Compensation

Compensation

-

While it’s recommended they have at least three sources when they retire, just 6.8% of savers have done so, according to a report.

February 4 -

I don't need outside credentials to bolster my credibility — I have my own.

February 4 -

-

While they don't need a child to claim the earned income tax credit, the benefit's value increases based on the number of kids clients have.

February 4 -

The recent moves display the stakes of the competitive recruiting fight, which has led to firms like AmeriFlex seeking to give advisors greater flexibility and resources.

February 4 -

"Since no one has a crystal ball to predict what will happen, I advise saving money on both sides of the tax fence," an expert says.

February 3 -

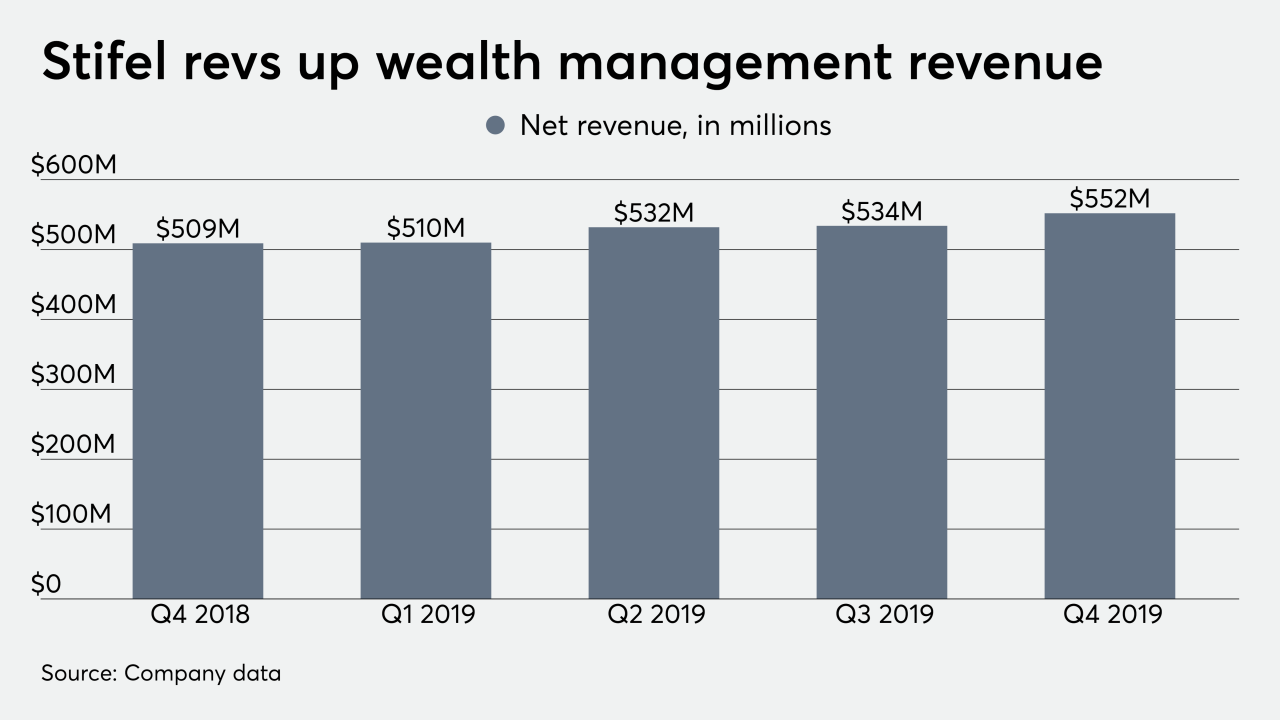

The regional broker-dealer has long been among the industry’s most aggressive recruiters.

February 3 -

The advisors join the bank following a major reorganization of its wealth management business.

February 3 -

While retirement readiness among Americans has improved in general, Gen Xers are struggling with housing, college and medical costs, a survey finds.

January 31 -

CEO Dan Arnold describes the firm’s tech-fueled advisor strategy.

January 31 -

One of the new hires oversees more than $300 million in client assets and has more than 30 years in the business.

January 31 -

To accommodate its burgeoning brokerage force, the firm opened 42 new branches last year.

January 31 -

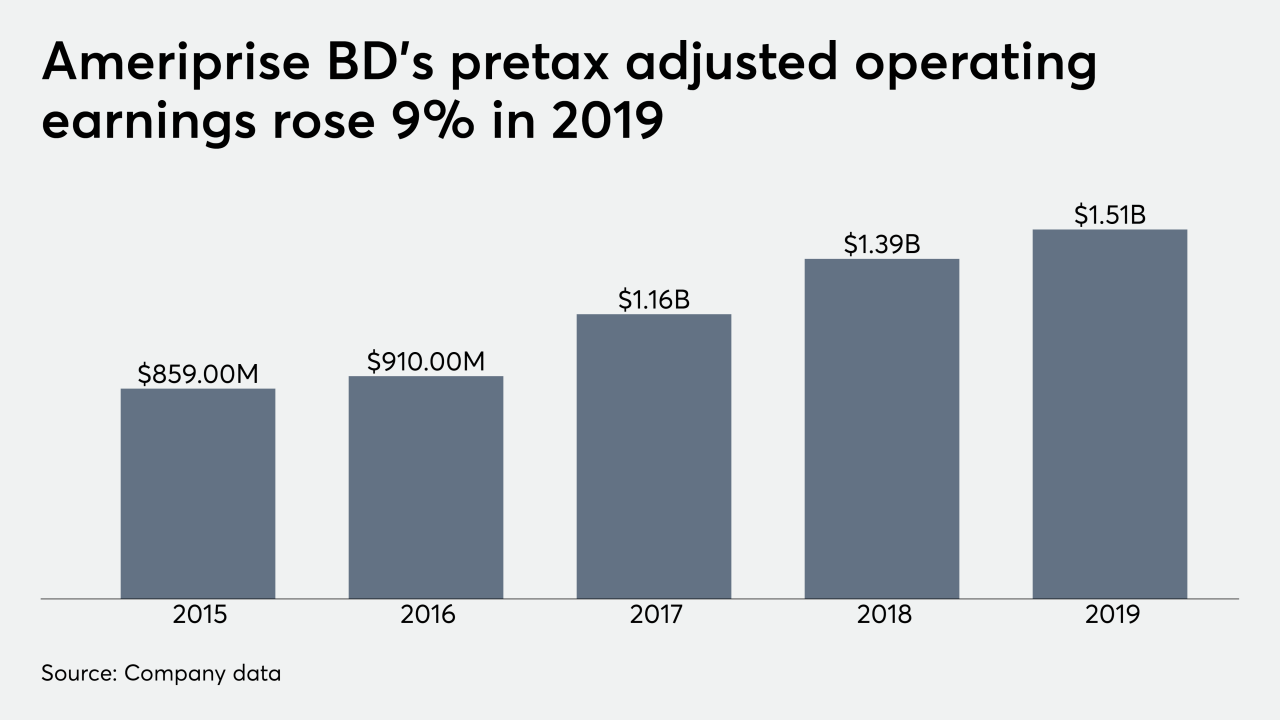

Jim Cracchiolo predicts the number of advisors will go back up, but he says the firm places more importance on boosting the size of their businesses.

January 31 -

An arbitration panel rejected efforts to impose a permanent injunction against a broker who left for Raymond James.

January 30 -

In the latest episode of Financial Planning’s new podcast series, advisor Rachel Robasciotti discusses her activism around mandatory arbitration and relates the remarkable story behind her RIA.

January 30 -

Relief comes as a result of the short notice firms were originally given to comply with the Secure Act, the agency says.

January 30 -

The move is part of a larger strategy to bring account minimums down for clients who either can't or don't want to buy entire shares of high-priced stocks.

January 30 -

After developing a plan to cover their bills and emergency expenses, clients in a new marriage are advised to start working on their long-term goals.

January 29 -

The takeaway for other firms: Be explicit, clear and public about seeking women employees and creating a safe workplace for them.

January 29 -

Steady gains made in equity markets last year were "clearly a tailwind,” an expert says.

January 29