-

“The broker-dealer world has tried to hang their hat on suitability, and if you close your eyes a little and squint, they almost look like fiduciaries — but not really,” one advisor says.

April 20 Momentum Advisors

Momentum Advisors -

If it's not uniform, and it's not a fiduciary standard, then it is at best a modest step forward, investor advocates say.

April 19 -

It appears the regulator bought into the investor choice argument of sales reps right from the beginning.

April 19 Financial Planning

Financial Planning -

New rules recognize the fact that commission-based transaction services can be the most cost effective way for Main Street investors to receive financial advice.

April 19 Baird

Baird -

New rules would set standards of conduct for brokers, require new disclosures and offer interpretive guidance for fiduciary advisors.

April 18 -

The commission's approach stands a good chance of superseding the Labor Department's fiduciary rule.

April 18 -

A spike in volatility and changes in U.S. tax law are some of the reasons why the firm says clients have moved their money in the quarter.

April 12 -

The new fee system will impact more than 800,000 customers.

April 11 -

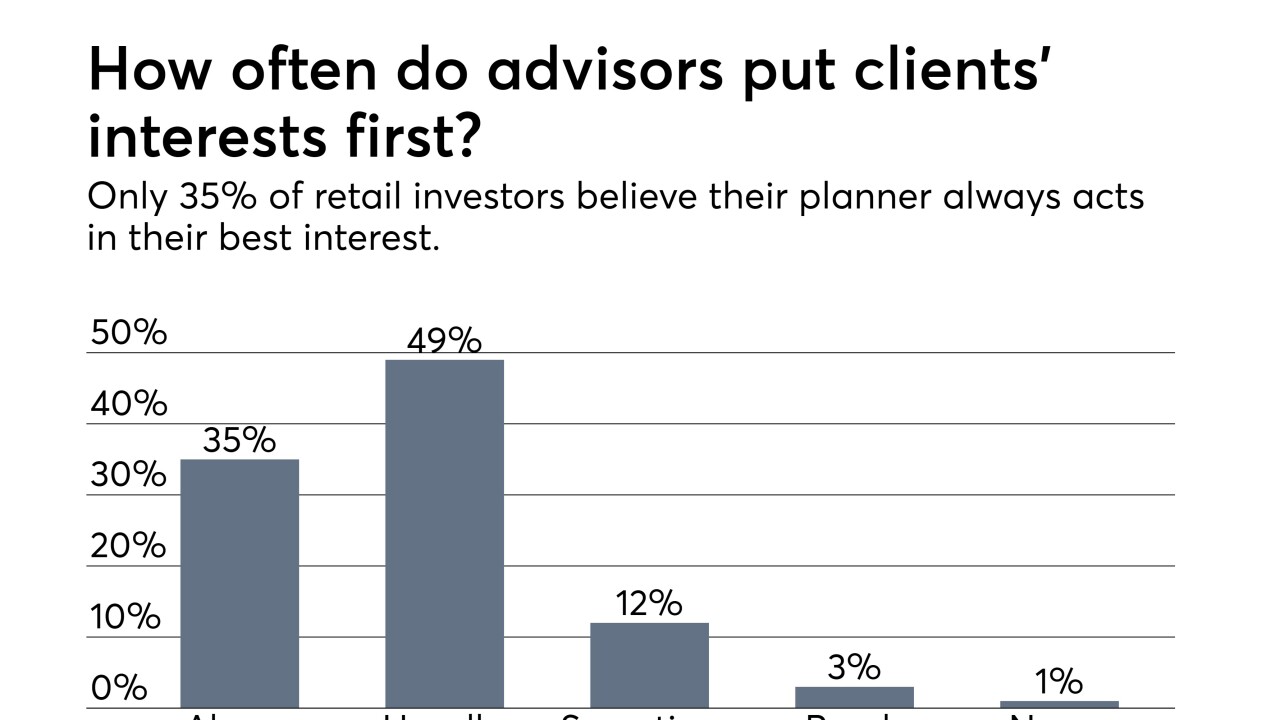

A new survey finds that investors prize full and upfront disclosures about fees and conflicts of interest, but advisors fall short.

April 6 -

Investors brought a class-action suit against brokerage alleging a "scheme to churn revenue from essentially dead assets."

April 5 -

As the financial planning industry nears a fee-only, fiduciary world, independent broker-dealers will face some important choices about their future business models.

April 2 Financial Planning

Financial Planning -

IBDs and regional firms are making the biggest changes, but RIAs have room for growth as well.

April 2 -

Instead of harmonizing standards of client care across the industry, it may be better to re-differentiate them in light of the fiduciary rule's recent court loss.

March 22Institute for the Fiduciary Standard -

After a federal appeals court strikes down the fiduciary rule, a legal path forward seems uncertain, but the regulation has already made its mark.

March 20 -

Merrill Lynch, UBS and others made considerable alterations to policies and procedures in order to be compliant with the Labor Department regulation.

March 19 -

Even after a federal appeals court struck down the rule, more clashes over the regulation of sales versus advice are inevitable.

March 19 -

Seniors should consider designating joint agents, reviewing the security features on their financial accounts, and having their names removed from credit card solicitations.

March 16 -

Industry insiders see the agency proceeding with its rule to harmonize standards for brokers and advisors.

March 16 -

The Department of Labor has an incentive to defend its rule-making authority even though it is considering revisions to the regulation.

March 16 -

A federal court has struck down the rule and the industry’s top online advice executives are speaking out.

March 16