We've highlighted the importance of dividends before, looking both at individual stocks, as well as the total returns of funds. However, those rankings were based on past performance data.

Now we're looking ahead at expected, future dividend ratios. Based on projections, of course, these mutual funds and ETFs have the highest expected dividends per share over the next five years, compared to their share price today.

Bear in mind, dividends can pile up over five years for an eye-popping projection (some are in the teens.) Moreover, when you look at the actual past return figures, you'll see many in the red. As with any potential investment, make sure clients know the risks and that it fits with their overall objectives.

Only funds with at least $100 million, and three years of operating history, were considered for the ranking. As always, we also show the expense ratios of each fund. All data from Morningstar.

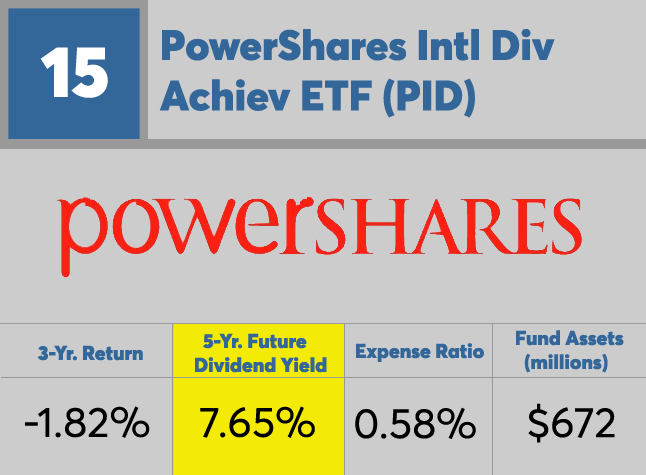

15. PowerShares Intl Div Achiev ETF

3-Yr. Return: -1.82%

5-Yr. Dividend Yield: 7.65%

Expense Ratio: 0.58%

Fund Assets (millions): $672

14. Cornerstone Advisors Real Assets Instl

3-Yr. Return: -4.66%

5-Yr. Dividend Yield: 7.79%

Expense Ratio: 0.73%

Fund Assets (millions): $182

13. WisdomTree Emerging Markets High Div ETF

3-Yr. Return: -4.33%

5-Yr. Dividend Yield: 7.83%

Expense Ratio: 0.63%

Fund Assets (millions): $1,502

12. Transamerica Dynamic Income

3-Yr. Return: 4.63%

5-Yr. Dividend Yield: 7.95%

Expense Ratio: 0.89%

Fund Assets (millions): $455

11. SPDR S&P Emerging Markets Dividend ETF

3-Yr. Return: -5.53%

5-Yr. Dividend Yield: 8.32%

Expense Ratio: 0.53%

Fund Assets (millions): $292

10. Global X SuperDividend ETF

3-Yr. Return: 5.32%

5-Yr. Dividend Yield: 8.62%

Expense Ratio: 0.58%

Fund Assets (millions): $835

9. Multi-Asset Diversified Income ETF

3-Yr. Return: 3.93%

5-Yr. Dividend Yield: 8.71%

Expense Ratio: 0.50%

Fund Assets (millions): $871

8. iShares Emerging Markets Dividend

3-Yr. Return: -4.63%

5-Yr. Dividend Yield: 8.78%

Expense Ratio: 0.49%

Fund Assets (millions): $236

7. Direxion Daily Russia Bull 3X ETF

3-Yr. Return: -49.24%

5-Yr. Dividend Yield: 9.17%

Expense Ratio: 0.95%

Fund Assets (millions): $176

6. VanEck Vectors Russia ETF

3-Yr. Return: -7.57%

5-Yr. Dividend Yield: 9.21%

Expense Ratio: 0.62%

Fund Assets (millions): $1,728

5. Longleaf Partners International

3-Yr. Return: -1.38%

5-Yr. Dividend Yield: 9.61%

Expense Ratio: 1.28%

Fund Assets (millions): $1,035

4. API Multi-Asset Income

3-Yr. Return: 2.36%

5-Yr. Dividend Yield: 9.62%

Expense Ratio: 1.12%

Fund Assets (millions): $690

3. Cornerstone Advisors Income Opps Instl

3-Yr. Return: 0.84%

5-Yr. Dividend Yield: 10.60%

Expense Ratio: 0.54%

Fund Assets (millions): $191

2. PowerShares KBW High Div Yld Fincl ETF

3-Yr. Return: 4.08%

5-Yr. Dividend Yield: 13.04%

Expense Ratio: 0.35%

Fund Assets (millions): $213

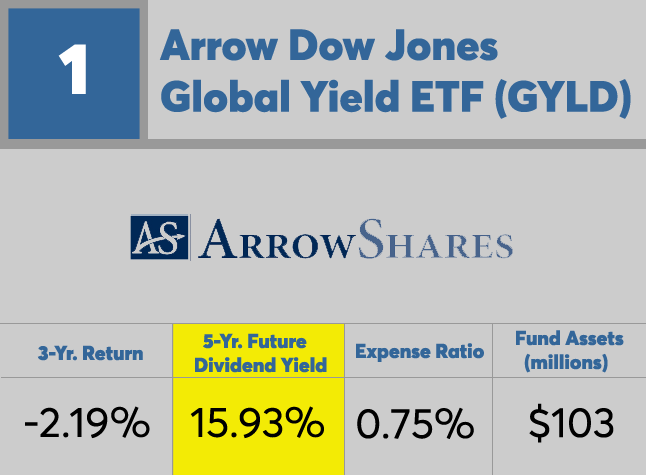

1. Arrow Dow Jones Global Yield ETF

3-Yr. Return: -2.19%

5-Yr. Dividend Yield: 15.93%

Expense Ratio: 0.75%

Fund Assets (millions): $103