In its annual letter, FINRA identified a number of areas where it will be ramping up scrutiny, from product suitability to cybersecurity. Here's a breakdown of the most important changes for advisers and firms. -- Andrew Welsch & Maddy Perkins

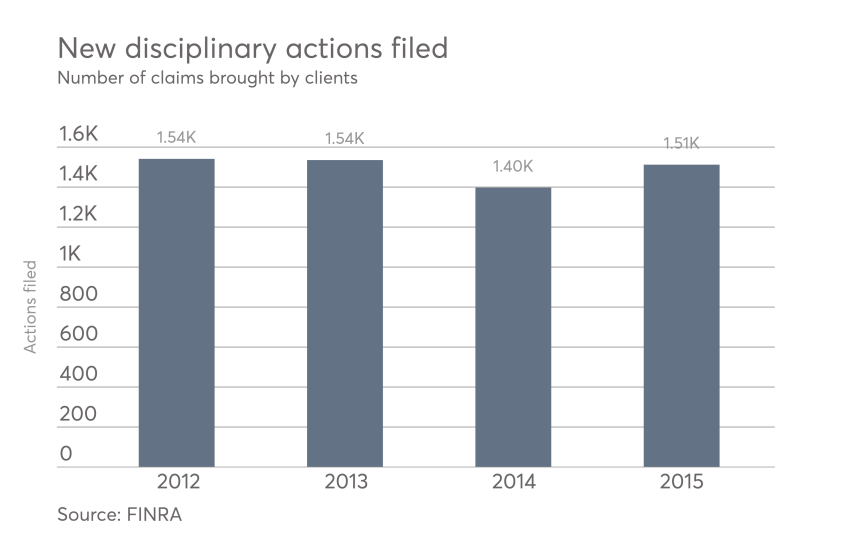

Rogue brokers

Firms that hire large numbers of brokers with disciplinary records will come under additional scrutiny. Furthermore, FINRA says it will pay close attention to how firms supervise branches, and particularly independent advisers.

Protecting the vulnerable

"We are seeing numerous cases where registered representatives have recommended that senior investors purchase speculative or complex products in search of yield. While the quest for higher yield is not per se problematic, FINRA will assess whether such recommendations were suitable given an investor’s profile and risk tolerance, and whether firms have appropriate supervisory mechanisms in place to detect and prevent problematic sales practices."

But is it suitable?

"FINRA continues to observe instances where firms recommend products that are unsuitable for customers, including situations where customers and sometimes registered representatives do not understand important product features," the regulator says.

In particular, FINRA will take a close look at complex products and how shifting interest rates affect investment recommendations.

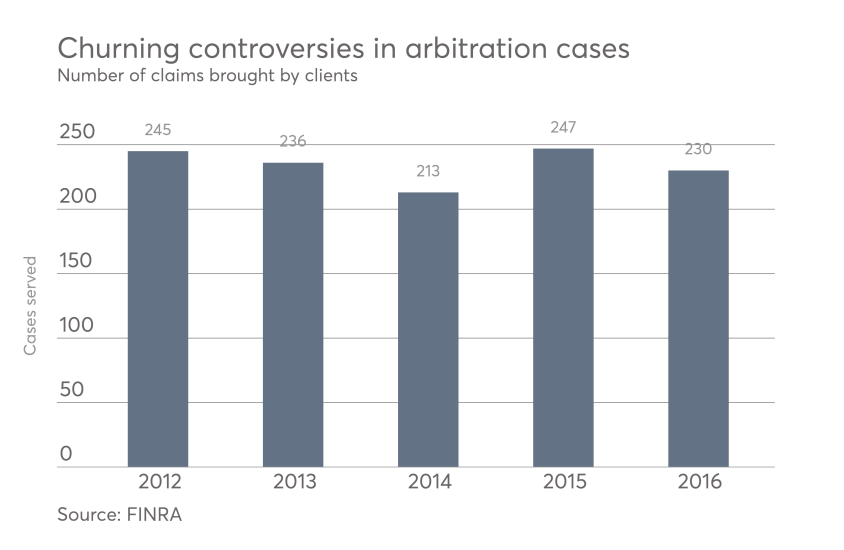

Excessive trading

Some advisers can expect their firms to tweak their compliance strategies. In its letter, FINRA urged "firms to evaluate whether their supervisory systems can detect activity intended to evade automated surveillance for excessive switching activity."

Don't quit your day job

Record and review all electronic communications

No one-size-fits-all approach to cybersecurity

Beware: The regulator notes some firms may fall under added scrutiny due to their vendor relationships and how they are managed.

Gaps in suspicious activity monitoring

For example, in the past year FINRA has sanctioned several firms for deficiencies in anti-money laundering and other supervisory programs, including