-

The investing world is rushing to cater people who want to make a difference with their money but are unwilling to accept higher volatility or fees.

February 4 -

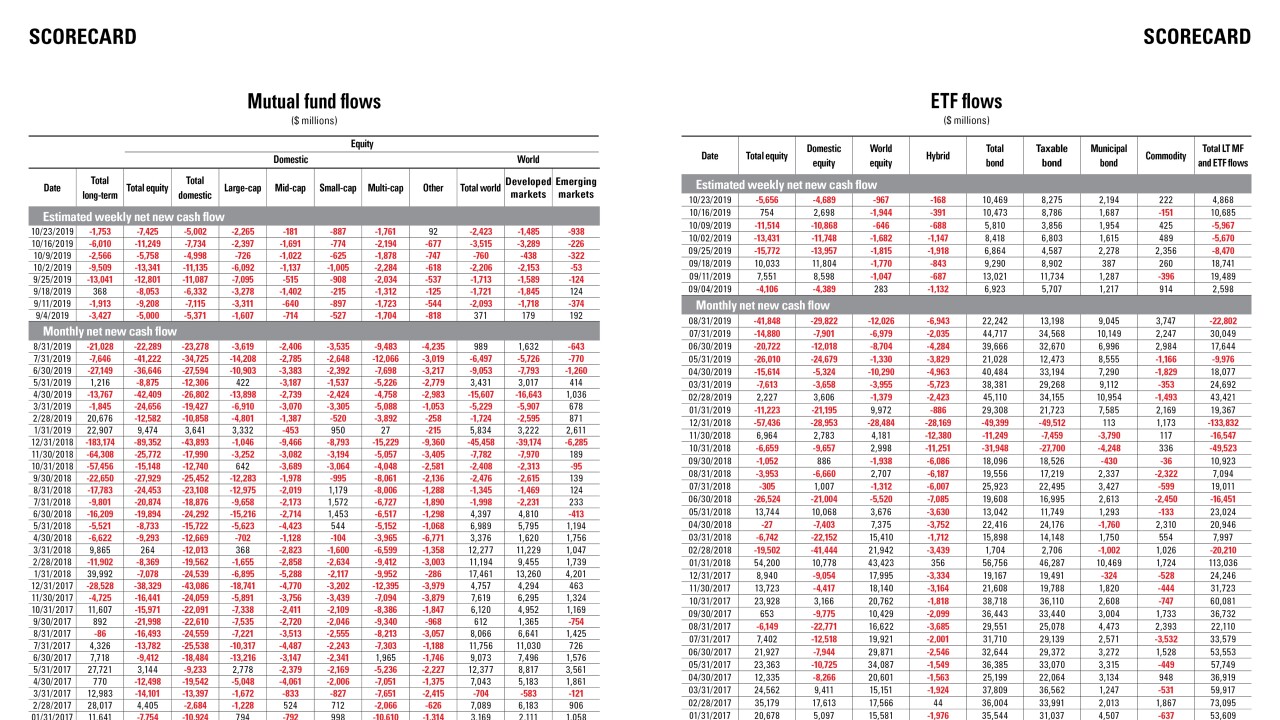

Data reported by the Investment Company Institute.

February 3 -

Buyers yanked $2.9 billion from the sector in the final days of January, nearly wiping out gains so far this year, data show.

January 31 -

The funds raked in $150 billion in 2019 as investors have gotten more comfortable with how they react across different market environments.

January 28 -

Once a top-performing fund with assets well over double today’s value, Templeton’s flagship bond fund has been diminished by the march of passive investments.

January 21 -

Nearly all of the fixed-income funds held short term debt.

January 15 -

In what was a stellar year for corporates, governments nearly missed the list entirely.

January 8 -

It was the biggest annual leap for strategies focused on corporate or government debt since 2014, boosting assets to more than $800 billion, data show.

January 8 -

Managers of the funds became increasingly involved with private debt last year; boosting their median allocation to 2.9% from 2.1%, data show.

January 6 -

In a business increasingly dominated by inexpensive index funds, the young juggernaut succeeded by actually picking good investments.

December 13 -

Despite the exodus, all of the mutual funds and ETFs on the list posted net gains for the year.

December 11 -

“There’s less performance chasing than you saw in the past, and that’s a positive thing,” an expert says.

December 4 -

-

Banks are hoping strategies like technology-enabled portfolio trading will help them grab a bigger slice of the shrinking fixed-income pie.

November 18 -

Those that shorted the market suffered “steep losses,” while market-neutral products posted “modest gains.”

November 13 -

Data reported by the Investment Company Institute.

November 7 -

The large number of closures in equities and “other” categories could not be offset by new additions, Index Industry Association research shows.

November 4 -

The SEC’s recently passed ETF modernization rule, which expands choice in the market, “is probably the end of the mutual fund industry.”

November 1 -

Given that almost one-third of leveraged loans are just a downgrade away from triple-C, even a modest slowdown could create a snowball effect of sorts.

October 28 -

The downside for their clients, however, is it may obscure just how much credit risk they’re exposing themselves to.

October 25