-

The number of advisors registering with FINRA has fallen since 2016, as more planners elect a fee-only model.

August 4 -

It will be the largest bank channel team at the IBD, with its former clearing house Pershing taking a hit.

July 29 -

Hilltop was fined a total of $475,000, with $100,000 pertaining to violations of municipal securities rules.

July 29 -

The price hikes would come as early as 2022, and follow a budget deficit in 2019.

July 2 -

This year’s survey results reveal challenges for independent broker-dealers and their future growth.

June 30

-

Brokers and fund managers are turning to innovation to remain competitive and capture new customers.

May 7 -

Charles Doraine settled with the Financial Industry Regulatory Authority on Monday without admitting or denying FINRA’s findings.

April 28 -

Even as Schwab, TD Ameritrade and E-Trade attract billions in new assets, company cash yields suffered from Fed cuts.

April 26 -

Which bank wealth management execs are at the top of their game, and how are they coping in the age of coronavirus?

April 1 -

After serving 18 months in jail, Craig Rothfeld knew “other people would need help too.”

March 19 -

That would be a big “no,” in most cases, according to FINRA, but gives rise to another question…

February 28 -

The all-in-one platform model is attracting some of the largest firms as consumers increasingly acclimate to housing all their financial needs under one roof.

February 20 -

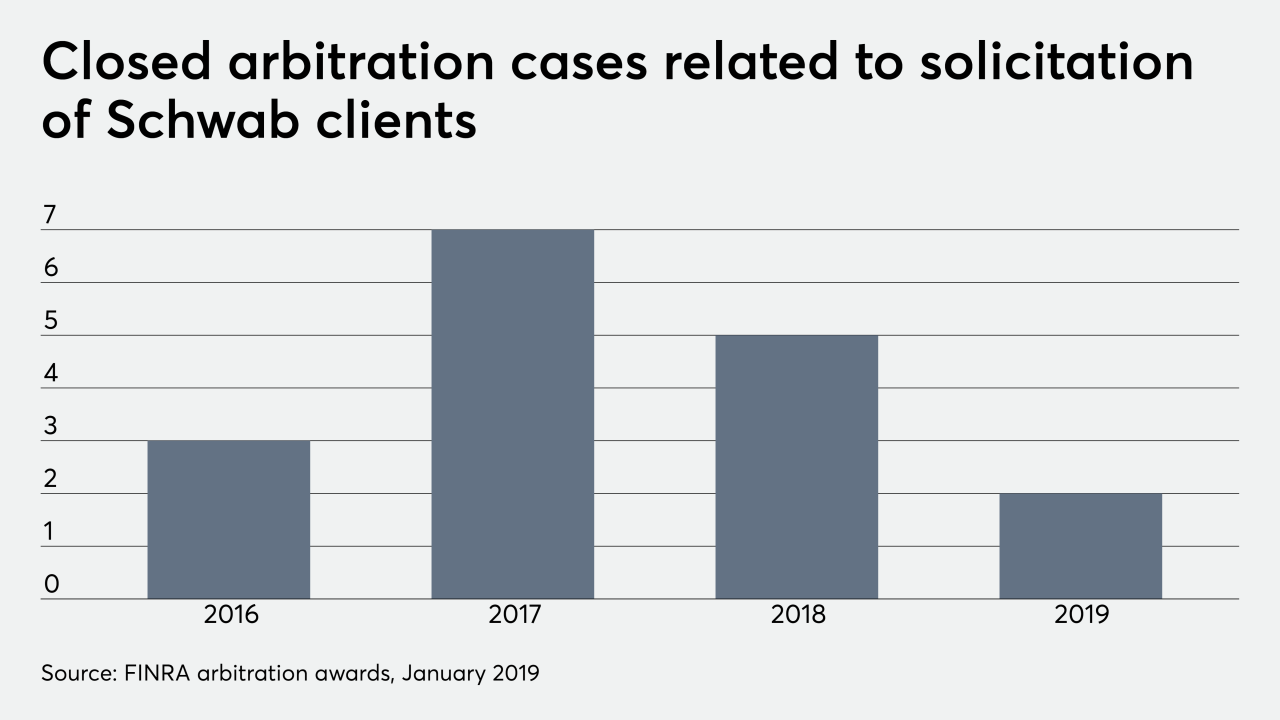

Planners — and RIAs that want to hire them — have faced hurdles tied to client solicitation rules.

January 13 -

In the 1960s, iconoclastic reformers started a campaign to kill fixed brokerage fees. Today, we’re witnessing the logical culmination of that effort.

January 3 -

While advisors have embraced cheaper trades, the move may have long term effects on strategies for client portfolios.

January 2 -

Supervisory failures at LPL Financial, J.P. Morgan Securities, Morgan Stanley, Merrill Lynch and Citigroup prevented assets from moving to beneficiaries on time.

December 27 -

One size fits all? The single form for disclosure of client-advisor relationships applies even if firms offer multiple products and services.

December 16 Cipperman Compliance Services

Cipperman Compliance Services -

The SEC says broker-dealers may treat investment advisors as if they were subject to the AML Rule — under certain conditions.

December 16 -

Who wins, loses after the massive BD merger crosses the finish line?

December 11 Elite Consulting Partners

Elite Consulting Partners -

Brokerage firms that sell the funds must determine whether clients understand their risks — a requirement that could discourage offering them at all.

December 6