FP50 2017: Which IBDs made the most in commissions?

For more in-depth coverage, please see

Data as of year-end 2016.

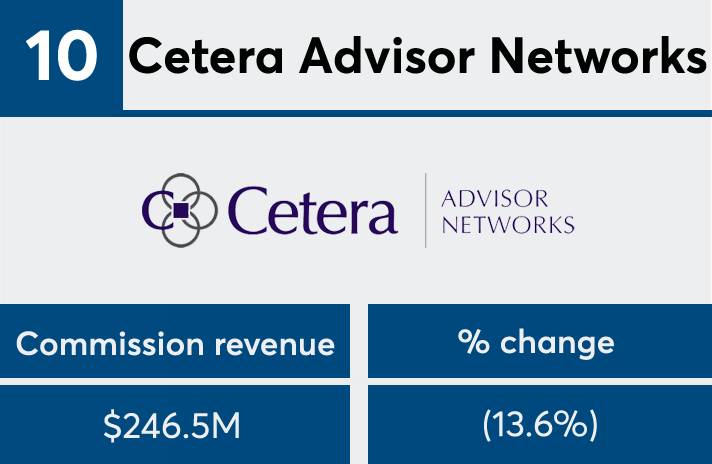

10. Cetera Advisor Networks

% change from 2015: (13.6%)

9. Voya Financial Advisors

% change from 2015: (8.6%)

8. Signator Investors

% change from 2015: 13.4%

7. Northwestern Mutual Investment Services

% change from 2015: (4.5%)

6. Commonwealth Financial Network

% change from 2015: (3.4%)

5. AXA Advisors

% change from 2015: (4.5%)

4. Lincoln Financial Network

% change from 2015: (6.0%)

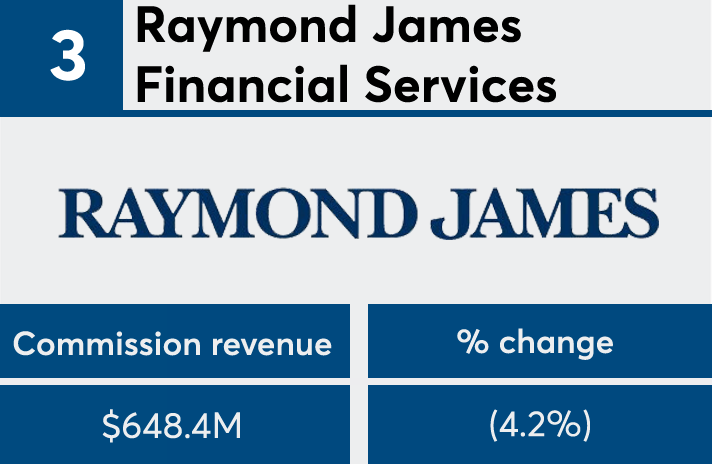

3. Raymond James Financial Services

% change from 2015: (4.2%)

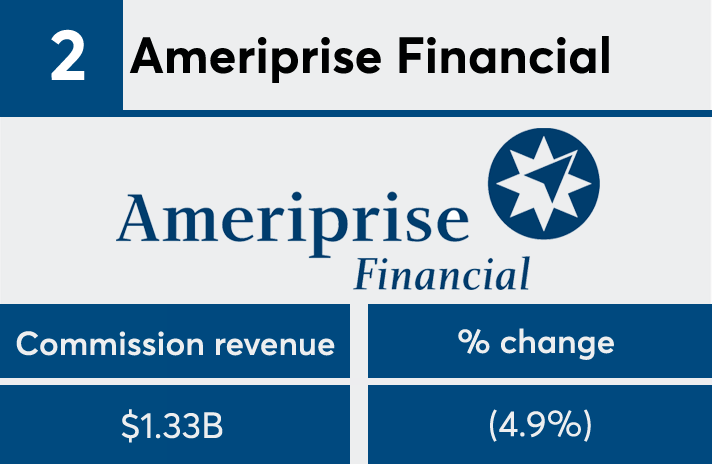

2. Ameriprise Financial

% change from 2015: (4.9%)

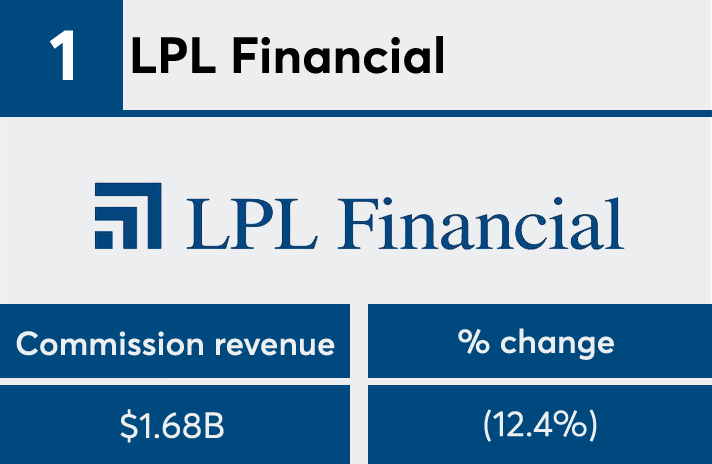

1. LPL Financial

% change from 2015: (12.4%)