Which funds have the highest UK exposure?

In the spirit of buying low, however, market carnage will always present some opportunities. "Extreme price moves bring the chance to rebalance and reset portfolio allocations," said David Lafferty, chief market strategist at Natixis Global Asset Management, in an email. Stock valuations, which have been elevated recently, will look more reasonable. ... While rebalancing can’t prevent losses, it helps to mitigate a potentially larger problem – the risk that the portfolio wanders too far from its long-term risk/return objectives."

Others agree. "Extreme levels of fear suggest to us that investors with longer-term time horizons are looking at a very attractive period in which to invest in equities," said Richard Bernstein, an independent adviser, in a note to clients. His shop continues to overweight equities, which has hurt recent performance, but he believes that an earnings-driven, P/E compression bull market will be the big market story this year and next.

Click through to see the funds that have the highest percentage exposures to the UK. Only funds with at least $100 million in assets are included. All data are from Morningstar.

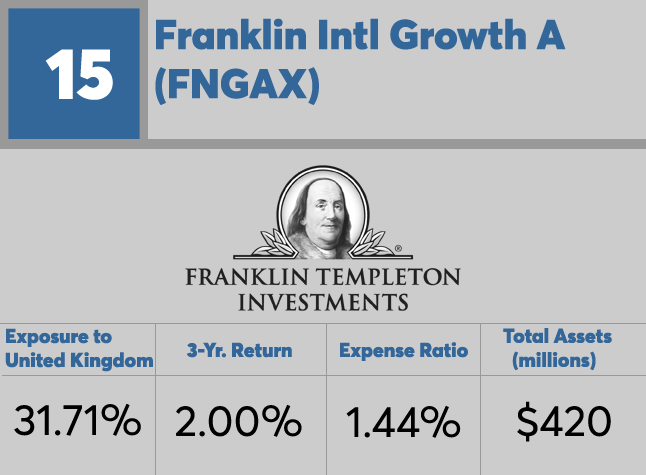

15. Franklin Intl Growth A

3-Yr. Return: 2.00%

Expense Ratio: 1.44%

Total Assets (millions): $420

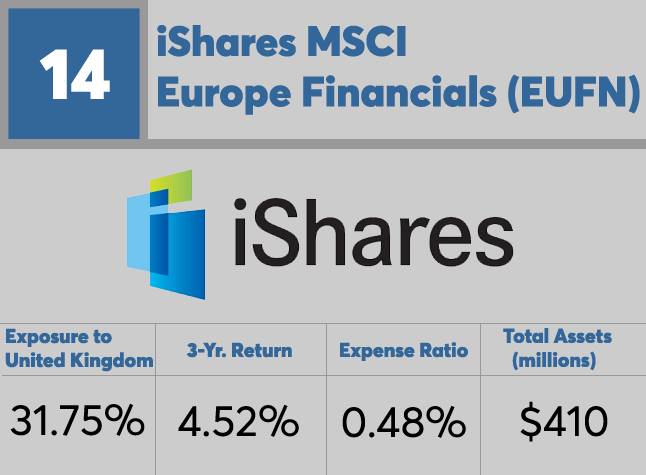

14. iShares MSCI Europe Financials

3-Yr. Return: 4.52%

Expense Ratio: 0.48%

Total Assets (millions): $410

13. Morgan Stanley Inst International Eq I

3-Yr. Return: 4.30%

Expense Ratio: 0.95%

Total Assets (millions): $4,040

12. SPDR STOXX Europe 50 ETF

3-Yr. Return: 2.97%

Expense Ratio: 0.29%

Total Assets (millions): $265

11. Fidelity Europe

3-Yr. Return: 6.95%

Expense Ratio: 1.03%

Total Assets (millions): $1,251

10. First Trust STOXX European Sel Div ETF

3-Yr. Return: 4.21%

Expense Ratio: 0.60%

Total Assets (millions): $184

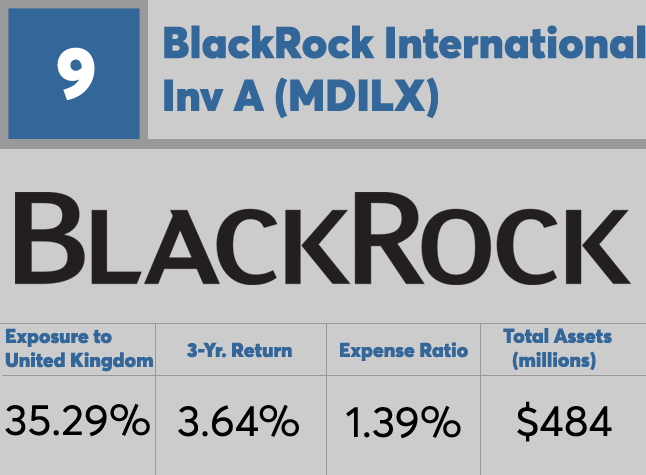

9. BlackRock International Inv A

3-Yr. Return: 3.64%

Expense Ratio: 1.39%

Total Assets (millions): $484

8. JNL/Mellon Capital Global 30 A

3-Yr. Return: 4.84%

Expense Ratio: 0.65%

Total Assets (millions): $321

7. Henderson European Focus A

3-Yr. Return: 9.56%

Expense Ratio: 1.31%

Total Assets (millions): $3,019

6. Federated Intl Strategic Val Div A

3-Yr. Return: 0.09%

Expense Ratio: 1.11%

Total Assets (millions): $814

8. Invesco European Growth A

3-Yr. Return: 6.61%

Expense Ratio: 1.38%

Total Assets (millions): $1,543

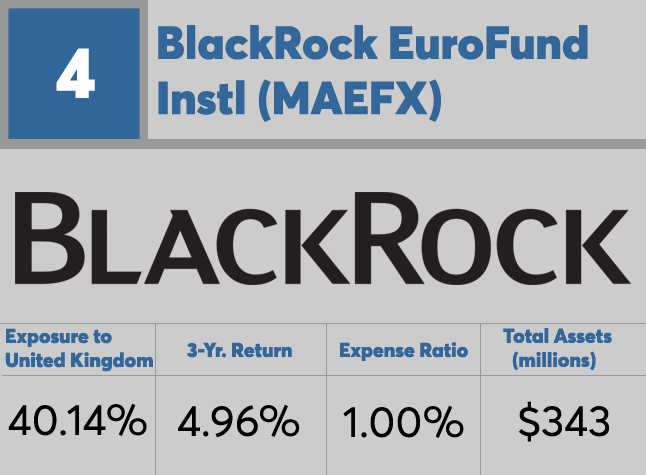

4. BlackRock EuroFund Instl

3-Yr. Return: 4.96%

Expense Ratio: 1.00%

Total Assets (millions): $343

3. Voya FTSE 100 Index Port I

3-Yr. Return: 1.41%

Expense Ratio: 0.42%

Total Assets (millions): $271

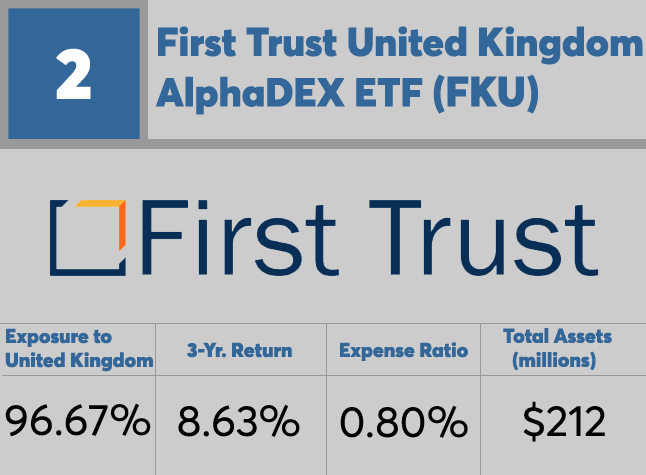

2. First Trust United Kingdom AlphaDEX ETF

3-Yr. Return: 8.63%

Expense Ratio: 0.80%

Total Assets (millions): $212

1. iShares MSCI United Kingdom

3-Yr. Return: 1.30%

Expense Ratio: 0.48%

Total Assets (millions): $3,207