-

While several analysts are bullish, not all are convinced of the Canadian asset manager’s newfound strategy.

May 21 -

During first quarter earnings last month, the bank said that it would take a $300 million restructuring charge related to the cuts in the second quarter.

May 19 -

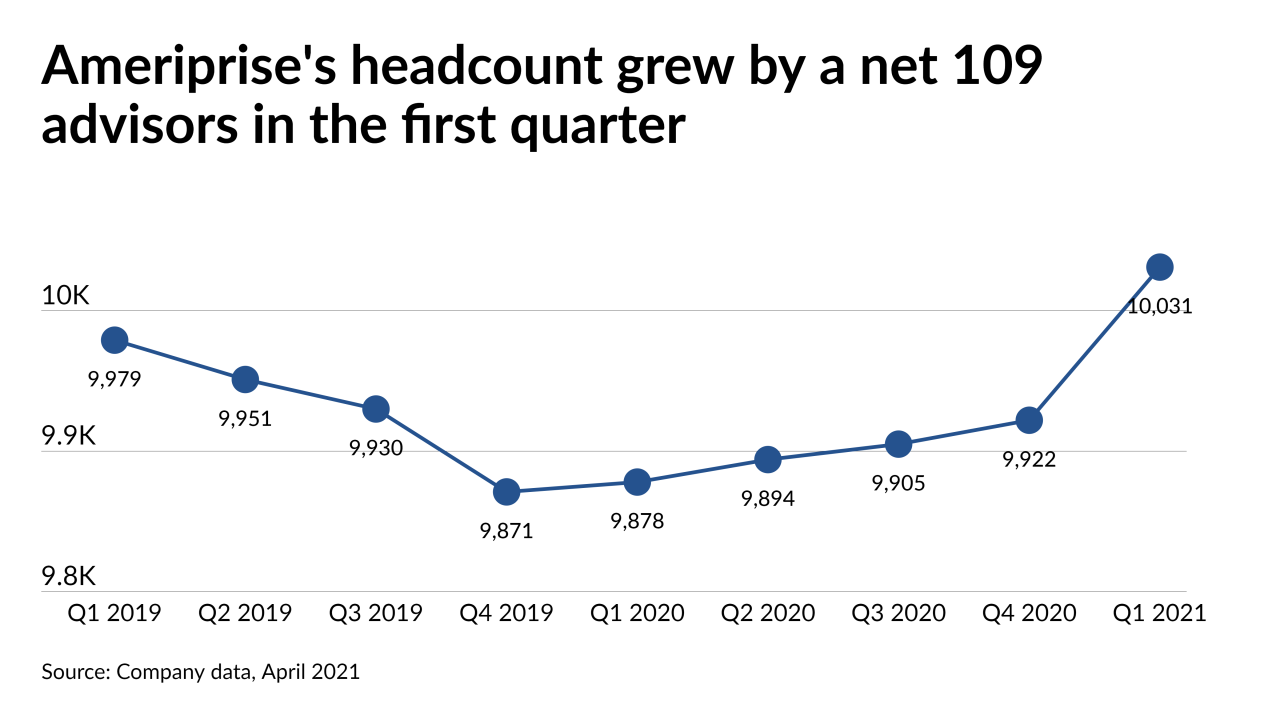

After its industry-leading headcount dipped slightly during the temporary ban, the wealth manager plans to offer more resources for incoming recruits.

May 10 -

The RIA completed seven transactions in the first quarter, along with starting a new international venture in partnership with the billionaire Hinduja family.

May 10 -

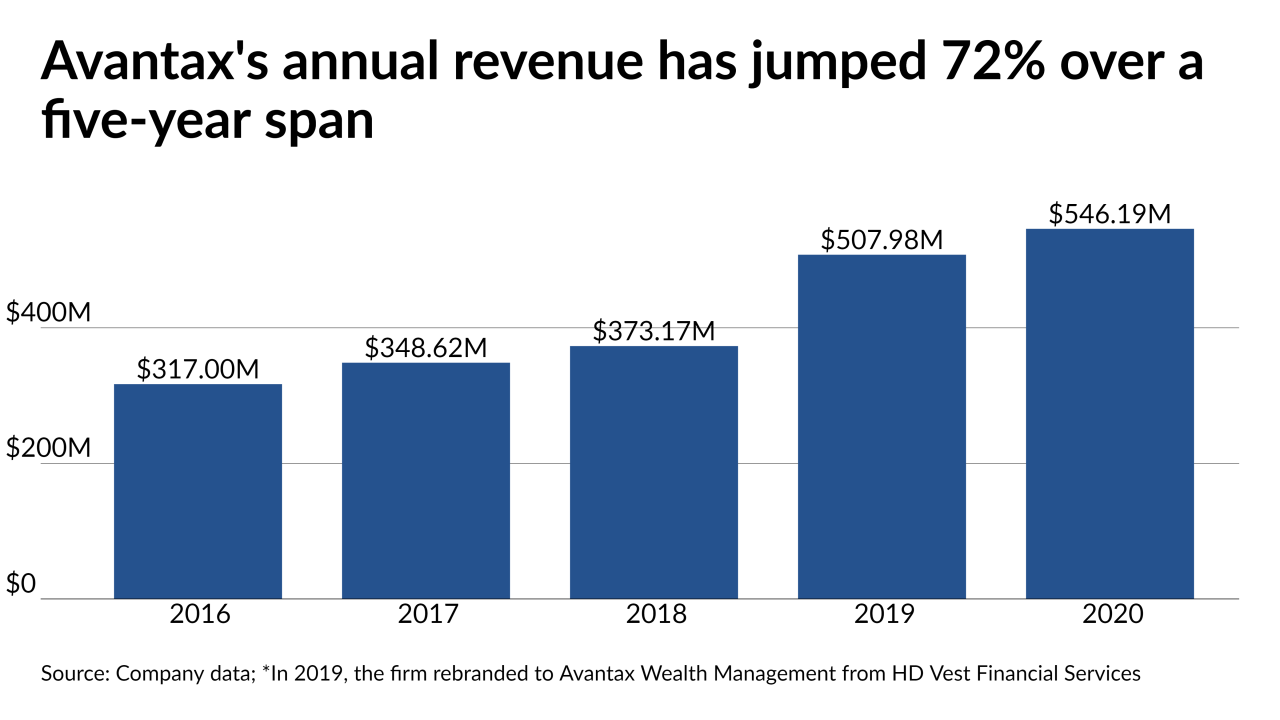

The tax-focused wealth manager’s parent disclosed lower first-quarter earnings after an eventful period marked by a proxy fight and a reported acquisition offer.

May 7 -

As its advisor headcounts in the W-2 channel have stagnated, Raymond James Advisor Select added a major former UBS quartet.

May 6 -

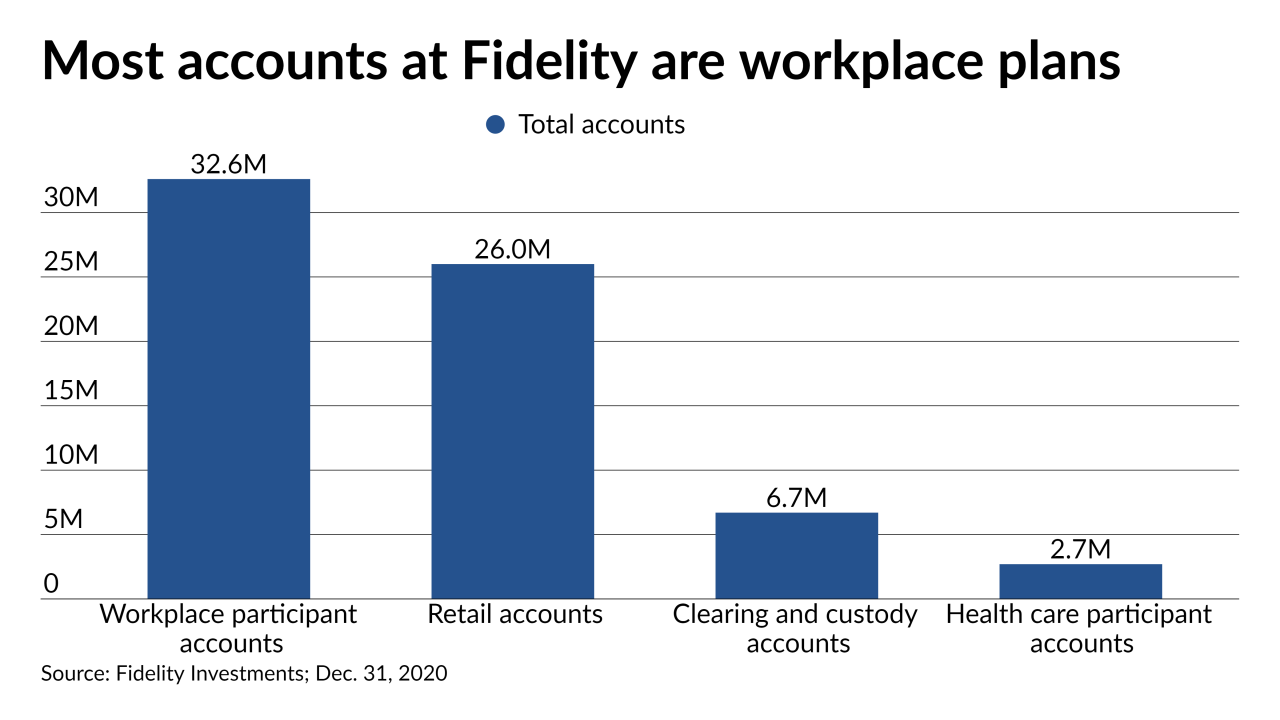

The company has benefited from a market surge, new investors and an uptick in broker breakaways.

May 5 -

More growth is on the way: the No. 1 IBD has one more massive recruiting move and a $300M acquisition to complete.

April 30 -

The firm slimmed down its headcount slightly, even as it saw an uptick in advisor-related revenues from fees and asset management.

April 29 -

The company upped its recruiting package last year, a change that has been “very well received by prospective advisors,” according to the CEO.

April 29 -

The firm’s recruiting is also gaining steam, despite the ongoing impact to its bottom line from low interest rates.

April 28 -

The Swiss bank added a sprinkle of new US advisors for the first time in years, amid record quarterly profits and plans for global job cuts.

April 27 -

As the firm repelled a rare activist challenge, a potential private equity buyer has approached it, according to a news report.

April 23 -

Despite record growth in wealth management, an otherwise rosy earnings report was marred by $911 million loss related to Archegos Capital.

April 16 -

Despite losing more than 295 net advisors in the first three months of the year, the wirehouse had one of its best quarters in history in terms of revenue.

April 15 -

A net 236 brokers left the wirehouse in the three months ending in March, the company said in its latest quarterly report.

April 14 -

There are lots of reasons to fret about debt — and more reasons not to, writes Matthew A. Winkler.

April 5 -

The funds are one of the largest forms of short-term debt vulnerable to investor runs in our financial system, writes former CFTC Chairman Timothy Massad.

March 18 -

Ancora, which previously took on Bed Bath & Beyond and Big Lots, argues the company suffers from poor leadership.

March 17 -

Questions about job losses and real estate are adding more complexity to the usual post-deal issues involving advisor retention and company consolidation.

March 5