-

Missed IRA RMDs can cost clients thousands, Vanguard research shows. But financial advisors can help erase tax penalties and avoid future ones with a few key strategies.

January 27 -

Rather than investigate her claims against the head of the firm's wealth unit, the accuser claims that Citi's human resources turned its spotlight on her. Citi denies the claims.

January 27 -

Agentic AI will continue to automate financial planner workflows — and that's a good thing.

January 27 FP Alpha

FP Alpha -

The Wall Street giant still is often associated with deposits, lending and checking and savings accounts. But it's among the throng of firms seeking to give clients easy access to both banking and investing services online.

January 26 -

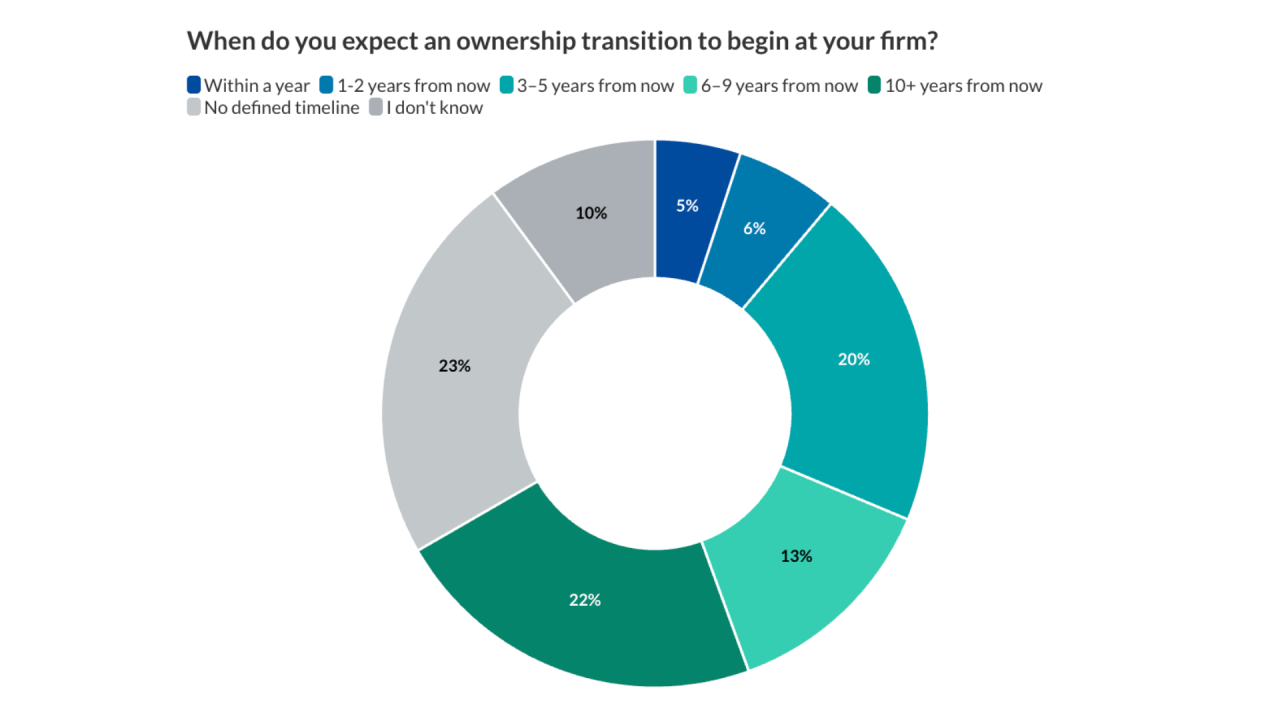

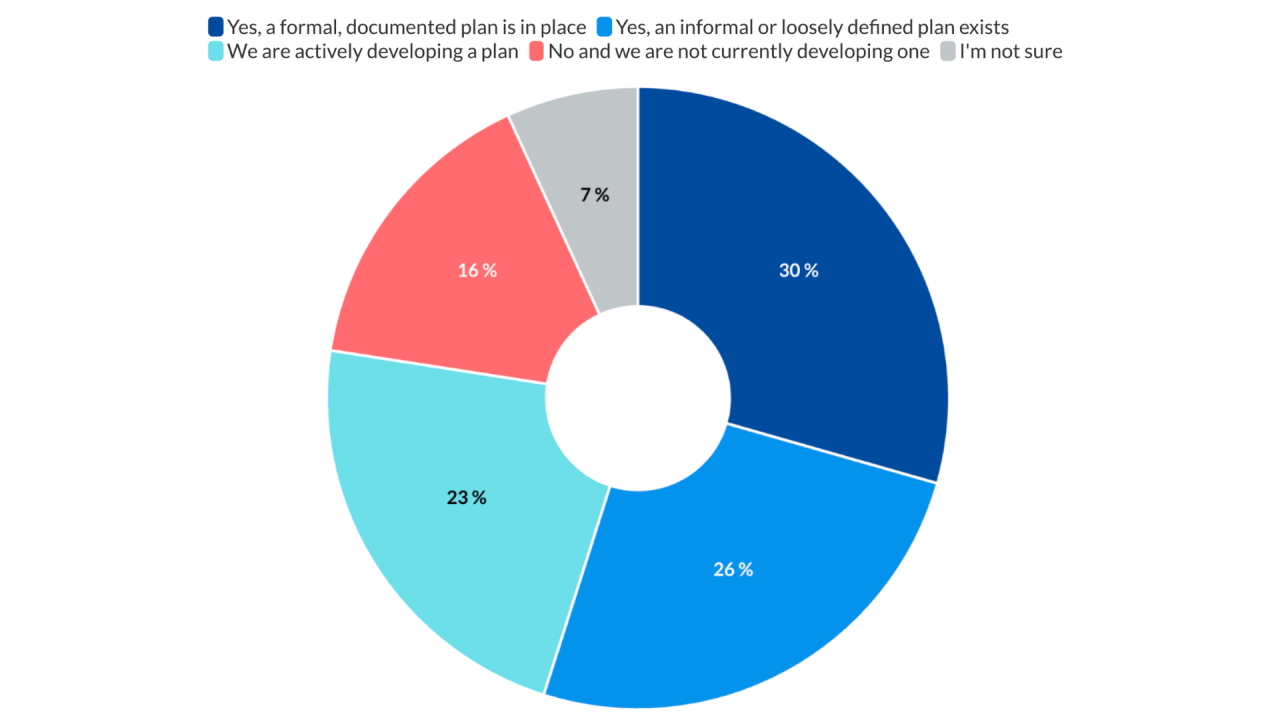

Many advisors haven't yet begun putting together an exit plan. Experts say there are common features and defined timelines that can help make it work.

January 26 -

Money News Network CEO Nicole Lapin and her RIA collaborators are building direct services through her growing base of readers, viewers and listeners.

January 26 -

The inquiry into the now-defunct Credit Suisse's former dealigns with Nazis comes as UBS pushes to build its U.S. wealth business working with wealthy clients.

January 26 -

The record pay package for the Goldman CEO comes after a year of soaring profits for the firm's investment bank.

January 26 -

Advisors know that a transition plan is important, but many fall into the trap of procrastination.

January 23 -

Plus, Cetera adds a $1.9B tax-focused firm, Choreo acquires two RIAs, and Modern Wealth expands in New York.

January 23 -

The raise comes following a year when the firm earned $57 billion in net income, approaching a record set in 2024.

January 23 -

Advisors can maintain professional certifications while keeping up to date on important issues in tax planning, compliance and more.

January 23 -

Looking for a new challenge, Mark Seither found the complexities of pilot compensation and tax planning to be a niche that energizes him.

January 23 -

Fixed-income ETFs are rapidly gaining popularity among advisors, driven by growing familiarity, diverse offerings and strong asset flows, new Cerulli research shows.

January 22 -

Brokers were worried a new rule intended to lighten their responsibility to monitor advisors' side hustles would ironically mean greater supervision duties with RIAs.

January 22 -

The results of Morningstar's latest study tracking fees and performance finds accelerating consolidation and commodification that makes advice more valuable.

January 22 -

Advisors spend a lot of time choosing the tools they use, and tech is more sophisticated than ever. But how much tech should clients actually see?

January 22 -

A Ninth Circuit appellate panel ruled that10 advisors recruited to LPL from Ameriprise have the right to resist turning over their personal devices to a forensic examiner to be searched for evidence of misappropriated client data.

January 21 -

Even as crypto prices slide, a growing share of financial advisors are adding digital assets to client portfolios, with firm policies slowly catching up.

January 21 -

An internal successor, a seller and an acquirer dish out the most common mistakes they say advisory firms must avoid to address the challenge.

January 21