The Financial Select Sector SPDR ETF, which had outflows of $1.5 billion in the last year, attracted a whopping $4.9 billion in inflows during the week after the election. The sector's flood of new money comes as a direct result of a steepening yield curve in response to Trump's win, an analyst says.

"This is a sign of both the Trump-inspired bullishness for the sector as well as the increase in the size and number of investors using ETFs to express opinions," says Eric Balchunas, an ETF analyst at Bloomberg Intelligence. "This is what it looks like when hot money gets excited. Keep in mind these flows could come out just as easily if the narrative changes again."

Scroll through to see the top 20 financial sector ETFs with more than $100 million in assets ranked by their net share class inflows over the last year. The following flow data was last reported on Oct. 31 and returns on Nov. 16. All data from Morningstar.

Financial Select Sector SPDR ETF (XLF)

1-Yr. Return: 16.82%

Expense Ratio: 0.15%

Net Assets (millions): $19,751

SPDR S&P Bank ETF (KBE)

1-Yr. Return: 17.02%

Expense Ratio: 0.35%

Net Assets (millions): $2,990

iShares US Broker-Dealers & Secs Exchs (IAI)

1-Yr. Return: 15.58%

Expense Ratio: 0.44%

Net Assets (millions): $142

First Trust Financials AlphaDEX ETF (FXO)

1-Yr. Return: 12.50%

Expense Ratio: 0.64%

Net Assets (millions): $837

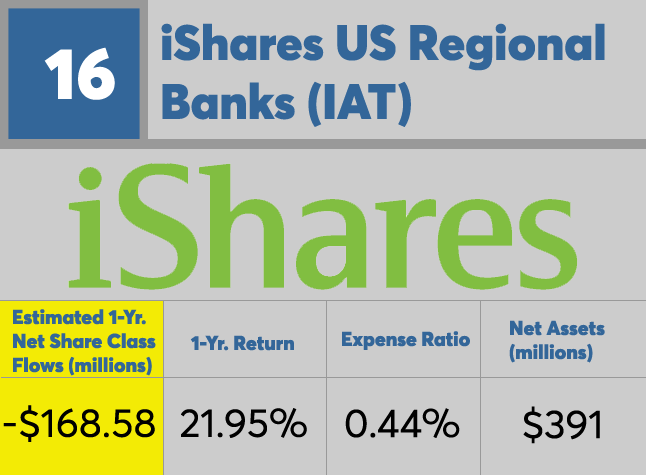

iShares US Regional Banks (IAT)

1-Yr. Return: 21.95%

Expense Ratio: 0.44%

Net Assets (millions): $391

SPDR S&P Regional Banking ETF (KRE)

1-Yr. Return: 19.14%

Expense Ratio: 0.35%

Net Assets (millions): $3,150

PowerShares KBW Bank ETF (KBWB)

1-Yr. Return: 18.39%

Expense Ratio: 0.35%

Net Assets (millions): $652

PowerShares KBW High Div Yld Fincl ETF (KBWD)

1-Yr. Return: 13.33%

Expense Ratio: 0.35%

Net Assets (millions): $229

Guggenheim S&P 500 Eq Weight Fincl ETF (RYF)

1-Yr. Return: 19.29%

Expense Ratio: 0.40%

Net Assets (millions): $146

iShares US Financial Services (IYG)

1-Yr. Return: 12.15%

Expense Ratio: 0.44%

Net Assets (millions): $1,126

PowerShares S&P SmallCap Financials ETF (PSCF)

1-Yr. Return: 20.20%

Expense Ratio: 0.29%

Net Assets (millions): $217

iShares MSCI Europe Financials (EUFN)

1-Yr. Return: -7.58%

Expense Ratio: 0.48%

Net Assets (millions): $340

VanEck Vectors BDC Income ETF (BIZD)

1-Yr. Return: 16.62%

Expense Ratio: 0.40%

Net Assets (millions): $112

First Trust Nasdaq ABA Community Bk ETF (QABA)

1-Yr. Return: 21.56%

Expense Ratio: 0.60%

Net Assets (millions): $277

SPDR S&P Insurance ETF (KIE)

1-Yr. Return: 15.36%

Expense Ratio: 0.35%

Net Assets (millions): $780

iShares Global Financials (IXG)

1-Yr. Return: 7.15%

Expense Ratio: 0.47%

Net Assets (millions): $321

Fidelity MSCI Financials ETF (FNCL)

1-Yr. Return: 18.40%

Expense Ratio: 0.12%

Net Assets (millions): $346

Vanguard Financials ETF )

1-Yr. Return: 18.42%

Expense Ratio: 0.10%

Net Assets (millions): $4,008

PowerShares KBW Regional Banking ETF (KBWR)

1-Yr. Return: 22.60%

Expense Ratio: 0.35%

Net Assets (millions): $179

iShares US Financials (IYF)

1-Yr. Return: 11.59%

Expense Ratio: 0.44%

Net Assets (millions): $1,704