-

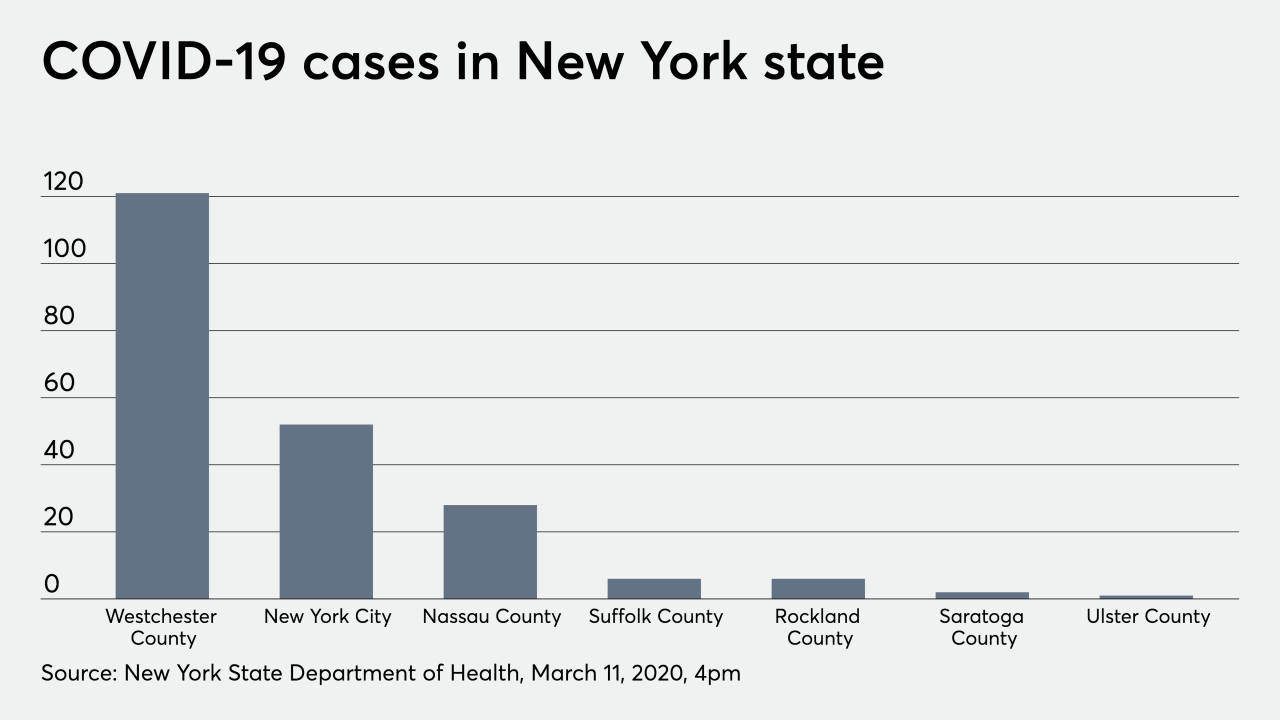

There are more than a hundred cases of COVID-19 in Westchester County, New York, and financial planners are handling more than market volatility.

March 12 -

Where some see unacceptable risk, others are eyeing bargain airplane tickets.

March 11 -

Financial institutions need to alert customers about emails or websites that pretend to offer important COVID-19 information but instead could end up stealing their account numbers or logins.

March 11 -

The early U.S. epicenter of the virus hasn’t seen mass closures of practices, but financial advisors from the area shared tips to try to get ahead of the impact.

March 10 -

The regulator is giving firms more flexibility in supervising employees working remotely and in relocating personnel to temporary locations.

March 10 -

Even with staff working from home, the agency “remains able and committed to fully executing its mission," the SEC said.

March 10 -

The employee “is at home while their health is being closely monitored by their doctor and public health authorities,” a spokeswoman for the bank said.

March 9 -

There is quite a bit of data indicating planners timed the markets poorly during the financial crisis. Let's not make the same mistakes again.

March 9 Wealth Logic

Wealth Logic -

The richer they are, the more options clients have to insulate themselves from the coronavirus and its effects.

March 9 -

-

Fund managers may be better equipped to weather the market storm than their passive peers because of their ability to quickly cut risk.

March 9 -

All travel requests need special approval and existing international travel plans would need re-approval, according to a company memo.

March 5 -

From travel bans to working remotely, here is how firms including Wells Fargo, Edelman, RBC and others are preparing for a possible pandemic.

March 3 -

The world’s pile of negative-yielding debt has grown as the economic backdrop soured and fears of a pandemic mounted.

March 3 -

The Federal Reserve has voted unanimously to cut the interest rate 50 basis points to 1.10% effective March 4, in the first emergency rate cut since 2008.

March 3 -

The Federal Open Market Committee cut the fed funds rate target 50 basis points to a range between 1% and 1.25%, it announced Tuesday.

March 3 -

Clients blasted the company on social media for not being able to make trades.

March 2 -

The bloodbath in risk assets has intensified on deepening concerns about the economic fallout from the spread of the coronavirus.

March 2 -

“Stocks and bonds say we’re doomed,” said Chris Rupkey, chief financial economist for MUFG Union Bank.

February 27 -

The haven has been favored as the coronavirus outbreak has spread beyond China, threatening a pandemic and slower growth.

February 26