The awards, presented annually, recognize managers whose funds demonstrate outsized performance and outstanding long-term risk-adjusted returns. Winners have also proven to be strong stewards of fund shareholders’ capital.

This year's winners were selected in four categories: domestic stock, international stock, fixed income and allocation/alternatives.

"In 2017, we saw a powerful equity rally around the world, while returns on the bond side were muted. In both areas, our Fund Managers of the Year used their proven investment approaches to come out on top," says Laura Pavlenko Lutton, Morningstar's director of manager research, North America. "We also recognize these managers for their strong investment teams, impressive long-term records and a clear dedication to making money for investors."

Morningstar’s 2017 Fund Manager of the Year award winners are:

Domestic stock:

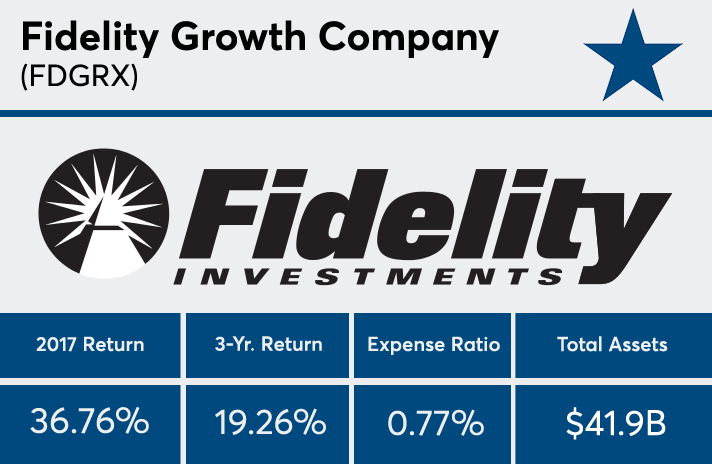

Steven Wymer, Fidelity Growth Company (FDGRX)

Wymer has managed Fidelity Growth Company since 1997. He has been singled out for his ability to spot growth companies in their early stages, including Nvidia, a 2017 high performer that was purchased in 2008. During his tenure, Wymer’s picks in technology and biotechnology have helped the fund consistently beat the Russell 3000 Growth Index. The fund has a 10-year return of 13.87%, and a one-year return of 45%. The fund also boasts below-average fees, with an expense ratio of 0.77%, and has been closed to new investors since 2006. It has a silver analyst rating and positive scores for the five pillars of the analyst rating — process, performance, people, parent and price.

International stock:

Sarah Ketterer, Harry Hartford and team, Causeway International Value (CIVIX)

This team, which includes six co-managers, uses a fundamental and quantitative analysis strategy to uncover firms that have experienced operational distress but have strong long-term risk-adjusted potential. This results in a lower-than-average turnover portfolio of 50 to 60 stocks. The managers’ euro zone picks — including Volkswagen, which rose over 40% in the wake of its U.S. emissions scandal — helped push the fund to a strong 2017 performance. The gold-rated fund has a one-year return of 30% and a 10-year return of 5%. The fund is open to new investors and has an expense ratio of 0.91%.

Fixed income:

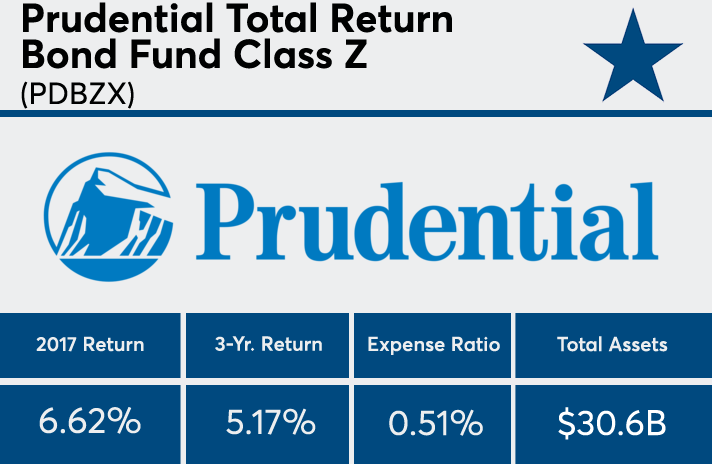

Michael Collins, Robert Tipp, Richard Piccirillo and Gregory Peters, Prudential Total Return Bond (PDBZX)

The team overseeing this silver-rated fund has guided it to a consistently strong risk-adjusted performance. The team, backed by other large teams of analysts, has largely focused on corporate bonds and securitized assets. The fund’s robust performance has been attributed to factors including security selection, sector allocation, duration, yield-curve calls and the ability to weather periods of market volatility. The fund has positive scores for all five pillars of the analyst rating. Its one-year return is 5.17% and its 10-year return is 5.78%. The fund is open to new investors and has an expense ratio of 0.51%.

Allocation/alternatives:

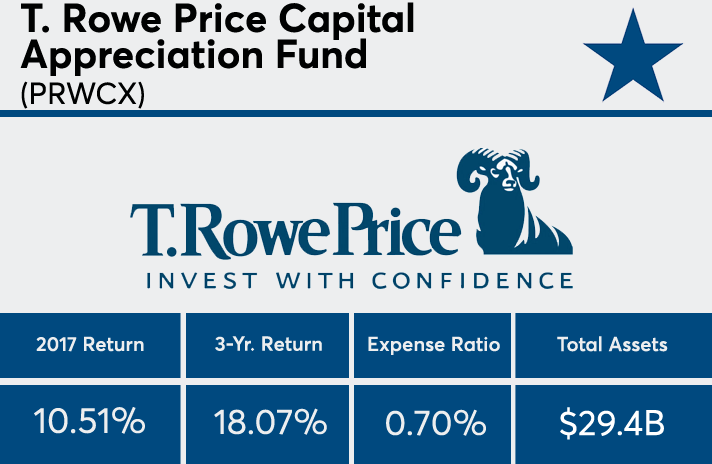

David Giroux, T. Rowe Price Capital Appreciation (PRWCX)

Overseen by Giroux, who also won Fund Manager of the Year for 2012, this fund has beaten its category average every year since 2008 and has outperformed its benchmark over the long term. Closed to new investors since 2014, the fund has an approximate 60/40 equity to fixed-income ratio, although Giroux periodically shifts the fund’s exposures based on current conditions. His success in 2017 has been attributed partly to strong health care picks including Abbott Laboratories and UnitedHealth Group, as well as a corporate bond focus. The gold-rated fund, which has been closed to new investors since 2014, has a one-year return of 18% and a 10-year return of just under 10%. Its expense ratio is 0.71%.

Click through to see data from the winners and runners up. Stars indicate the winners. All data from Morningstar Direct.

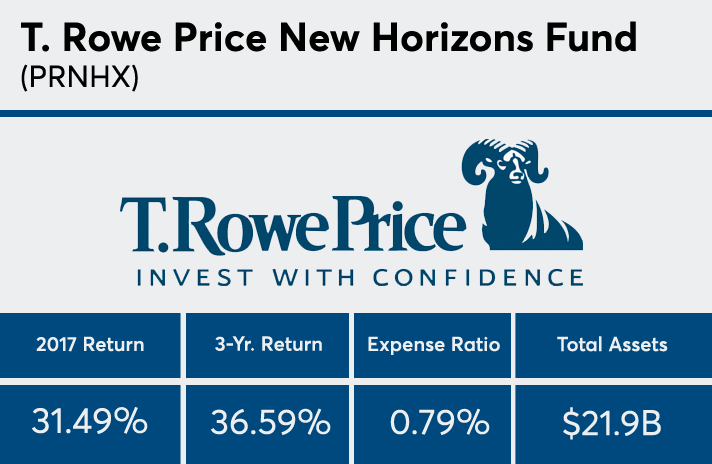

Domestic stock: T. Rowe Price New Horizons Fund (PRNHX)

3-Yr. Returns: 36.59%

Expense Ratio: 0.79%

Total Assets: $21.9 billion

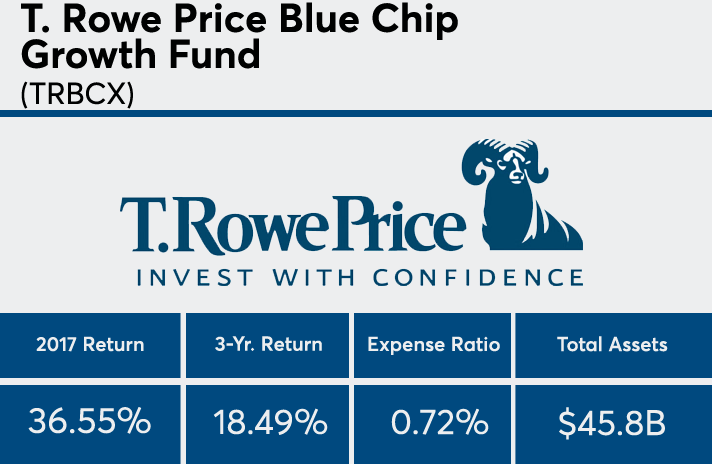

Domestic stock: T. Rowe Price Blue Chip Growth Fund (TRBCX)

3-Yr. Returns: 18.49%

Expense Ratio: 0.72%

Total Assets: $45.8 billion

Domestic stock: Harbor Small Cap Value Fund Institutional Class (HASCX)

3-Yr. Returns: 15.66%

Expense Ratio: 0.87%

Total Assets: $1.4 billion

Domestic stock (WINNER): Fidelity Growth Company (FDGRX)

3-Yr. Returns: 19.26%

Expense Ratio: 0.77%

Total Assets: $41.9 billion

International stock: Vanguard International Growth Fund Investor Shares (VWIGX)

3-Yr. Returns: 47.29%

Expense Ratio: 0.45%

Total Assets: $34.1 billion

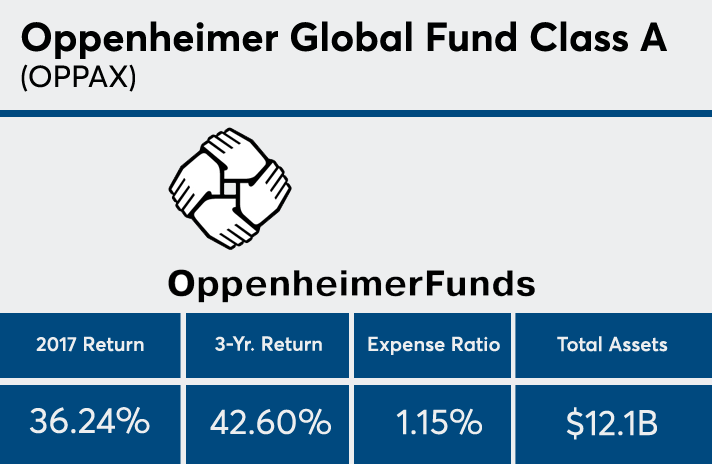

International stock: 6 Oppenheimer Global Fund Class A (OPPAX)

3-Yr. Returns: 42.60%

Expense Ratio: 1.15%

Total Assets: $12.1 billion

International stock (WINNER): Causeway International Value Fund Class Institutional (CIVIX)

3-Yr. Returns: 29.78%

Expense Ratio: 0.91%

Total Assets: $9.1 billion

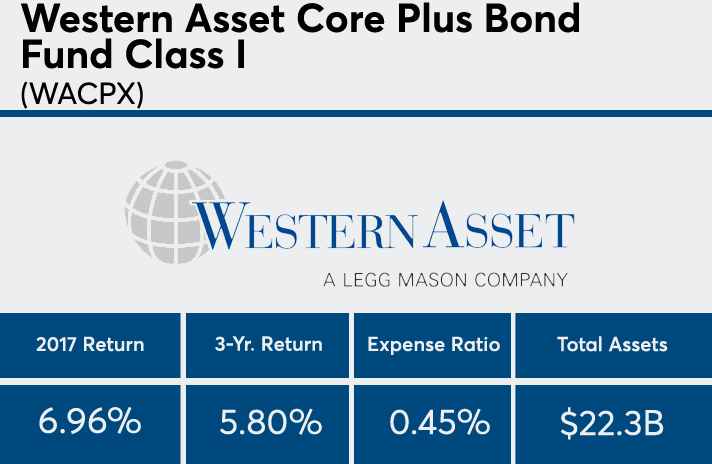

Fixed income: 11 Western Asset Core Plus Bond Fund Class I (WACPX)

3-Yr. Returns: 5.80%

Expense Ratio: 0.45%

Total Assets: $22.3 billion

Fixed income: Pimco Total Return Fund Institutional Class (PTTRX)

3-Yr. Returns: 3.57%

Expense Ratio: 0.46%

Total Assets: $73.8 billion

Fixed income: Pimco Income Fund Institutional Class (PIMIX)

3-Yr. Returns: 7.98%

Expense Ratio: 0.50%

Total Assets: $107.8 billion

Fixed income (WINNER): Prudential Total Return Bond Fund Class Z (PDBZX)

3-Yr. Returns: 5.17%

Expense Ratio: 0.51%

Total Assets: $30.6 billion

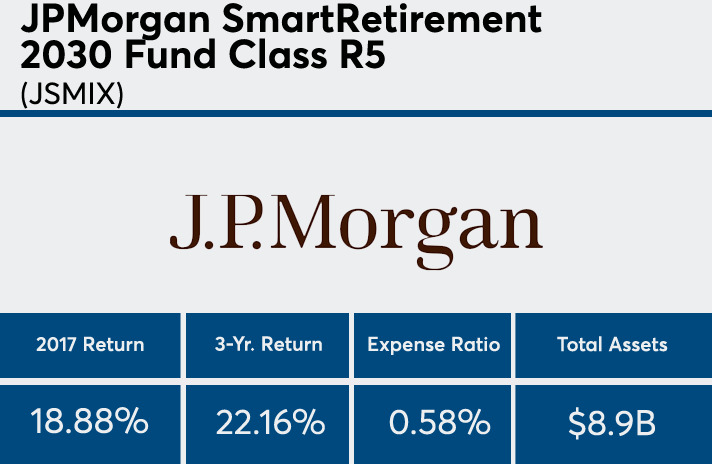

Allocation/Alternatives: JPMorgan SmartRetirement 2030 Fund Class R5 (JSMIX)

3-Yr. Returns: 22.16%

Expense Ratio: 0.58%

Total Assets: $8.9 billion

Allocation/Alternatives: Gateway Fund Class Y Shares (GTEYX)

3-Yr. Returns: 10.38%

Expense Ratio: 0.70%

Total Assets: $8.7 billion

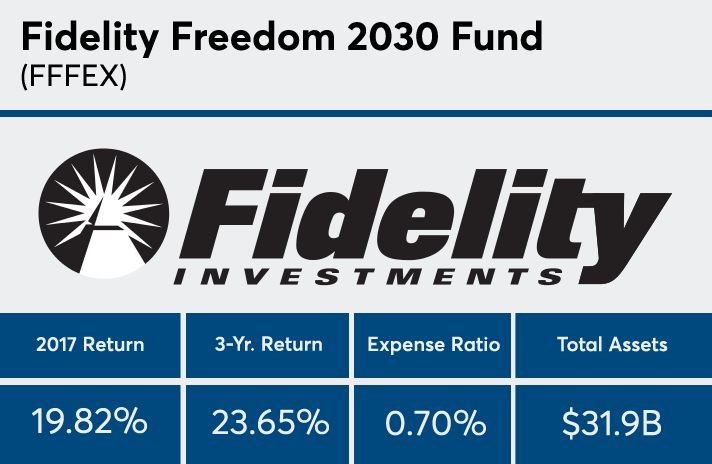

Allocation/Alternatives: Fidelity Freedom 2030 Fund (FFFEX)

3-Yr. Returns: 23.65%

Expense Ratio: 0.70%

Total Assets: $31.9 billion

Allocation/Alternatives (WINNER): T. Rowe Price Capital Appreciation Fund (PRWCX)

3-Yr. Returns: 18.07%

Expense Ratio: 0.70%

Total Assets: $29.4 billion