Solid returns and low volatility: Top ETFs

Halfway through 2016, investors have already surpassed the $10.7 billion placed in the ETF category all of last year, according to Deutsche Bank. Low-volatility ETFs have attracted $14.3 billion from January through June.

Other ETF categories “experienced erratic flows with cumulative YTD flows bottoming at over $35 billion in outflows in February and ending at over $15 billion outflows at the end of June,” the bank’s researchers report.

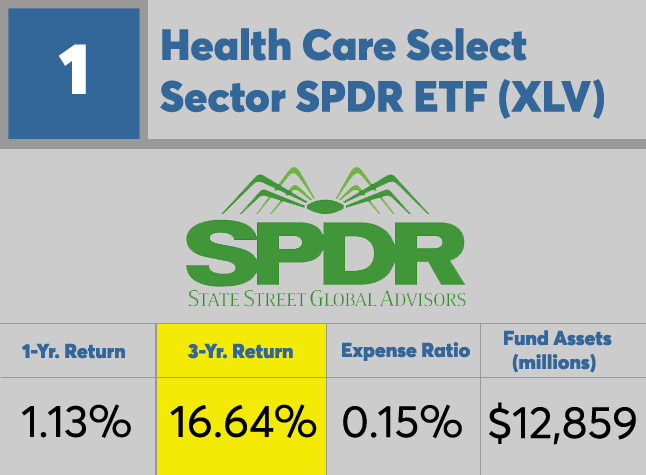

While health care and, biotech, are typically volatile, the Health Care Select Sector SPDR ETF leads the low-volatility space because of its large-cap concentration, says Morningstar ETF research head Alex Bryan.

“Earnings and cash flows in that sector tend to be a little less volatile,” he says.

Scroll through to see the top performers ranked by three-year return. All data from Morningstar.

15. Guggenheim S&P 500 Eq Wt Indls ETF

1-Yr. Return: 6.86%

3-Yr. Return: 11.57%

Expense Ratio: 0.40%

Fund Assets (millions): $107.92

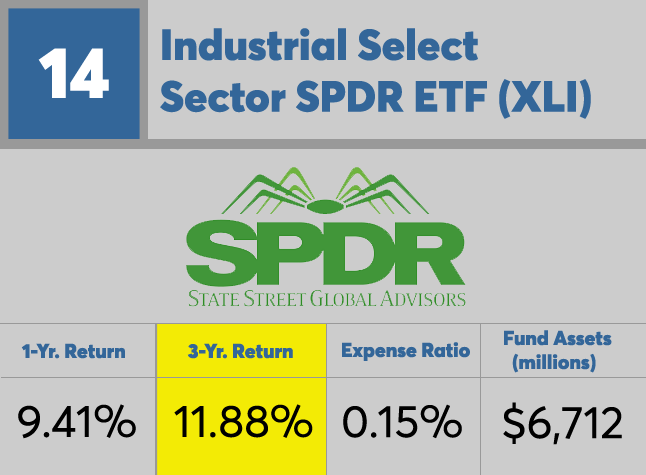

14. Industrial Select Sector SPDR ETF

1-Yr. Return: 9.41%

3-Yr. Return: 11.88%

Expense Ratio: 0.15%

Fund Assets (millions): $6,712

13. iShares US Consumer Services

1-Yr. Return: 4.23%

3-Yr. Return: 12.82%

Expense Ratio: 0.43%

Fund Assets (millions): $893.34

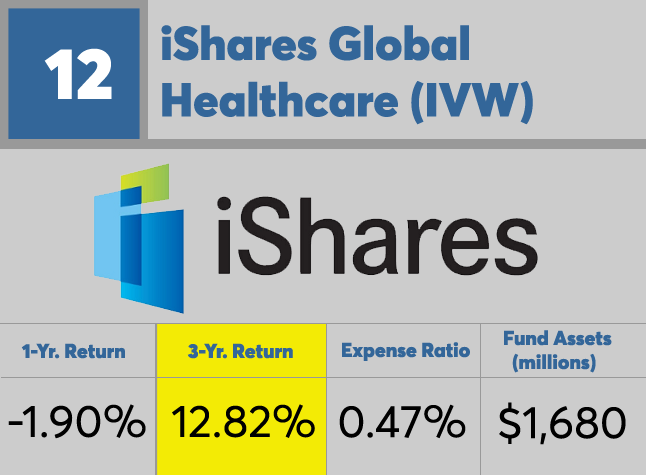

12. iShares Global Healthcare

1-Yr. Return: -1.90%

3-Yr. Return: 12.82%

Expense Ratio: 0.47%

Fund Assets (millions): $1,680

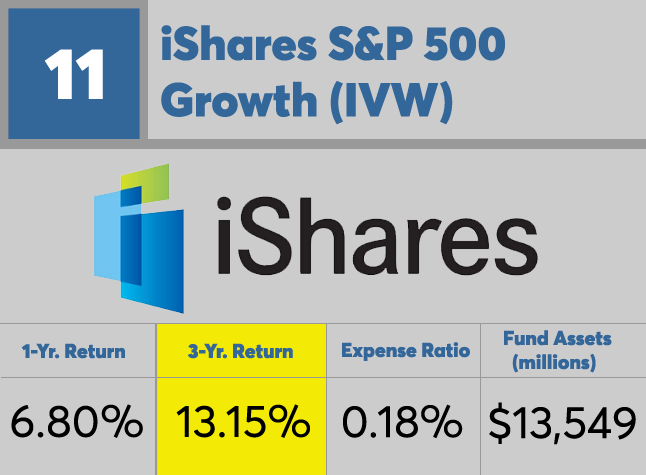

11. iShares S&P 500 Growth

1-Yr. Return: 6.80%

3-Yr. Return: 13.15%

Expense Ratio: 0.18%

Fund Assets (millions): $13,549

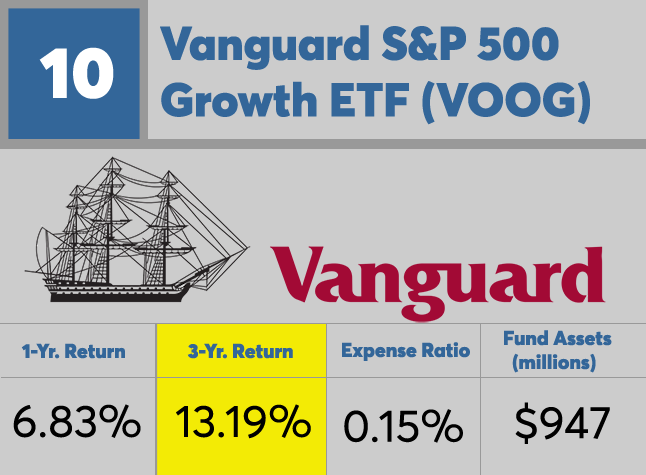

10. Vanguard S&P 500 Growth ETF

1-Yr. Return: 6.83%

3-Yr. Return: 13.19%

Expense Ratio: 0.15%

Fund Assets (millions): $947.76

9. iShares Select Dividend

1-Yr. Return: 17.17%

3-Yr. Return: 13.28%

Expense Ratio: 0.39%

Fund Assets (millions): $15,904

8. iShares Russell Top 200 Growth

1-Yr. Return: 7.67%

3-Yr. Return: 13.89%

Expense Ratio: 0.20%

Fund Assets (millions): $624.39

7. First Trust Value Line Dividend ETF

1-Yr. Return: 17.75%

3-Yr. Return: 13.91%

Expense Ratio: 0.70%

Fund Assets (millions): $2,145

6. PowerShares S&P 500 Low Volatility ETF

1-Yr. Return: 19.14%

3-Yr. Return: 13.91%

Expense Ratio: 0.25%

Fund Assets (millions): $7,865

5. Technology Select Sector SPDR ETF

1-Yr. Return: 9.91%

3-Yr. Return: 14.43%

Expense Ratio: 0.15%

Fund Assets (millions): $12,327

4. iShares Edge MSCI Min Vol USA

1-Yr. Return: 17.29%

3-Yr. Return: 14.83%

Expense Ratio: 0.15%

Fund Assets (millions): $15,080

3. PowerShares Aerospace & Defense ETF

1-Yr. Return: 9.71%

3-Yr. Return: 15.67%

Expense Ratio: 0.66%

Fund Assets (millions): $320

2. PowerShares S&P 500 High Div Low VolETF

1-Yr. Return: 25.23%

3-Yr. Return: 16.07%

Expense Ratio: 0.30%

Fund Assets (millions): $2,228

1. Health Care Select Sector SPDR ETF

1-Yr. Return: 1.13%

3-Yr. Return: 16.64%

Expense Ratio: 0.15%

Fund Assets (millions): $12,859