Compensation

Compensation

-

JPMorgan Chase said it plans to hire 300 additional Black and Latino wealth advisors by 2025 to serve more clients from those communities and allow employees from diverse backgrounds to advance in their careers.

March 26 -

Employees indicated they want more personal time and women in particular have sought greater flexibility to work remotely, its co-head of wealth management says.

March 24 -

Rockefeller Capital Management’s latest recruiting spate has netted it three wirehouse teams in Texas, Cincinnati and Los Angeles — one of which caters to Native American tribes.

March 23 -

The firm will enlist law firm Paul, Weiss, Rifkind, Wharton & Garrison to review the issue and other incidents to surface in recent weeks.

March 23 -

Advisors have to make sure the whole team is treated fairly; avoiding making women into "the chick who always pours coffee,” writes Amanda Kerley.

March 22 -

“Honestly, it’s a little frightening,” said Joel Schiffman, who oversees defined contribution products in North America for Schroders.

March 19 -

Ancora, which previously took on Bed Bath & Beyond and Big Lots, argues the company suffers from poor leadership.

March 17 -

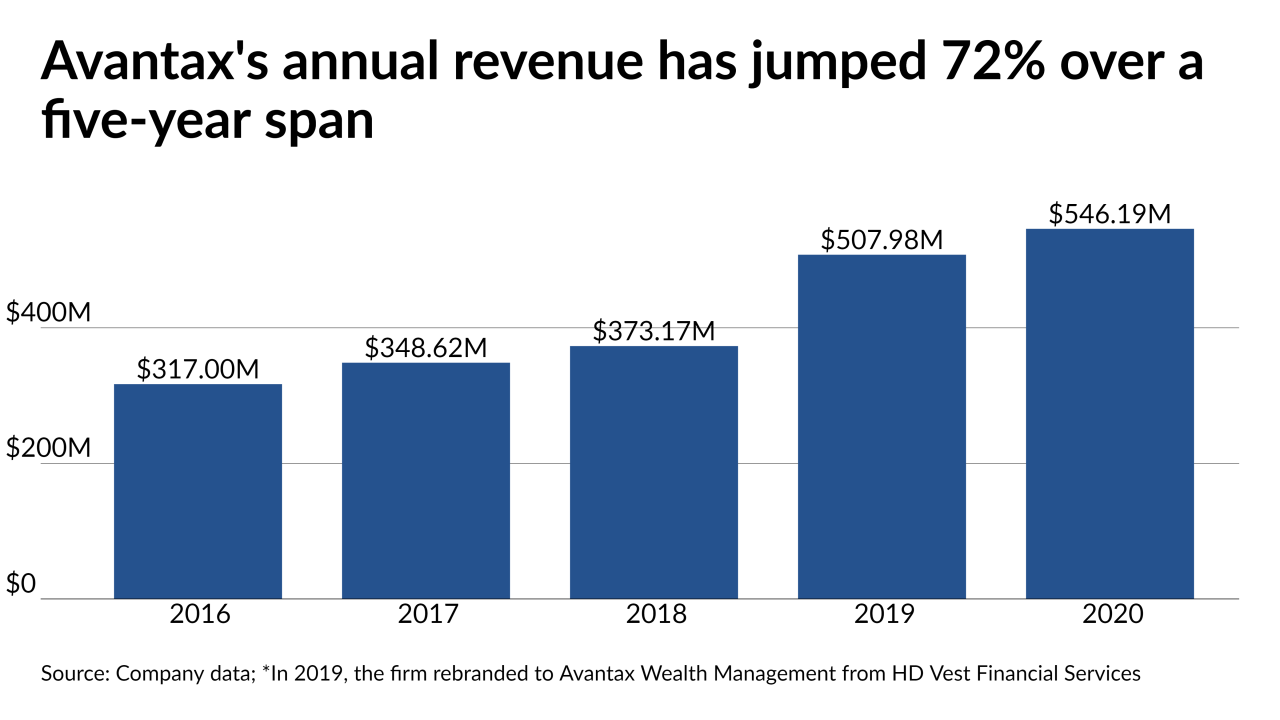

With a new brand and new leadership, the firm hopes to tap into a burgeoning wealth management sector.

March 16 -

Two experienced private equity investors in wealth management struck a deal for a minority stake in one of the industry’s biggest names.

March 15 -

“The rollout of this plan has acted as a tipping point,” says Nick Pennino, an Edward Jones advisor.

March 15 -

The IBD network added a community bank’s investment program after exceeding the goals it set at the beginning of 2020, its head recruiter says.

March 11 -

the Labor Department said it wouldn’t enforce Trump-era rules for fund investments or proxy voting, nor will it sanction retirement plans that don’t comply with the regulations.

March 11 -

A Pakistani Muslim women who started her career as a financial advisor in the U.S. after 9/11, Ayesha Yasin faced and overcame multiple stereotypes.

March 8 -

The legislation would rival the $2 trillion March 2020 CARES Act in size and scope and follow a $900 billion December relief package.

March 8 -

Questions about job losses and real estate are adding more complexity to the usual post-deal issues involving advisor retention and company consolidation.

March 5 -

Helping employees reach a financially stable retirement is a top priority for employers.

March 5 -

The largest banks have cut compensation or held it steady for their top executives. Many regionals, though not all, are expected to make similar decisions as boards balance the desire to reward strong leadership during the pandemic with lackluster financial performance and public relations concerns.

March 5 -

The RIA acquired the innovative practice while bulking up its social justice investing efforts and its wealth redistribution planning services.

March 4 -

The firm hopes to more readily attract talent from rivals.

March 3 -

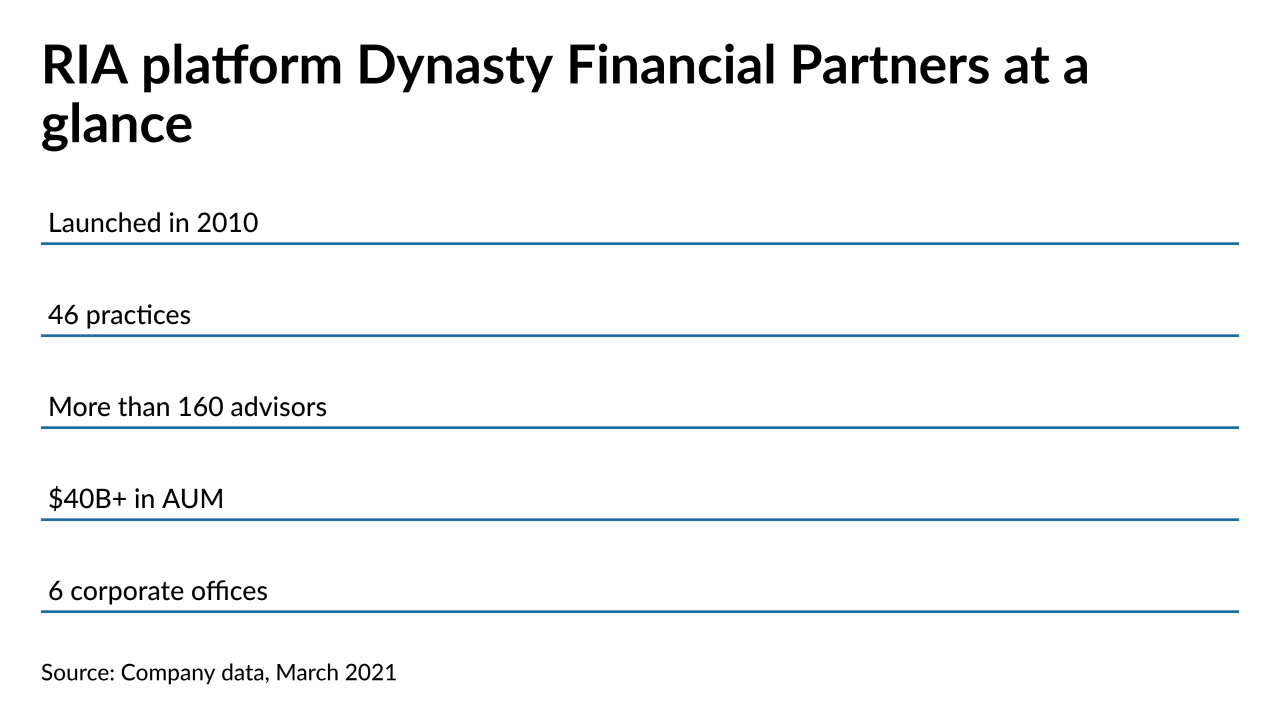

The quartet of financial advisors range in age from their 20s to their 90s, and are the second group to sign with Dynasty this week.

March 3