-

State Street’s stockpile takes up one corner of a vault in a system that stores bullion on behalf of central banks, sovereign wealth funds and others.

May 26 -

Firms founded by Jason Wenk allegedly failed to oversee a former advisor accused of investing clients in unregistered securities.

May 22 -

As liquidity disappeared amid the coronavirus-sparked mayhem, veteran fixed-income portfolio manager Gemma Wright-Casparius saw opportunities.

May 20 -

The central bank plans to make both outright purchases of corporate bonds as well as funds potentially invested in sub-investment grade debt.

May 14 -

Withdrawals this year have equaled almost half of last year’s inflows, leaving Pimco with net outflows of $46.8 billion in the first quarter.

May 12 -

“This is all about having the flexibility and having multiple options for our investors,” says GSAM’s head of ETF strategy.

May 12 -

Crush of inflows to money-market funds has come even as the funds’ own yields approach zero.

May 8 -

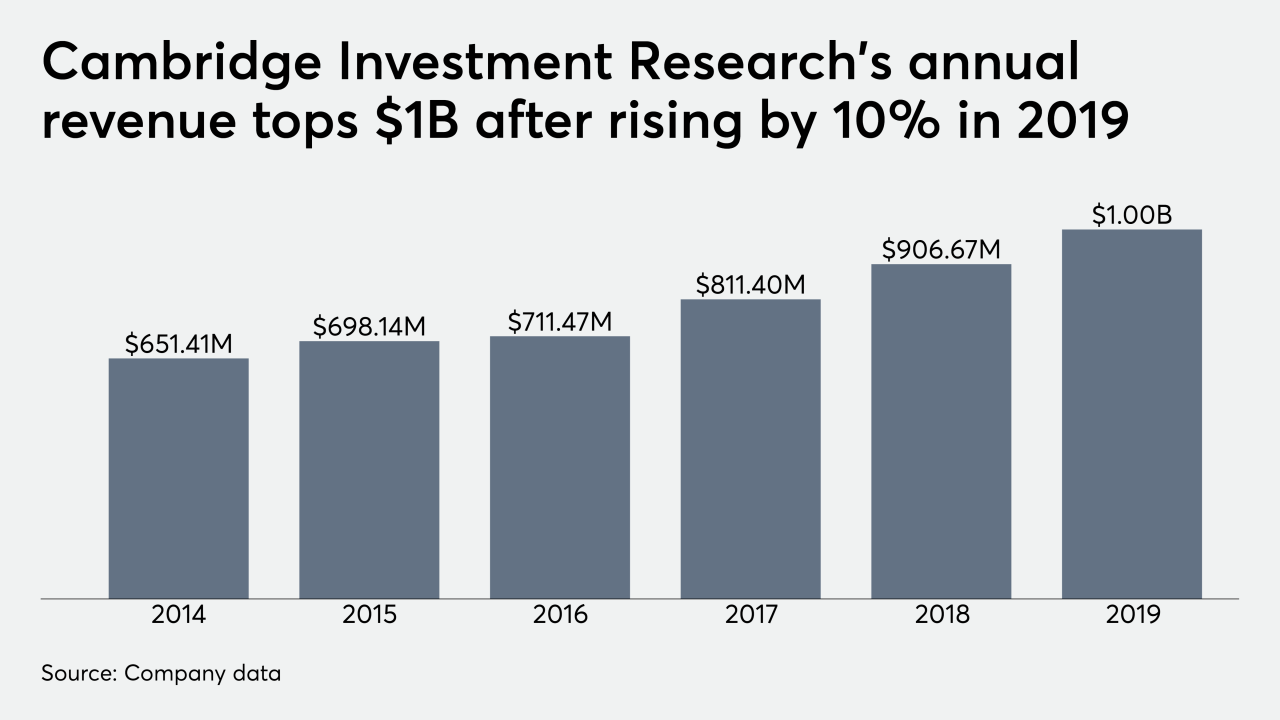

The privately held firm recruited more than 160 reps in the first quarter on the strength of its balance sheet, CEO Amy Webber says.

May 6 -

With marketing, reporting and the Junxure CRM, the acquisition brings much more than a robo advisor to the asset manager.

May 6 -

Many of the executives selected this year say the industry’s future may lie in its sudden change to a fully virtual business model.

May 1 -

Funds advised by Katie Koch, whose firm has about $1.8 trillion under supervision, are beating their benchmarks at an 80% rate in 2020.

May 1 -

The S&P CoreLogic Case-Shiller home price index hasn't yet reflected the impact of the coronavirus, but an independent market maker has some thoughts on how it might.

April 30 -

There’s a lot to complain about these days, from the effectiveness of the government’s $3 trillion stimulus package to unlimited quantitative easing.

April 29 -

This year’s honorees discuss how their firms are coping with the coronavirus pandemic and how this period may reshape the industry.

April 28 -

Fallout from the deepest worldwide downturn since the Great Depression has magnified economic and social inequality across the globe.

April 28 -

With few corners of the fixed-income industry safe from harm, investors’ faith in managers appears to be intact — for now.

April 24 -

Dubbed Disco III, the fund will target leveraged loans, high-yield bonds and collateralized loan obligations.

April 23 -

The holdings in these top-performers “are companies that will be replaced, from a performance standpoint, over the next decade,” an expert says.

April 22 -

Total net assets in Michael Hasenstab's Templeton Global Bond Fund slumped to $22.6 billion as of March 31, public filings show.

April 21 -

Asset managers are targeting massive amounts of capital to benefit from credit market stress as the coronavirus leaves many companies in need of support.

April 21