-

Alpine Securities will seek to overturn a FINRA finding that it saddled clients with “unreasonable” fees and converted accounts without authorization.

March 30 -

The regulator didn’t provide any explanation for the much larger payout, but it did release another similar settlement the following day.

March 11 -

Despite industry criticism, the regulator’s ongoing wave of cases has expanded into allegations that wealth managers breached their duty of best execution.

March 3 -

The cuts continue a trend that started 20 years ago.

February 10 -

The regulator has charged about 100 other wealth managers with failing to explain 12b-1 fees tied to their mutual fund recommendations.

January 12 -

The firm faces an additional penalty after it didn’t participate in the regulator’s self-reporting initiative.

December 21 -

In the wake of the regulator’s latest risk alert, compliance experts identify several steps advisors can take to stay clear of more cases and deficiencies.

November 15 -

Higher internal expenses in mutual fund share classes came with much lower overall advisory fees in wrap accounts, the firm argues.

September 28 -

The firms agreed to censures, the settlement payments and to cease-and-desist orders tied to their alleged misconduct.

July 14 -

The case against Centaurus Financial comes after the industry and consumer advocates decried the previous administration’s approach for different reasons.

June 10 -

The litigation reveals how wealth managers’ deals with product sponsors work and how one with a former Voya unit went awry.

April 29 -

The moves come just one day after BlackRock announced reductions on $7.6 billion of its style funds.

March 26 -

The firm has been locked in a contest with runner-up Vanguard for flows, with the latter winning last year for the first time since 2013.

March 22 -

SEC cases that go beyond faulting firms for their failure to disclose conflicts of interest have drawn pushback from the industry.

December 30 -

The allegations involving 12b-1 fees, cash sweeps and commissions also include violations of best execution rules.

December 23 -

In a bid to attract clients left out by AUM fees, IBDs are enabling advisors to take approaches first made popular in the full RIA channel.

December 1 -

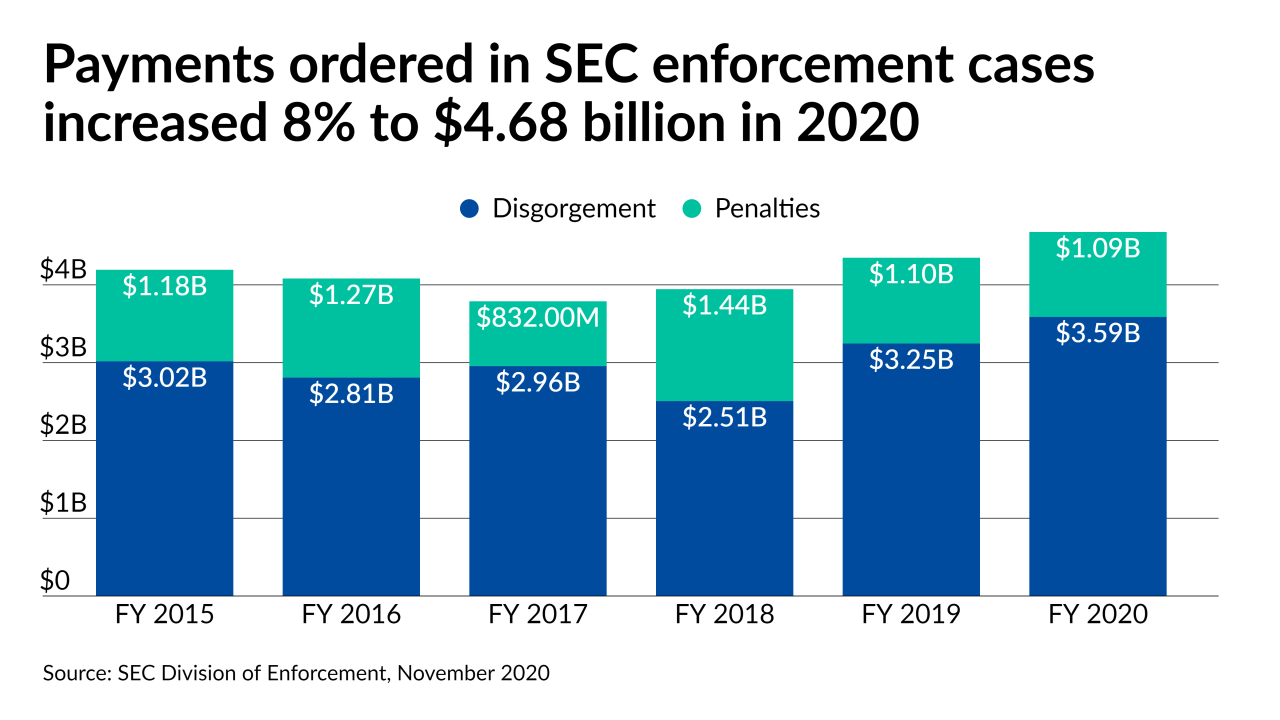

But the regulator also ordered record payouts in 2020, including restitution through a self-reporting program that drew industry ire.

November 5 -

CEO Jamie Price says the change will reduce potential conflicts of interest related to transaction fees and come with lower prices in wrap accounts.

October 29 -

Lower transaction costs can often come with higher expense ratios at the nation’s largest IBD.

August 26 -

The regulator charged a $1.4 billion hybrid firm over disclosure of its cash sweep arrangements with its clearing firm.

August 18