If a fund manager sells every stock in a given year, the fund will have a turnover rate of 100%. For actively managed funds, a certain level of turnover is expected. Indeed, the industry average is roughly 89%, according to the Motley Fool.

Higher trading costs are one ramification of significant buying and selling. Of the 20 funds on our list, 13 are higher than 1%; another three are higher than 90 basis points.

We created a list of funds with at least $100 million in assets and with the highest turnover ratios. We ranked those funds by three-year returns.

The average turnover rate of these 20 funds is 161%; the average expense ratio is 1.2%; and the average three-year return is 14.2%. Click through to see which funds made the list.

All data from Morningstar Direct.

20. Victory RS Growth (RSGRX)

Turnover Ratio: 123%

Expense Ratio: 1.10%

Total Assets (millions): $253

19. Alger SMid Cap Focus (ALMAX)

Turnover Ratio: 164%

Expense Ratio: 1.35%

Total Assets (millions): $184

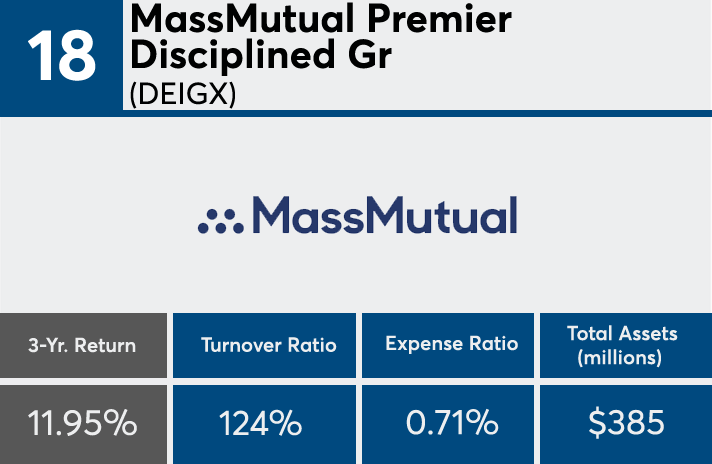

18. MassMutual Premier Disciplined Gr (DEIGX)

Turnover Ratio: 124%

Expense Ratio: 0.71%

Total Assets (millions): $385

17. Calvert Small Cap (CCVAX)

Turnover Ratio: 150%

Expense Ratio: 1.36%

Total Assets (millions): $299

16. Driehaus International Small Cap Growth (DRIOX)

Turnover Ratio: 151%

Expense Ratio: 1.72%

Total Assets (millions): $310

15. Virtus Rampart Enhanced Core Equity (PDIAX)

Turnover Ratio: 496%

Expense Ratio: 1.21%

Total Assets (millions): $186

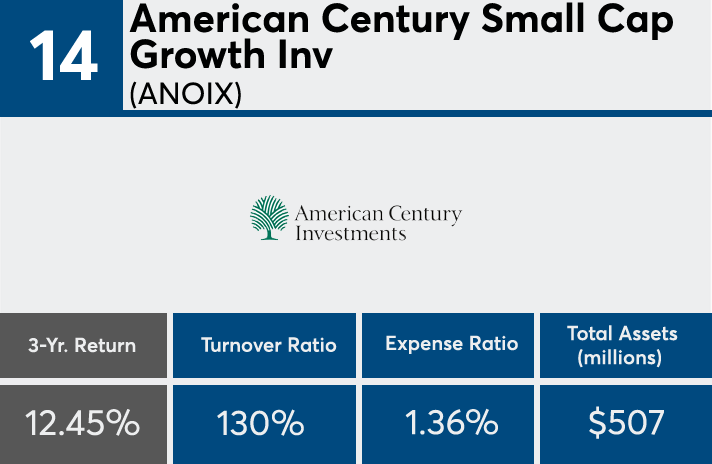

14. American Century Small Cap Growth Inv (ANOIX)

Turnover Ratio: 130%

Expense Ratio: 1.36%

Total Assets (millions): $507

13. Ivy Small Cap Core (IYSAX)

Turnover Ratio: 133%

Expense Ratio: 1.50%

Total Assets (millions): $576

12. Fidelity Trend (FTRNX)

Turnover Ratio: 129%

Expense Ratio: 0.74%

Total Assets (millions): $1,691

11. JPMorgan Large Cap Value (HLQVX)

Turnover Ratio: 145%

Expense Ratio: 0.77%

Total Assets (millions): $1,205

10. Oberweis International Opportunities (OBIOX)

Turnover Ratio: 139%

Expense Ratio: 1.60%

Total Assets (millions): $889

9. T. Rowe Price Global Stock (PRGSX)

Turnover Ratio: 135%

Expense Ratio: 0.89%

Total Assets (millions): $790

8. CornerCap Small-Cap Value Investor (CSCVX)

Turnover Ratio: 129%

Expense Ratio: 1.30%

Total Assets (millions): $119

7. TCM Small Cap Growth (TCMSX)

Turnover Ratio: 134%

Expense Ratio: 0.96%

Total Assets (millions): $374

6. Deutsche Science and Technology (KTCAX)

Turnover Ratio: 171%

Expense Ratio: 0.99%

Total Assets (millions): $750

5. Zacks Small-Cap Core Inv (ZSCCX)

Turnover Ratio: 147%

Expense Ratio: 1.39%

Total Assets (millions): $140

4. Wells Fargo Specialized Technology (WFSTX)

Turnover Ratio: 131%

Expense Ratio: 1.41%

Total Assets (millions): $394

3. Fidelity Small Cap Growth (FCPGX)

Turnover Ratio: 140%

Expense Ratio: 1.09%

Total Assets (millions): $3,428

2. Driehaus Micro Cap Growth (DMCRX)

Turnover Ratio: 180%

Expense Ratio: 1.48%

Total Assets (millions): $326

1. T. Rowe Price Global Technology (PRGTX)

Turnover Ratio: 171%

Expense Ratio: 0.90%

Total Assets (millions): $5,535