-

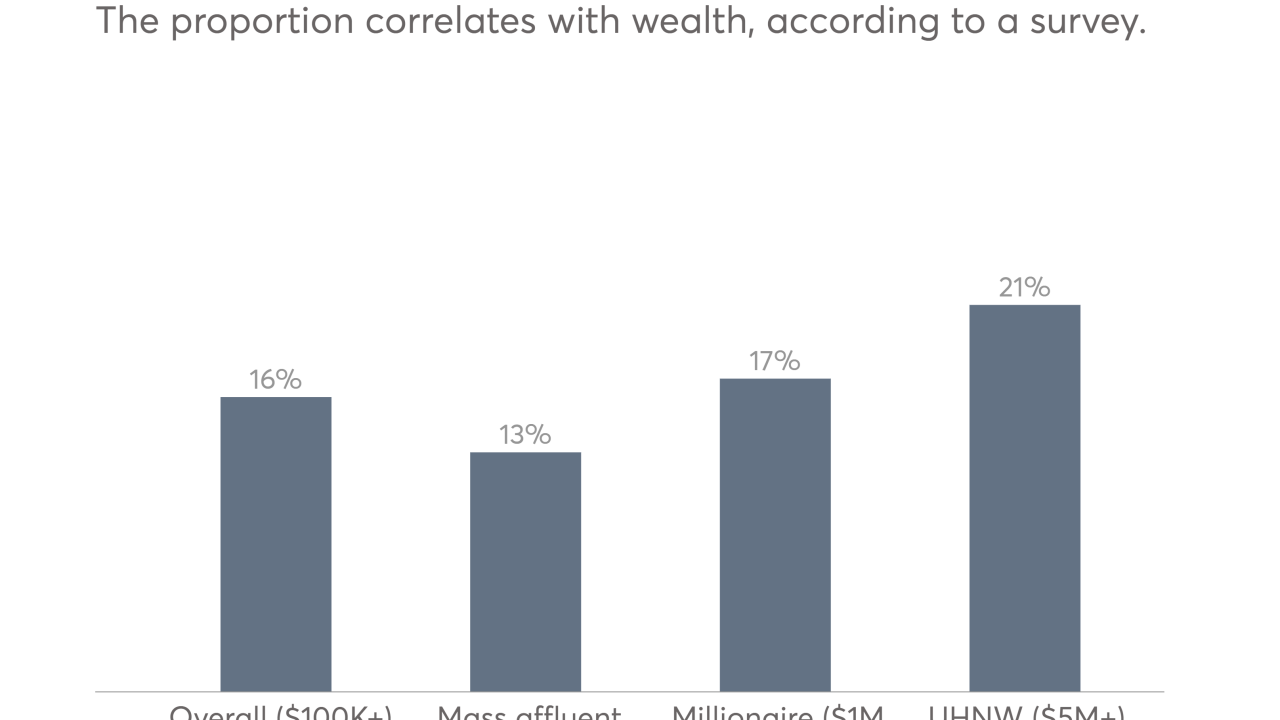

HNW investors and their planners shun the tax-advantaged savings accounts, according to a study.

March 21 -

Surprise riches can help clients as much as hurt them.

December 21 -

Assets in college savings plans named for an obscure section of the tax code hit a record this summer, totaling $266.2 billion, up 5.1% year-over-year.

September 30 -

Whether clients are making 529 plan distributions, a direct tuition payment or an in-kind gift, for grandparents, timing is everything.

June 20 -

The 529 market has nearly doubled over the past five years, reaching a record-high $227 billion in AUM by the end of 2015.

June 3 -

Advisors who apply debt-management and cash-flow projection skills to the repayment of student loans can save clients tens of thousands of dollars (and build loyalty, too).

March 21 -

Rocketing education costs and loan debt are giving advisors a great opportunity to help clients navigate the college-planning maze.

February 25 -

For planners looking to recruit as well as those looking for suitable programs, this comprehensive list of planning programs at five dozen colleges and universities across the country includes costs, enrollment and student-to-faculty ratios.

November 2 -

Many HNW clients are using these state-run plans to shelter assets from the inheritance tax.

October 25 -

Many HNW clients are using these state-run plans to shelter assets from the inheritance tax.

October 25 -

A slideshow of education-related tax opportunities

September 28 -

Remember, 529 plans aren't the only game in town. Here are some alternative solutions for clients to fund their kids' educations.

September 21 -

Hillary Clinton has rolled out a plan to make college affordable that her presidential campaign has dubbed the New College Compact, enabling students to pay for higher education without taking out costly student loans.

August 12 -

Nearing the top 1% of total U.S. households, the Obama family holds roughly $1.25 million in Treasury notes and bills.

May 19 -

The vast majority of Americans cannot afford to send their children to college, finds Edward Jones' fourth annual 529 Plan Awareness Survey. Here's how to help your clients.

May 15 -

Increased longevity and the fact that those belonging to the Greatest Generation married at a young age are two reasons for the increase in dual-generation retirements; Plus, the reason why parents shouldn't be too generous with their children's college education funds.

March 13 -

Your affluent clients may think they can just write a check to cover college costs. They're probably wrong. Here are a few issues that parents (and grandparents) should consider.

March 4 -

Big tax bill looms for mutual fund investors; 4 secrets to getting more from your 529 account; How taxes and trading costs kill investment returns

October 23 -

Small businesses can turbocharge their retirement plans; The gift of a retirement account is a lifetime asset; Why Americans keep treating their 401(k) plans like a piggy bank

September 19 -

3 lessons from S&P 500 high-point; Getting a read on mortgage REITs; Tax-free savings for education expenses

August 27