-

The firm’s recruiting is also gaining steam, despite the ongoing impact to its bottom line from low interest rates.

April 28 -

The Swiss bank added a sprinkle of new US advisors for the first time in years, amid record quarterly profits and plans for global job cuts.

April 27 -

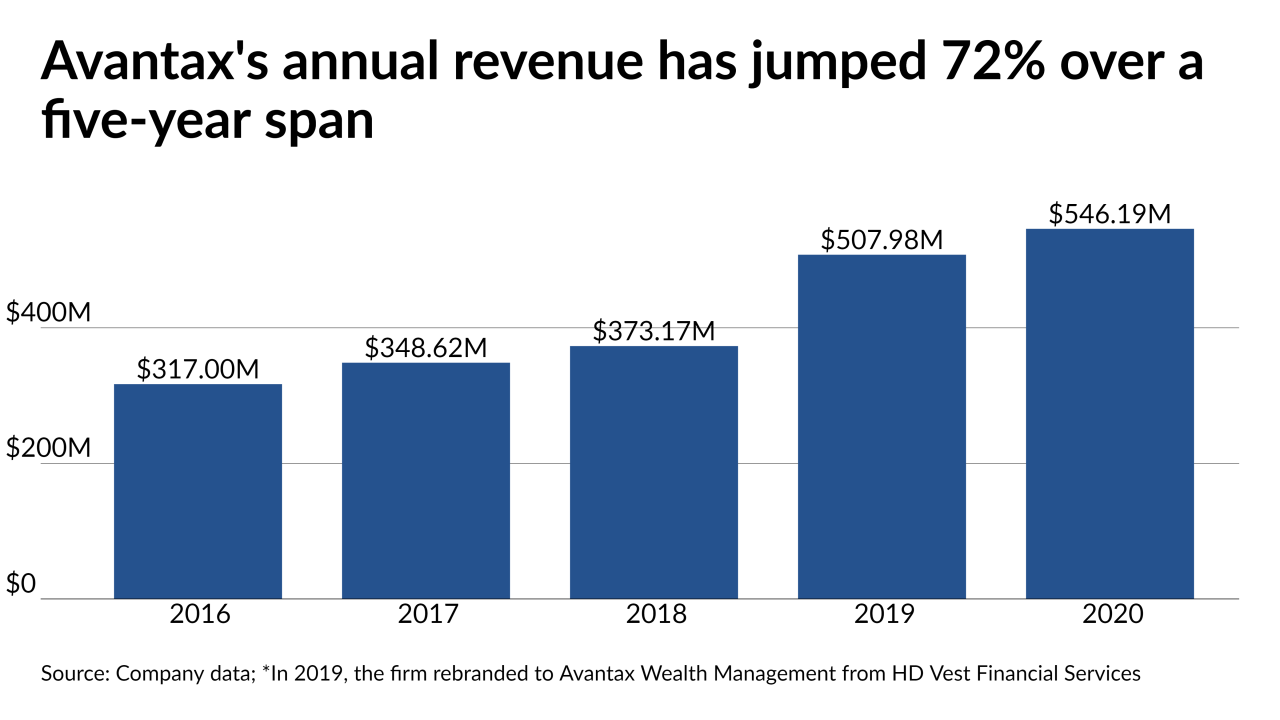

As the firm repelled a rare activist challenge, a potential private equity buyer has approached it, according to a news report.

April 23 -

Despite record growth in wealth management, an otherwise rosy earnings report was marred by $911 million loss related to Archegos Capital.

April 16 -

Despite losing more than 295 net advisors in the first three months of the year, the wirehouse had one of its best quarters in history in terms of revenue.

April 15 -

A net 236 brokers left the wirehouse in the three months ending in March, the company said in its latest quarterly report.

April 14 -

There are lots of reasons to fret about debt — and more reasons not to, writes Matthew A. Winkler.

April 5 -

The funds are one of the largest forms of short-term debt vulnerable to investor runs in our financial system, writes former CFTC Chairman Timothy Massad.

March 18 -

Ancora, which previously took on Bed Bath & Beyond and Big Lots, argues the company suffers from poor leadership.

March 17 -

Questions about job losses and real estate are adding more complexity to the usual post-deal issues involving advisor retention and company consolidation.

March 5 -

The robo's fastest growing business now offers custom model portfolios in a bid to attract more wealth managers.

February 11 -

The private equity-backed firm’s deal could tack on some 900 advisors to its ranks.

February 8 -

As the No. 1 IBD rolls out M&A services to advisors this quarter and reels in record recruits, Dan Arnold says the firm is experimenting.

February 5 -

APIs, proprietary funds, customer service issues: executives explain what they’re planning as their company hits $6.7 trillion in client assets.

February 4 -

Despite the credit-positive reading by one agency, the IBDs are competing against less leveraged rivals.

February 1 -

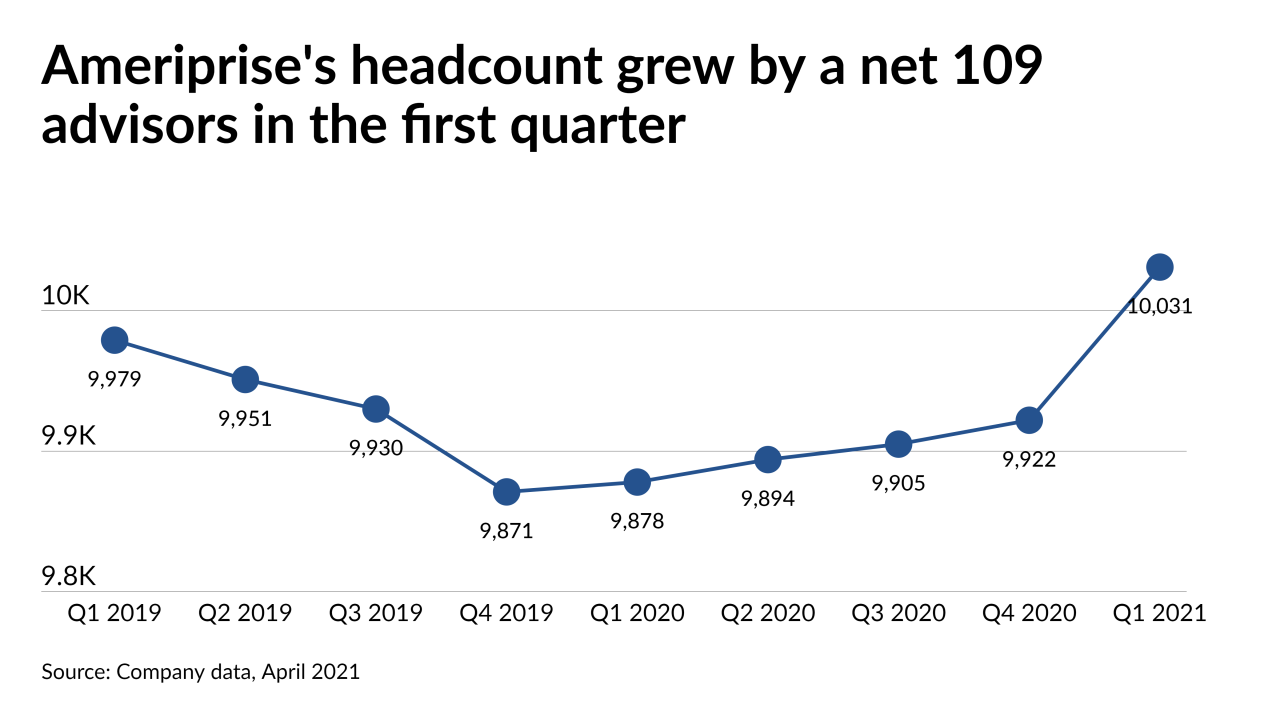

The nearly 10,000 advisors affiliated with the firm grow 2.5 times as fast as their peers at rival brokerages, CEO Jim Cracchiolo says.

January 29 -

The capital injection is “a strong sign of confidence from investors that will help us continue to further serve our customers,” a company spokesperson said in a statement.

January 29 -

The increase comes as the recruiting market heats up.

January 28 -

The 2,500-advisor firm is sneaking up on larger rivals by adopting an approach that’s increasingly popular across wealth management.

January 27 -

Strong 2020 returns have given a boost to the Swiss bank's new CEO, Ralph Hamers, whose start has been overshadowed by a Dutch probe into his role in a money laundering scandal at his former employer.

January 27