This comes with a few caveats, however. For one, most of these funds are short-term bond funds, which can be tough to fit into many portfolios. Plus, their overall gains aren’t very high. The 20 funds listed here averaged a 3.64% annualized return, compared the S&P 500’s 7.7% annualized gain over the same period. Perhaps worst, their expense ratios are relatively high – average is nearly half a percentage point – in the current age when most investors are accustomed to cheap access to the markets.

Still, if staying in the black trumps all else for clients, these funds have done so for 20 years, a time frame that included two market crashes and two recessions. We collected all the mutual funds that posted a gain (any gain) each year since 1997. Then we deleted any that didn’t have at least $100 million in assets. That gave us about 45. Here we present the top 20 ranked by their 20-year annualized gains, plus the best and worst year for each fund.

All data from Morningstar.

20. DFA One-Year Fixed-Income (DFIHX)

Best-Year Return: 6.73% (2000)

Worst-Year Return: 0.26% (2014)

Expense Ratio: 0.17%

Fund Assets (millions): $7,314

19. PIA Short Term Securities Adv (PIASX)

Best-Year Return: 7.93% (2000)

Worst-Year Return: 0.27% (2013)

Expense Ratio: 0.39%

Fund Assets (millions): $168

18. Goldman Sachs Short Dur T/F (GSDUX)

Best-Year Return: 6.19% (2009)

Worst-Year Return: 0.13% (2013)

Expense Ratio: 0.39%

Fund Assets (millions): $4,594

17. LWAS/DFA Two-Year Government (DFYGX)

Best-Year Return: 7.27% (2001)

Worst-Year Return: 0.10% (2015)

Expense Ratio: 0.28%

Fund Assets (millions): $110

16. DFA Two-Year Global Fixed-Income (DFGFX)

Best-Year Return: 6.48% (1998)

Worst-Year Return: 0.33% (2015)

Expense Ratio: 0.17%

Fund Assets (millions): $4,979

15. Touchstone Ultra Short Dur (TSDOX)

Best-Year Return: 6.99% (2000)

Worst-Year Return: 0.40% (2015)

Expense Ratio: 0.69%

Fund Assets (millions): $672

14. MainStay Tax Advantaged Shrt Term (MSTIX)

Best-Year Return: 8.12% (2000)

Worst-Year Return: 0.04% (2013)

Expense Ratio: 0.55%

Fund Assets (millions): $314

13. PNC Limited Maturity Bond (PMYIX)

Best-Year Return: 9.19% (2001)

Worst-Year Return: 0.25 (2015)

Expense Ratio: 0.49%

Fund Assets (millions): $295

12. JPMorgan Short Duration Bond (HLLVX)

Best-Year Return: 8.06% (2001)

Worst-Year Return: 0.12% (2013)

Expense Ratio: 0.55%

Fund Assets (millions): $4,566

11. Northern Short Bond (BSBAX)

Best-Year Return: 8.48% (2000)

Worst-Year Return: 0.15% (2015)

Expense Ratio: 0.40%

Fund Assets (millions): $499

10. Payden Low Duration Fund (PYSBX)

Best-Year Return: 8.78% (2001)

Worst-Year Return: 0.43% (2015)

Expense Ratio: 0.45%

Fund Assets (millions): $1,026

9. T. Rowe Price Short-Term Bond (PRWBX)

Best-Year Return: 9% (2009)

Worst-Year Return: 0.30% (2013)

Expense Ratio: 0.53%

Fund Assets (millions): $4,925

8. Goldman Sachs Short Dur Govt (GSTGX)

Best-Year Return: 8.75% (2001)

Worst-Year Return: 0.20% (2015)

Expense Ratio: 0.47%

Fund Assets (millions): $1,204

7. Janus Short-Term Bond (JNSTX)

Best-Year Return: 8.56% (2009)

Worst-Year Return: 0.29% (2015)

Expense Ratio: 0.64%

Fund Assets (millions): $2,100

6. Vanguard Short-Term Bond Index (VBISX)

Best-Year Return: 8.98% (2001)

Worst-Year Return: 0.07% (2013)

Expense Ratio: 0.15%

Fund Assets (millions): $48,549

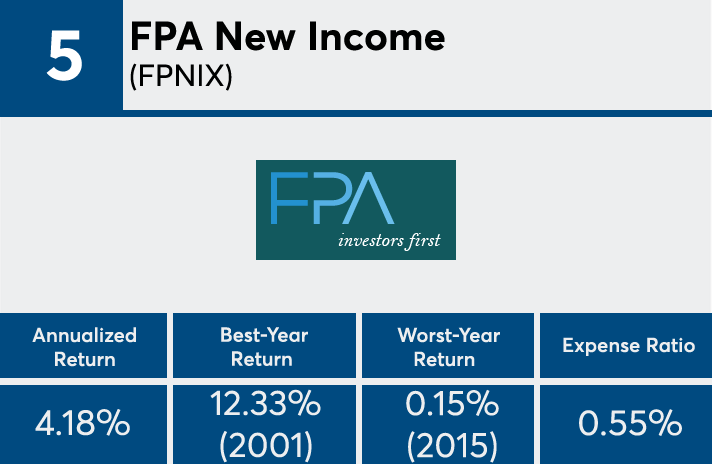

5. FPA New Income (FPNIX)

Best-Year Return: 12.33% (2001)

Worst-Year Return: 0.15% (2015)

Expense Ratio: 0.55%

Fund Assets (millions): $4,942

4. Great-West Short Duration Bond (MXSDX)

Best-Year Return: 10.03% (2009)

Worst-Year Return: 0.33% (2008)

Expense Ratio: 0.60%

Fund Assets (millions): $197

3. Prudential Short-Term Corporate Bd (PBSMX)

Best-Year Return: 13.53% (2009)

Worst-Year Return: 0.77% (2008)

Expense Ratio: 0.77%

Fund Assets (millions): $10,108

2. Weitz Short Duration Income Instl (WEFIX)

Best-Year Return: 10.85% (2009)

Worst-Year Return: 0.25% (2015)

Expense Ratio: 0.62%

Fund Assets (millions): $1,200

1. Colorado BondShares A Tax-Exempt (HICOX)

Best-Year Return: 9.50% (1997)

Worst-Year Return: 0.70% (2008)

Expense Ratio: 0.55%

Fund Assets (millions): $1,083