Digital wealth's next phase

But competitors are pushing for more growth, attempting to capture a share of what Deloitte predicts will be $7 trillion in robo advice assets by 2020.

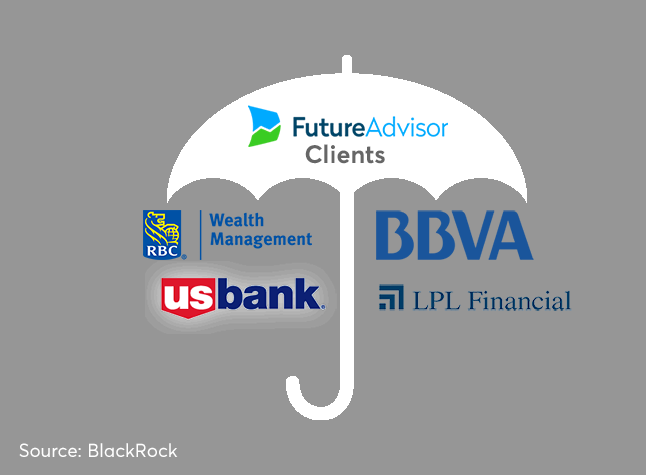

Vanguard's competitors, which include Schwab's Intelligent Portfolios, Betterment, Wealthfront and Personal Capital, have all posted AUM growth of over 40% since the end of 2015. And despite BlackRock's early dominance among institutional clients, SigFig has made gains, such as partnerships with UBS, Eaton Vance and Banco Santander.

The need for continued growth and new assets has digital wealth firms pushing into new ground and developing new offerings. Betterment's partnership with Uber highlighted the need to pursue nontraditional wealth management clients. Another robo adviser, Hedgeable, plans to offer loans as an asset class.

What's shaping up to be a battleground is the 401(k) space. Betterment and blooom have demonstrated an ability to gather accounts. In response, incumbent firms have developed their own digital platforms or acquired them, such as TIAA's recent purchase of MyVest.

Individual advisers and others employed in the financial industry will likely be challenged in their own work as well. Many may soon have to adapt— either learning new skills or changing roles — as the hybrid robo model couples with advances in cognitive computing.

Growth of robos

Weigh in

Wider sweep

The go-to play

Digital competition's next battle

Industry stalwart

Digital conversion

Call center adviser

Cognitive computing's rise