-

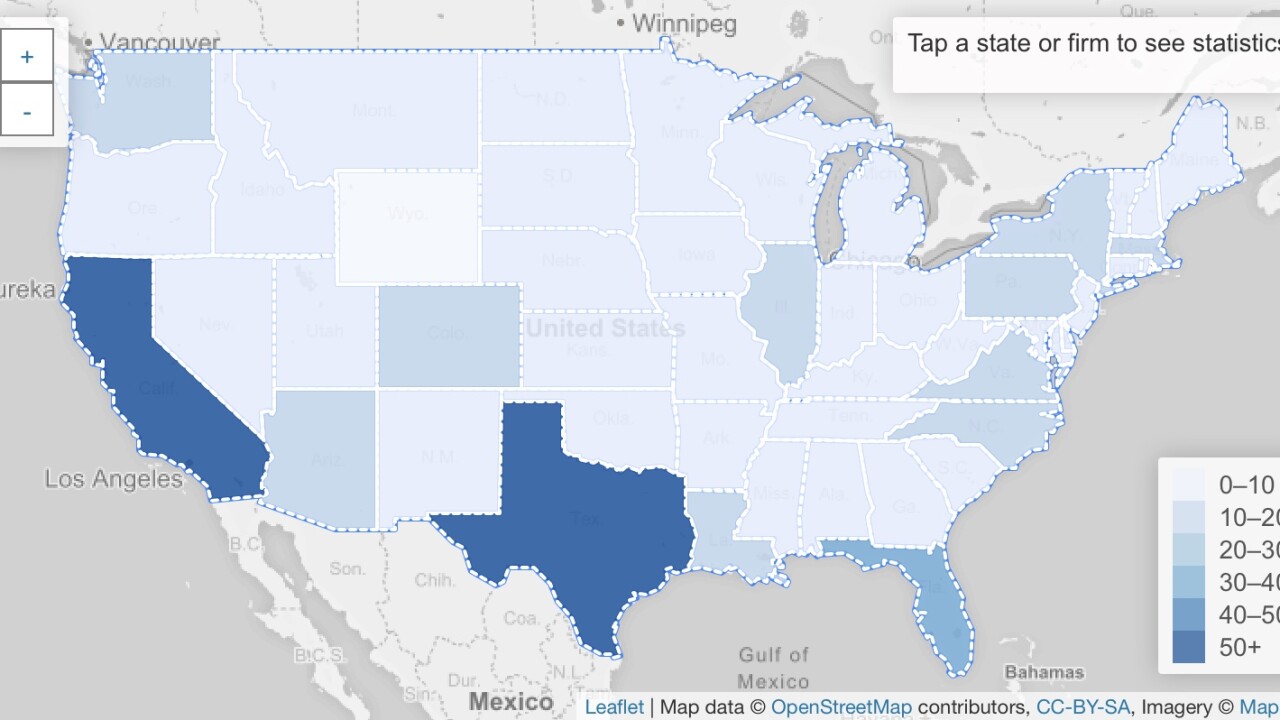

Our exclusive interactive infographic reveals some interesting trends on the top 10 new firms and their locations.

August 22 -

The IBD aims to be a 17,000-strong firm, but not every advisor will want to join up, experts warn.

August 22 -

An advisor questions a witness’s qualifications.

August 17 -

Let's have a robust discussion about how to improve outcomes for clients, but let's stop inventing bogus reasons why we shouldn't look after their best interests.

August 17 Unison Advisors

Unison Advisors -

The rep ignored FINRA's repeated requests for documents it needed to investigate allegations that she made inaccurate statements on a mortgage gift letter.

August 16 -

Louis Blazer III used client funds to finance 'Mafia the Movie,' according to the complaint.

August 14 -

Risk alert: The agency expects advisors to follow these steps.

August 11 -

A recent OCIE report shows that advisors are missing the mark on protecting their businesses against cyber threats.

August 11 -

The department is asking the Office of Management and Budget to postpone the compliance date for 18 months for the best interest contract exemption and other aspects of the rule.

August 9 -

The advisors collected $1.7 million by fraudulently pushing variable annuities, investigators say.

August 3 -

John helped found the coalition between the board, NAPFA and the FPA.

August 3 -

The rep took more than $1,500 from the bank's cash drawer over a three-month period beginning on New Year's Eve last year, FINRA claimed.

August 2 -

The violations ranged from the improper reuse of signed customer forms to the execution of discretionary transactions without written authorization.

August 1 -

"This is a challenging time for the firm with the DoL rule," CEO Paul Reilly said.

July 27 -

The move will streamline investigations and standardize sanctions, the regulator says.

July 26 -

The new executive will lead a team counseling advisers on how to comply with the DOL rule.

July 25 -

When and how are former employers allowed to file? Attorney and compliance expert Alan J. Foxman explains.

July 21 -

Are the measures you're taking enough? Compliance expert Alan J. Foxman explains.

July 21 -

The agency plans to split the award between just two people who reported the bank’s product-pushing tactics.

July 19 -

FINRA claimed he intentionally structured 10 cash deposits totaling $50,000 in five personal bank accounts in amounts under the $10,000 currency transaction reporting threshold.

July 19