-

Real interest rates, which protect from inflation, have fallen in recent years, making it more expensive to finance future spending, Allison Schrager writes.

May 14 -

New flows to traditional fixed income investments remain strong, according to Cerulli Associates data.

April 14 -

The broker allegedly spent his client’s money on luxury items then pivoted to a Medicare fraud scam a couple of years later.

March 16 -

It’s a move that combines two businesses providing products and services in high demand — investment returns and retirement income, the firms said.

March 8 -

With few areas of growth in 2020, insurers are focusing on burgeoning RILAs and finding more distribution channels, experts say.

February 11 -

Sammons is trying to solve the longtime question of how best to combine planning with certain products through technology.

February 1 -

Three provisions in the far-reaching law “make it likely that annuities will become more prevalent in company plans,” one expert says.

January 27 -

The investment plays on a trend, “which is the blurring of the distinction between traditional insurance products and wealth management products.”

January 13 -

Decisions we make during financial crises alter as retirement nears — and not always for the better.

December 28 Raymond James Insurance Group

Raymond James Insurance Group -

The wealth manager whose parent firm also owns an insurer and asset manager settled its third case involving the same time period.

December 23 -

The low interest rates pushing down sales across most fixed and variable lines are also boosting certain products.

November 25 -

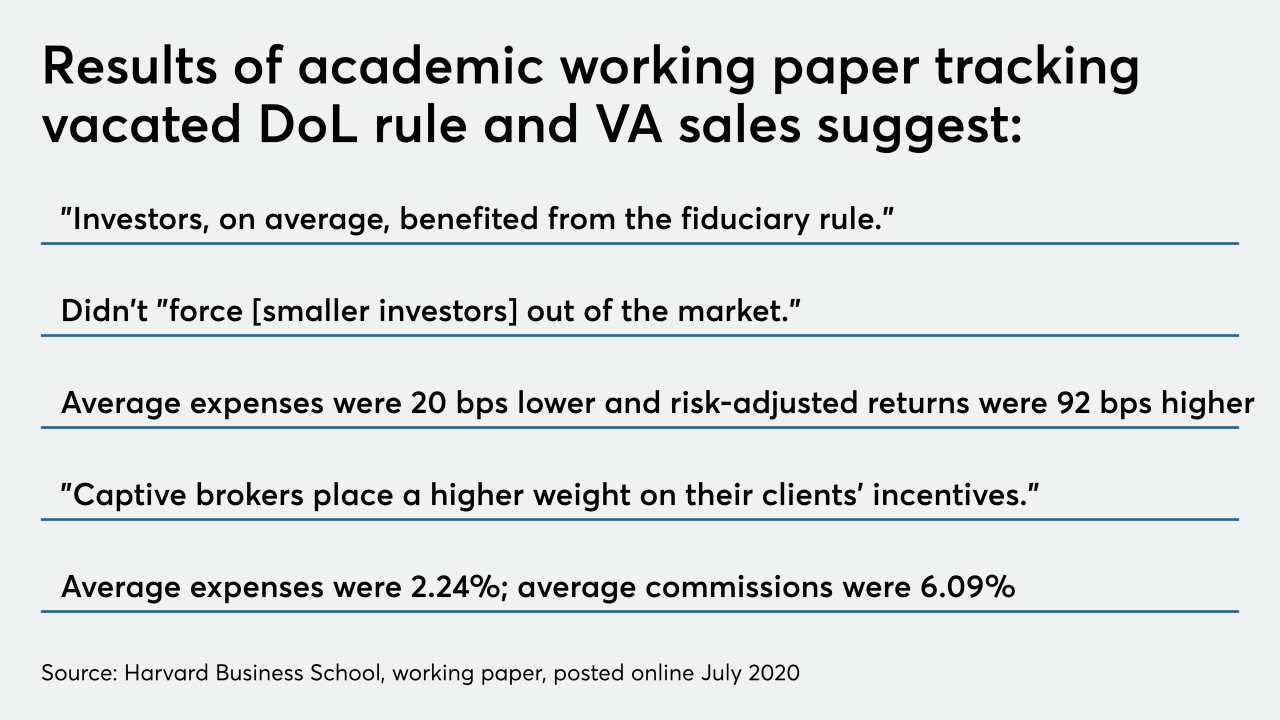

A recent study suggests sales of "expensive" VAs fell as a result of the vacated rule. But there are other factors at play, writes Raymond James' Scott Stolz.

October 16 Raymond James Insurance Group

Raymond James Insurance Group -

“If insurance and annuities had always been commission free, RIAs would be power users,” says David Lau, CEO of DPL Financial which is partnering with SS&C Advent.

October 13 -

Expenses fell by 20 basis points and risk-adjusted returns climbed 92 bps, according to the study.

September 24 -

Could single premium immediate annuities be the answer to ultralow rates?

September 21 Wealth Logic

Wealth Logic -

Sales are tumbling and gravitating to different products as Wells Fargo settles a FINRA case and researchers examine the defunct fiduciary rule.

September 3 -

Northwestern Mutual’s practices raise difficult questions about the nature of retail advice just as wealth management faces greater scrutiny under new rules.

July 17 -

Companies that connect advisors and carriers are seeing a surge in use.

June 17 -

“It is amazing that annuity sales are only down in the single digits, given the devastating effects that COVID-19 has wreaked on the annuity industry,” an expert says.

June 1 -

The Internal Revenue Service and the Treasury Department issued proposed regulations Wednesday to update the income tax withholding rules for periodic retirement and annuity payments made after Dec. 31, 2020.

May 27