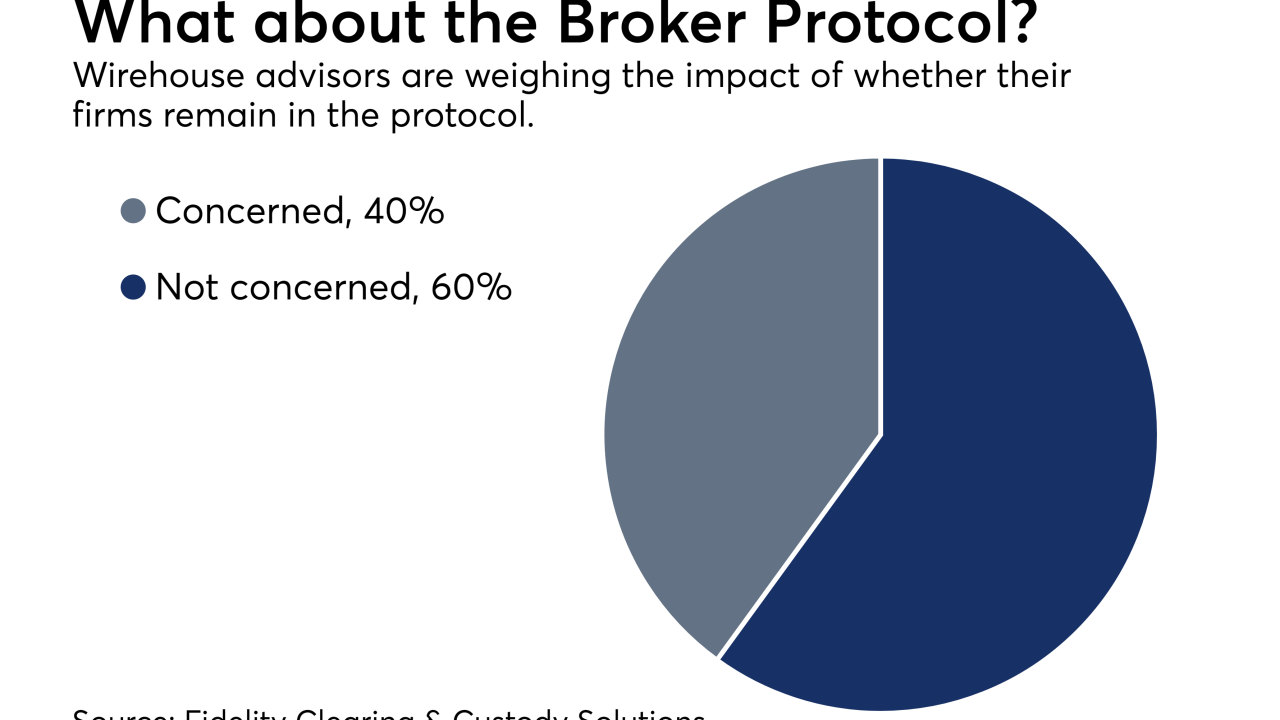

The trickle of brokers leaving wirehouses for greater independence is quietly becoming a flood.

May 22 -

Wells Fargo was among biggest losers as advisors jumped to other firms.

May 22 -

More advisors can’t ignore the call to go independent.

May 17 -

Banks such as UBS aim to offer money managers refuge from jittery markets by combining bonds with more exotic options.

May 17 -

Buffett can put cash to better use than paying dividends. But the majority of CEOs lack his skill so investors and their advisors should be happy when corporate boards pay shareholder dividends.

May 16 -

The rep processed a $9,850 wire request from an imposter posing as a customer, even after the customer called to say that the request was not genuine, FINRA claimed.

May 16 -

There's no reason that today's millennial-friendly microinvesting apps can't switch focus from spare change to real assets, industry executives warn.

May 16