Precious metals performers: Shiny but scary

Short-term data depicts just how essential a quick flood to the category can be. Those who selected gold, silver or other precious metal funds in light of recent market volatility have been able to profit handsomely all of the category’s top YTD performers raked in triple digit returns while the same funds over the long-term all experienced double-digit negative returns.

Click through our slideshow for the top YTD returns in the category, contrasted with long-term performance numbers. All data provided by Morningstar.

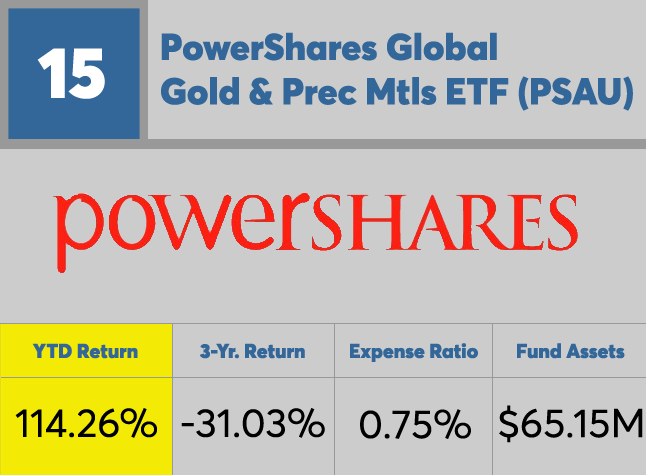

15. PowerShares Global Gold & Prec Mtls ETF

YTD Return: 114.26%

3-Yr. Return: -31.03%

Expense Ratio: 0.75%

Fund Assets: $65.15M

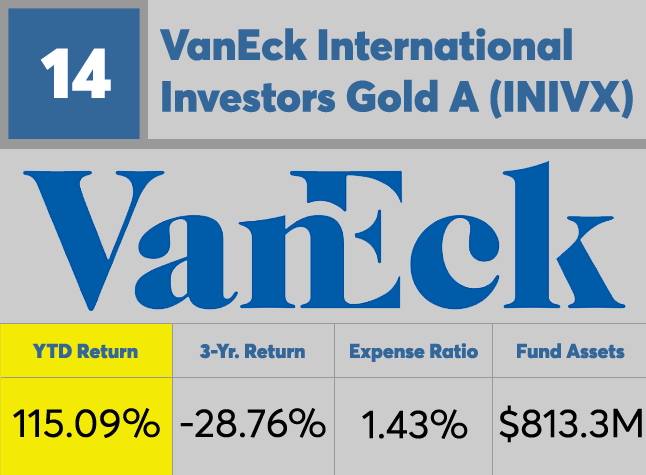

14. VanEck International Investors Gold A

YTD Return: 115.09%

3-Yr. Return: -28.76%

Expense Ratio: 1.43%

Fund Assets: $813.3M

13. American Century Global Gold Inv

YTD Return: 115.13%

3-Yr. Return: -30.80%

Expense Ratio: 0.67%

Fund Assets: $517.7M

12. VanEck Vectors Gold Miners ETF

YTD Return: 117.64%

3-Yr. Return: -32.79%

Expense Ratio: 0.52%

Fund Assets: $9.86B

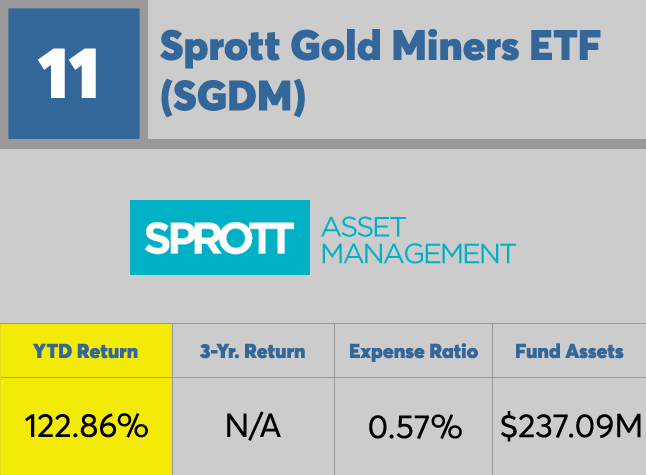

11. Sprott Gold Miners ETF

YTD Return: 122.86%

3-Yr. Return: N/A

Expense Ratio: 0.57%

Fund Assets: $237.09M

10. EuroPac Gold A

YTD Return: 123.56%

3-Yr. Return: N/A

Expense Ratio: 1.54%

Fund Assets: $76.9M

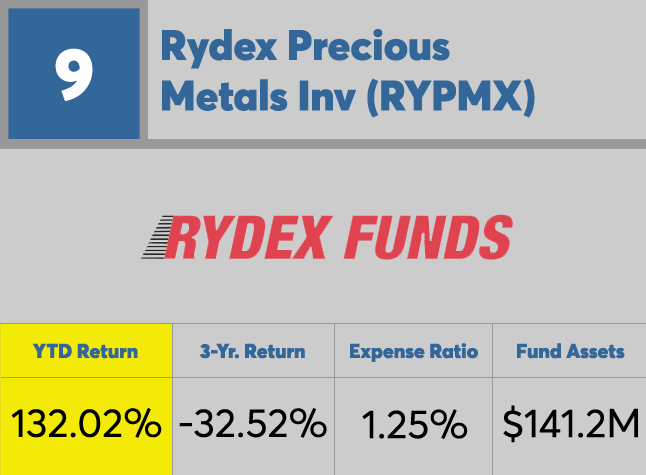

9. Rydex Precious Metals Inv

YTD Return: 132.02%

3-Yr. Return: -32.52%

Expense Ratio: 1.25%

Fund Assets: $141.2M

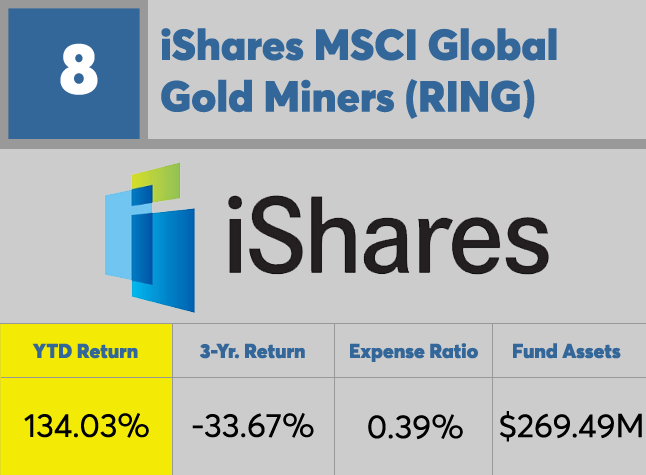

8. iShares MSCI Global Gold Miners

YTD Return: 134.03%

3-Yr. Return: -33.67%

Expense Ratio: 0.39%

Fund Assets: $269.49M

7. US Global Investors World Prec Mnral

YTD Return: 134.62%

3-Yr. Return: -30.047%

Expense Ratio: 1.86%

Fund Assets: $195.2M

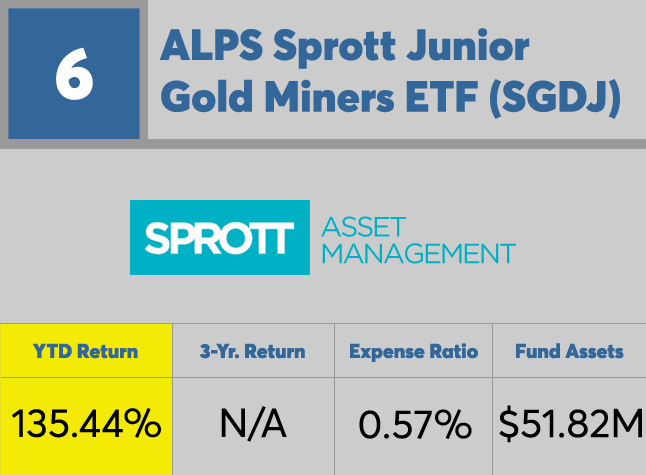

6. ALPS Sprott Junior Gold Miners ETF

YTD Return: 135.44%

3-Yr. Return: N/A

Expense Ratio: 0.57%

Fund Assets: $51.82M

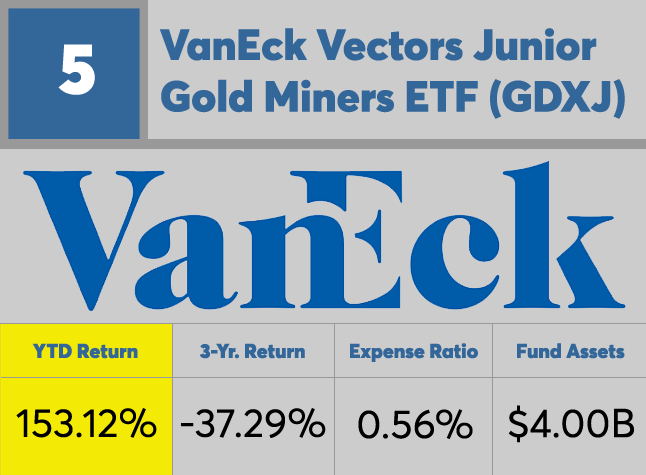

5. VanEck Vectors Junior Gold Miners ETF

YTD Return: 153.12%

3-Yr. Return: -37.29%

Expense Ratio: 0.56%

Fund Assets: $4.00B

4. Global X Gold Explorers ETF

YTD Return: 165.93%

3-Yr. Return: -32.28%

Expense Ratio: 0.65%

Fund Assets: $79.28M

3. Global X Silver Miners ETF

YTD Return: 165.95%

3-Yr. Return: -34.88%

Expense Ratio: 0.65%

Fund Assets: $430.34M

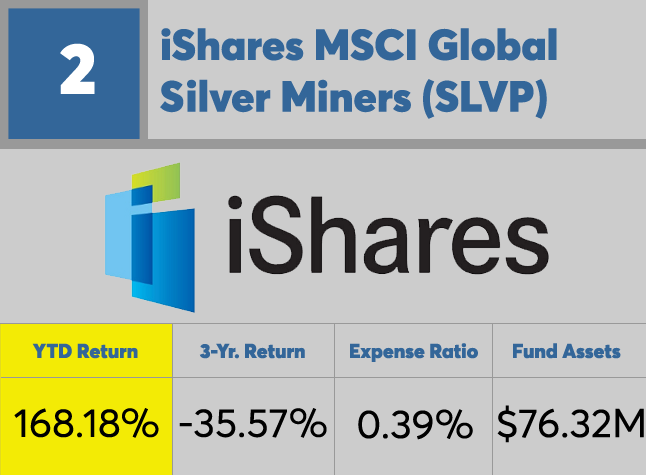

2. iShares MSCI Global Silver Miners

YTD Return: 168.18%

3-Yr. Return: -35.57%

Expense Ratio: 0.39%%

Fund Assets: $76.32M

1. PureFunds ISE Junior Silver ETF

YTD Return: 241.98%

3-Yr. Return: -36.25%

Expense Ratio: 0.69%%

Fund Assets: $67.97M