Open-end funds that reported the highest net share class outflows over the past five years; including the Fidelity Growth Company, Columbia Acorn Z and the Dodge & Cox Stock, are prime examples, says Robert Johnson, the director of economic analysis at Morningstar.

"[Investors] are figuring out now that they might as well do something that's low cost and that they can get out of easily,” Johnson says. “There are active managers that do well, and that have reasonable costs … so, I don’t want to paint them all that there's no hope for active management; it's just a terrible headwind to face.”

Scroll through to see the top 20 mutual funds with more than $1 billion in assets ranked by their net share class outflows over the last five years. The following flow data was last reported on Oct. 31 and returns on Nov. 4. All data is from Morningstar.

20. Permanent Portfolio Permanent I (PRPFX)

5-Yr. Return: 0.73%

Expense Ratio: 0.80%

Net Assets (millions): $2,978

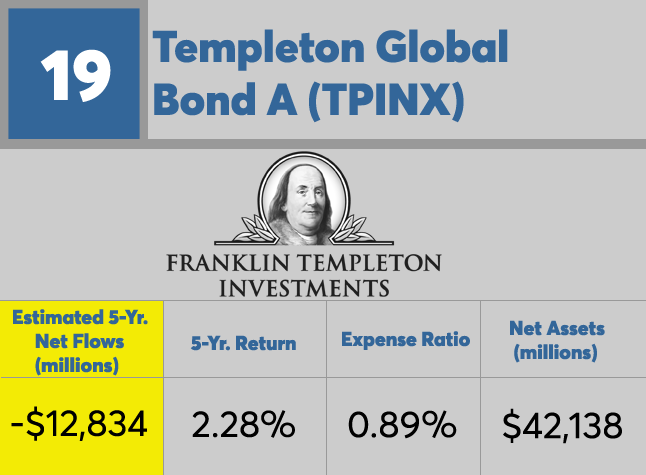

19. Templeton Global Bond A (TPINX)

5-Yr. Return: 2.28%

Expense Ratio: 0.89%

Net Assets (millions): $42,138

18. American Funds Washington Mutual A (AWSHX)

5-Yr. Return: 11.97%

Expense Ratio: 0.58%

Net Assets (millions): $79,482

17. Dodge & Cox Stock (DODGX)

5-Yr. Return: 14.36%

Expense Ratio: 0.52%

Net Assets (millions): $56,229

16. T. Rowe Price Equity Income (PRFDX)

5-Yr. Return: 10.91%

Expense Ratio: 0.66%

Net Assets (millions): $21,858

15. Columbia Acorn Z (ACRNX)

5-Yr. Return: 8.52%

Expense Ratio: 0.82%

Net Assets (millions): $4,949

14. Vanguard Total Stock Mkt Idx Inv (VTSMX)

5-Yr. Return: 12.69%

Expense Ratio: 0.16%

Net Assets (millions): $463,127

13. Davis NY Venture A (NYVTX)

5-Yr. Return: 11.09%

Expense Ratio: 0.86%

Net Assets (millions): $11,135

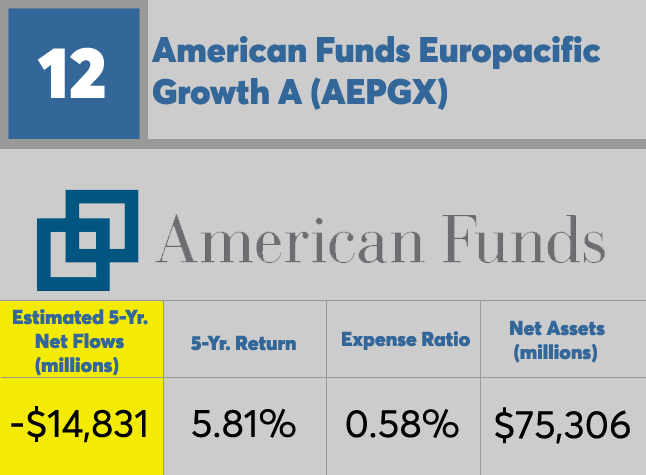

12. American Funds Europacific Growth A (AEPGX)

5-Yr. Return: 5.81%

Expense Ratio: 0.83%

Net Assets (millions): $120,940

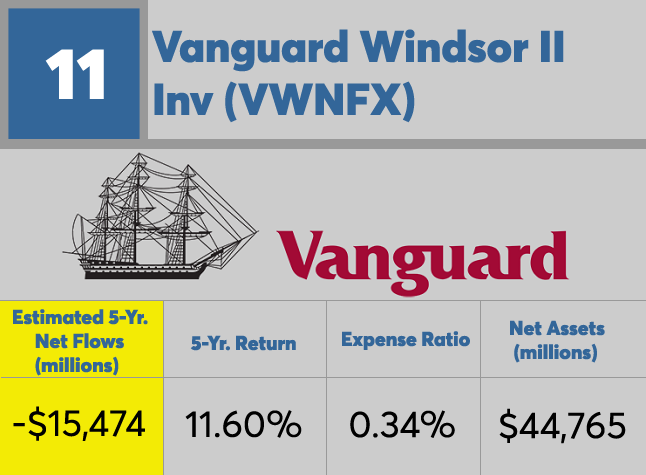

11. Vanguard Windsor II Inv (VWNFX)

5-Yr. Return: 11.60%

Expense Ratio: 0.34%

Net Assets (millions): $44,765

10. American Funds Invmt Co of America A (AIVSX)

5-Yr. Return: 12.71%

Expense Ratio: 0.58%

Net Assets (millions): $75,306

American Funds Capital World Gr & Inc A (CWGIX)

5-Yr. Return: 8.84%

Expense Ratio: 0.77%

Net Assets (millions): $80,038

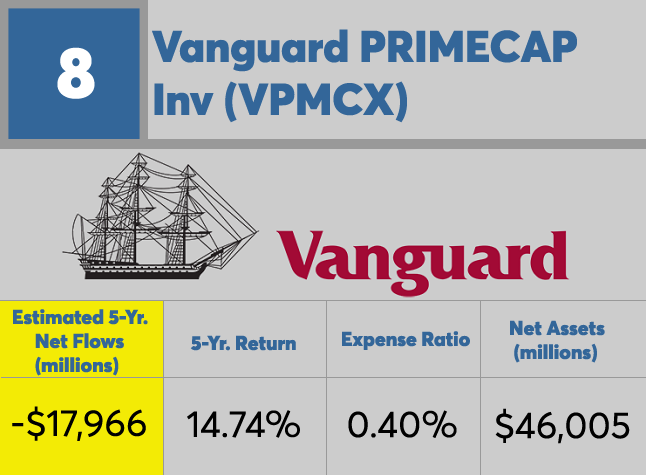

8. Vanguard PRIMECAP Inv (VPMCX)

5-Yr. Return: 14.74%

Expense Ratio: 0.40%

Net Assets (millions): $46,005

7. Fidelity 500 Index Investor (FUSEX)

5-Yr. Return: $13.04%

Expense Ratio: 0.09%

Net Assets (millions): $101,547

6. Vanguard 500 Index Inv (VFINX)

5-Yr. Return: 12.97%

Expense Ratio: 0.16%

Net Assets (millions): $259,673

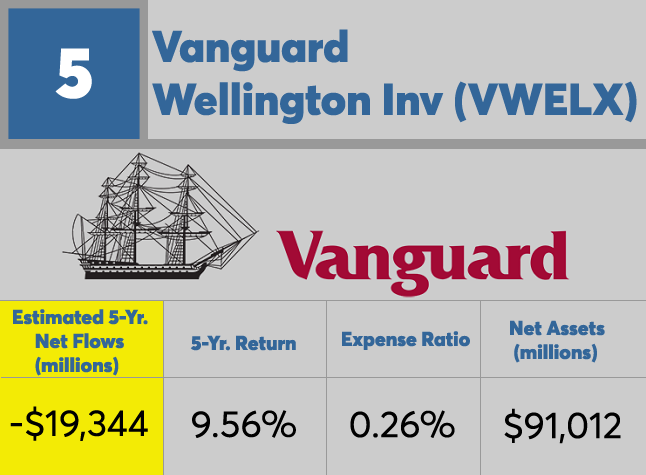

5. Vanguard Wellington Inv (VWELX)

5-Yr. Return: 9.56%

Expense Ratio: 0.26%

Net Assets (millions): $91,012

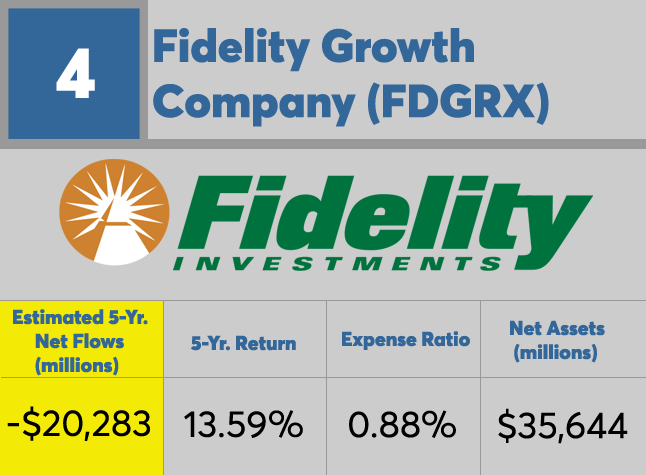

4. Fidelity Growth Company (FDGRX)

5-Yr. Return: 13.59%

Expense Ratio: 0.88%

Net Assets (millions): $35,644

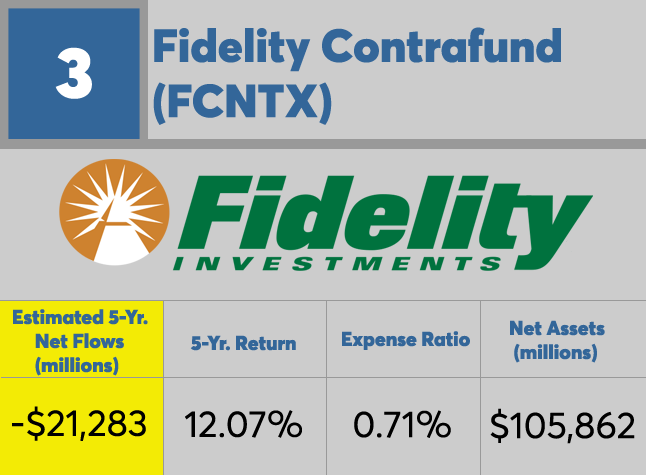

3. Fidelity Contrafund (FCNTX)

5-Yr. Return: 12.07%

Expense Ratio: 0.71%

Net Assets (millions): $105,862

2. American Funds Growth Fund of America A (AGTHX)

5-Yr. Return: $13.29

Expense Ratio: 0.66%

Net Assets (millions): $140,102

1. PIMCO Total Return Instl (PTTRX)

5-Yr. Return: 3.76%

Expense Ratio: 0.46%

Net Assets (millions): $82,598