-

CEO Dan Arnold described the firm's multipronged strategy for further growth.

October 25 -

The No. 1 IBD’s Focus conference drew 4,000 advisors, but it faces friction ahead in its ongoing expansion.

September 12 -

Dan Arnold deployed a five-pronged argument for why consolidation is a recruiting boon for the No. 1 IBD.

July 26 -

The firm is “looking to aggressively compete” by lowering and simplifying the fees on its advisory platforms, a top executive says.

June 10 -

The No. 1 IBD aims to triple its potential target market reach, in part by adapting some aspects of employee services to independence.

June 7 -

CEO Dan Arnold presented details of the firm's mounting ambition after announcing the acquisition of a brokerage and RIA with $3 billion in client assets.

May 22 -

In a bid to further enhance its capabilities for advisors, the firm is also slashing ETF transaction fees on select funds later this year.

May 3 -

Dan Arnold received $7.1 million in 2018, far below the longer-tenured chiefs of rival firms Ameriprise and Raymond James.

April 1 -

With competition heating up, the IBD is offering advisors better technology and higher pay.

February 11 Elite Consulting Partners

Elite Consulting Partners -

CEO Dan Arnold pledged new tech-enhanced support for advisors as part of a larger cultural transformation.

February 1 -

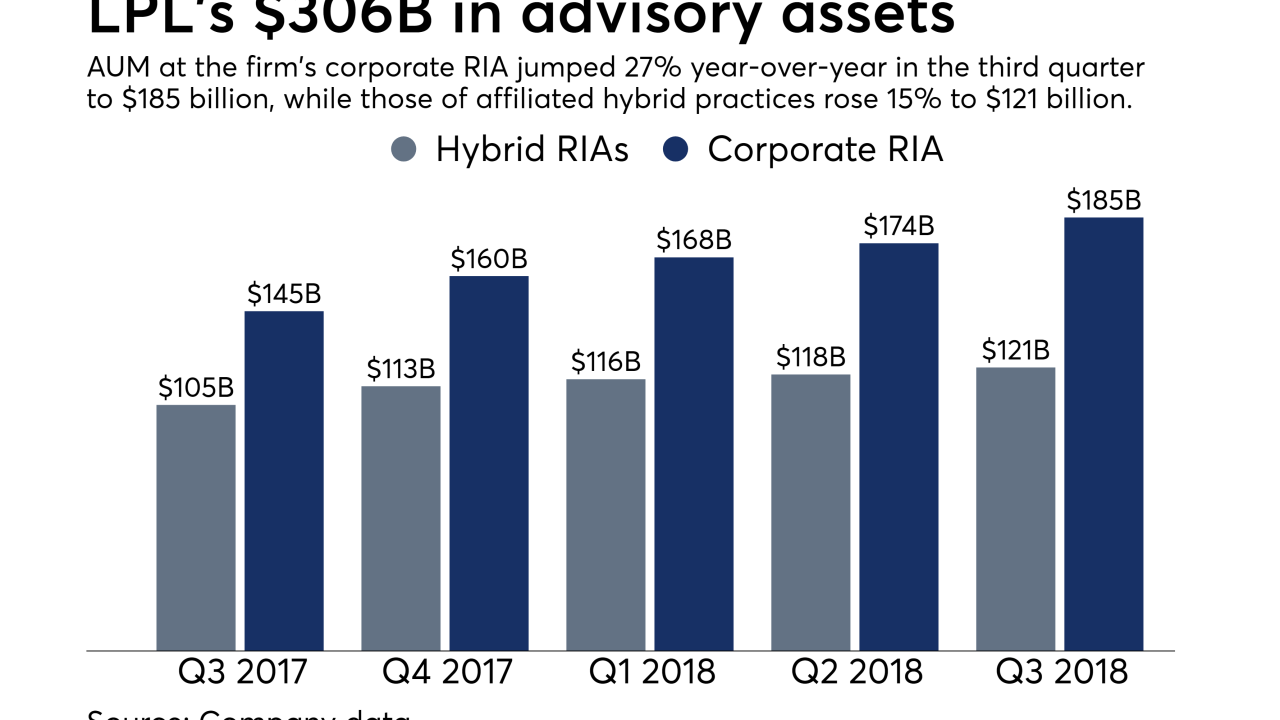

The No. 1 IBD’s advisory AUM flows show results from the company’s efforts to reward advisors for choosing its custody instead of outside firms.

December 19 -

The No. 1 IBD unveiled positive recruiting numbers for the third quarter, alongside an 84% jump in profits.

October 26 -

Planners ranging from sole practitioners to the largest OSJ enterprises welcomed the CEO’s comment that the firm's culture was not aligned with its strategy.

September 4 -

The firms may or may not be vying against one another, but their advisor forces are moving in different directions.

August 8 -

The No. 1 IBD adapted Riskalyze to its still-evolving ClientWorks portal and added Black Diamond to its discounted vendor program.

July 30 -

Dan Arnold says the firm remains interested if deals are a match for the No. 1 IBD.

July 27 -

The No. 1 IBD’s top recruiting executive announced his retirement after the firm disclosed some mixed recent results.

June 25 -

The firm’s principal says his team wanted to join the No. 1 IBD, which is testing larger recruiting offers.

June 15 -

Independent Financial Partners’ CEO predicts the firm will retain about 80% of its business, despite a daunting series of challenges.

May 17 -

The firm broke off from its OSJ and followed four others of its type in leaving the No. 1 IBD after a change in its RIA rules.

May 15