9. Signator Investors

% Accounts >$100K: 14%

8. LPL Financial

% Accounts >$100K: 26%

7. Prospera Financial Services

% Accounts >$100K: 28%

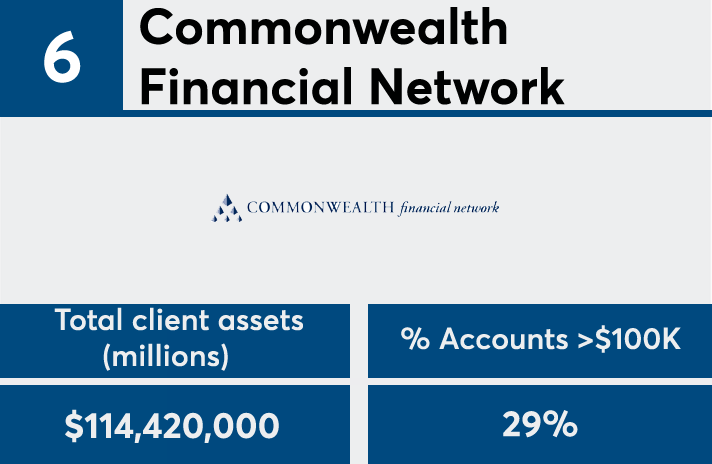

6. Commonwealth Financial Network

% Accounts >$100K: 29%

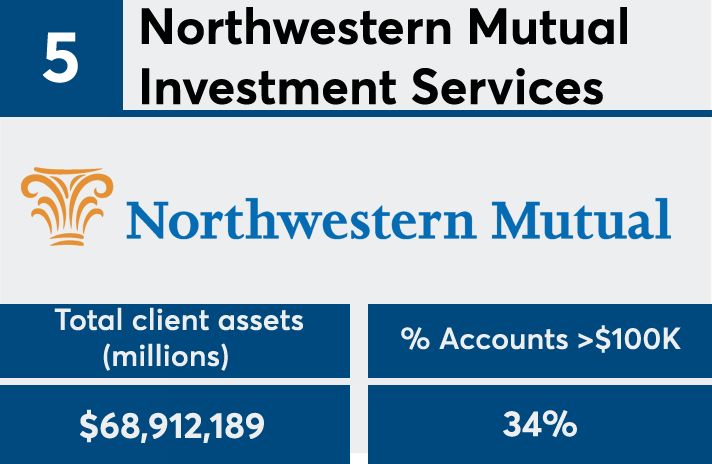

5. Northwestern Mutual Investment Services

% Accounts >$100K: 34%

4. Cadaret Grant

% Accounts >$100K: 38%

3. American Portfolios Financial Services

% Accounts >$100K: 39%

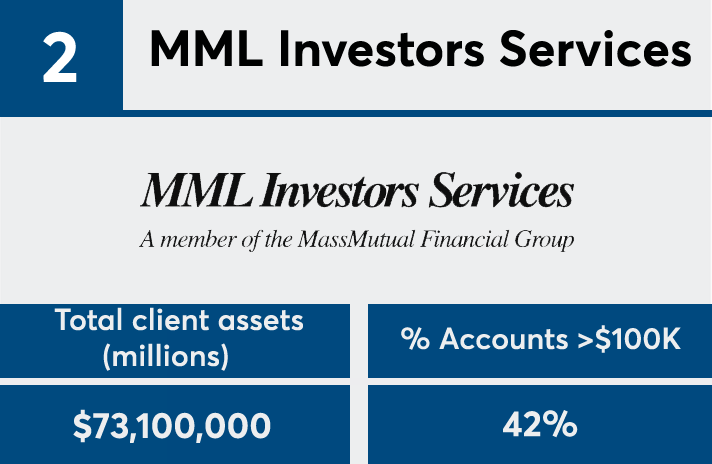

2. MML Investors Services

% Accounts >$100K: 42%

1. Kovack Securities

% Accounts >$100K: 47%