-

The epic OBBBA tax law brings glad tidings to most families, but complacency can lead to costs for financial advisors and their clients.

December 23 American College of Financial Services

American College of Financial Services -

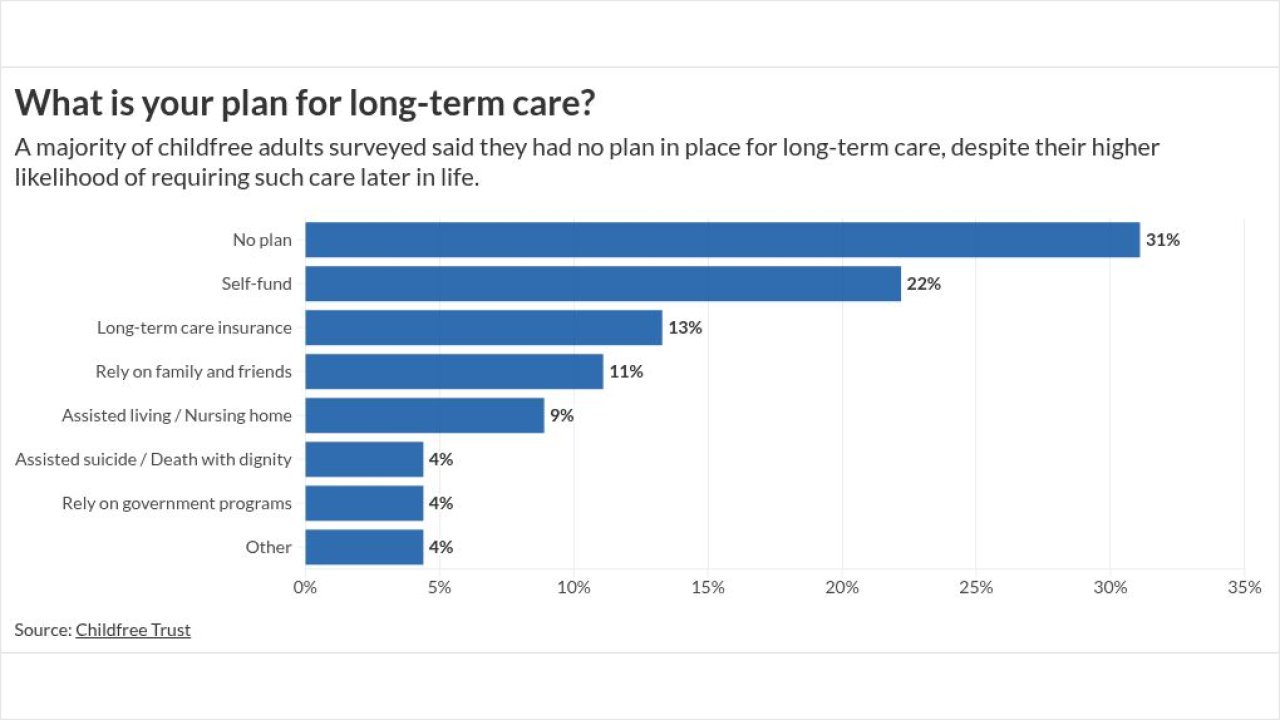

New research highlights a widening planning gap among childfree savers, with lagging estate and long-term care planning exposing unique risks — and opportunities for advisors.

December 19 -

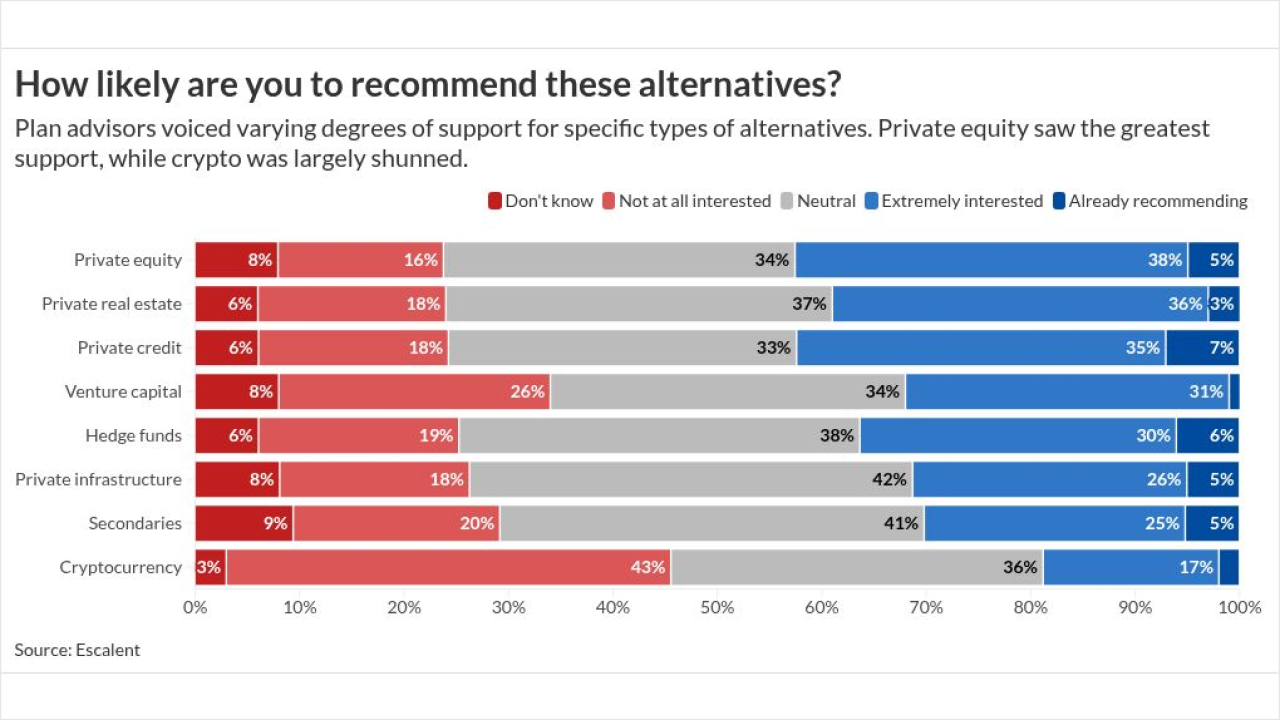

As ERISA rules around alternatives ease, more workplace plan advisors are warming to once-niche investments like private equity and private credit. But advisors remain skeptical of certain asset classes.

December 18 -

Independent research firm Morningstar's latest study of the value of financial advice examines tax-efficient IRA asset location during the decumulation phase.

December 18 -

Most borrowers use defined contribution plan loans for essential health and housing costs rather than discretionary spending, new EBRI research found. Still, many financial advisors remain skeptical of such loans.

December 16 -

Retirement savers say they want investment choice, but confidence in navigating those decisions remains low, according to new T. Rowe Price research.

December 8 -

Researchers found that potentially traumatic childhood experiences, including physical abuse and parental separation, have lasting financial consequences, shaping workers' savings and retirement security decades later.

December 5 -

When it comes to retirement planning, financial advisors are always looking for an edge. Could these strategies get them there?

December 3 -

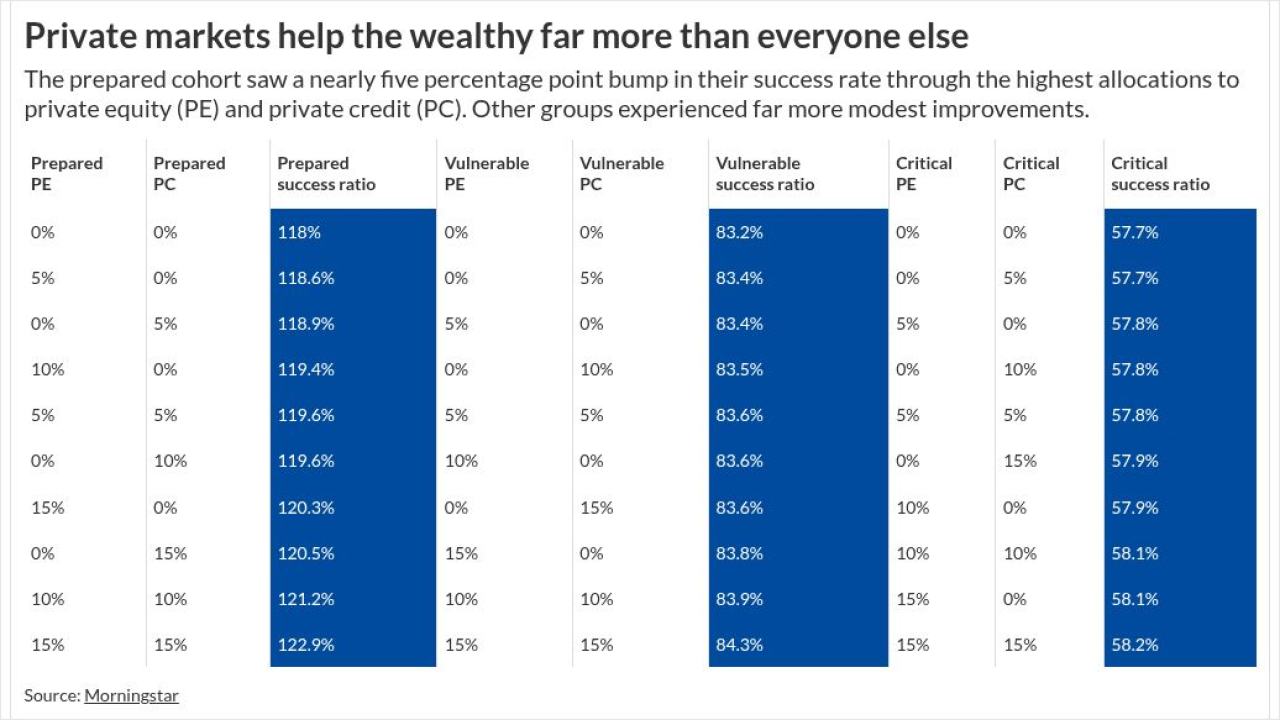

Private allocations can give retirees on a glide path a modest lift in returns, new Morningstar research shows — though the impact isn't uniform across savers.

December 2 -

Advisors who reframed strategic decisions shifted investor perceptions of identical financial results, research shows; here's what that means for retirement planning.

November 26 Janus Henderson Investors

Janus Henderson Investors -

Rising Part B costs will absorb much of Social Security's 2026 cost-of-living adjustment — leaving less room in retirees' budgets.

November 24 -

Generation Z is favoring Roth accounts like no generation before, new Fidelity research shows. Here's why younger investors are betting on post-tax retirement savings.

November 20 -

Glide paths may not deliver the highest returns, but experts say they account for behavioral limits that other strategies overlook.

November 19 -

A similar measure stalled years ago, but some advisors say the current bill has more momentum among lawmakers.

November 13 -

The Internal Revenue Service increased the annual retirement plan contribution limits for 2026 thanks to cost-of-living adjustments for inflation.

November 13 -

Americans tend to be overly pessimistic about their own life expectancy — a fact with major implications for retirement planning. But new research shows that certain interventions can help.

November 11 -

The industry asked for and received a delay in the rule from the IRS in 2023. Now that it's going into effect, here are the key implications for sponsors and savers.

November 10 -

Middle-class Americans say paying off debt is their top financial priority. Financial advisors say a fixation on paying down debt can hurt in the long run.

November 3 -

Larry Sprung wasn't looking for love (authors), but he wound up finding a great set of clients.

October 28 -

Public-sector pensions are shifting more risk onto employees through hybrid designs, variable contributions and COLA changes, transforming retirement planning for millions.

October 27