-

Investors flocked to ultra-short bond funds as few are willing to bet against persistent rising rates.

October 5 -

Stellar U.S. economic data, hawkish monetary expectations and strong commodity prices have pushed 10-year and 30-year Treasurys to breakout range.

October 4 -

The "Rule of 100" follows the rule-of-thumb of growing more conservative as investors grow older, but it also may be obsolete since it was developed when interest rates were higher.

October 3 -

The crash of 2008 was intense but, in hindsight, short-lived. Market gains began a few months afterward and have continued with few exceptions.

October 3 -

Dick Lampen says the SEC charges against Dr. Phillip Frost, the firm’s primary shareholder, won’t affect its “significant” other resources.

October 1 -

The iShares 20+ Year Treasury Bond ETF took in close to $2 billion in September, putting it on track for its second most monthly inflows ever.

September 27 -

No one’s talking about the latest Treasury market selloff because it’s tough to find the negative ramifications across other asset classes.

September 20 -

The bond market’s demise has been predicted so many times in recent years that it's hard to keep track. And while returns have been subdued, it's been nothing remotely close to the apocalypse scenario outlined by the bears.

September 18 -

The longest bull run in American history makes this environment an opportune one to cash out equity positions.

September 13 Snowden Lane Partners

Snowden Lane Partners -

Forget bond ladders. Laddering defined-maturity exchange traded funds may be a safer fixed-income strategy for clients.

September 1 -

-

-

To fill the gap, they are looking at the existing debt market with fresh eyes, tapping into potentially overlooked asset classes.

August 29 -

When the financial clouds are gathering, your clients have preparations to make. Top of the list: reduce risk.

August 21 -

-

-

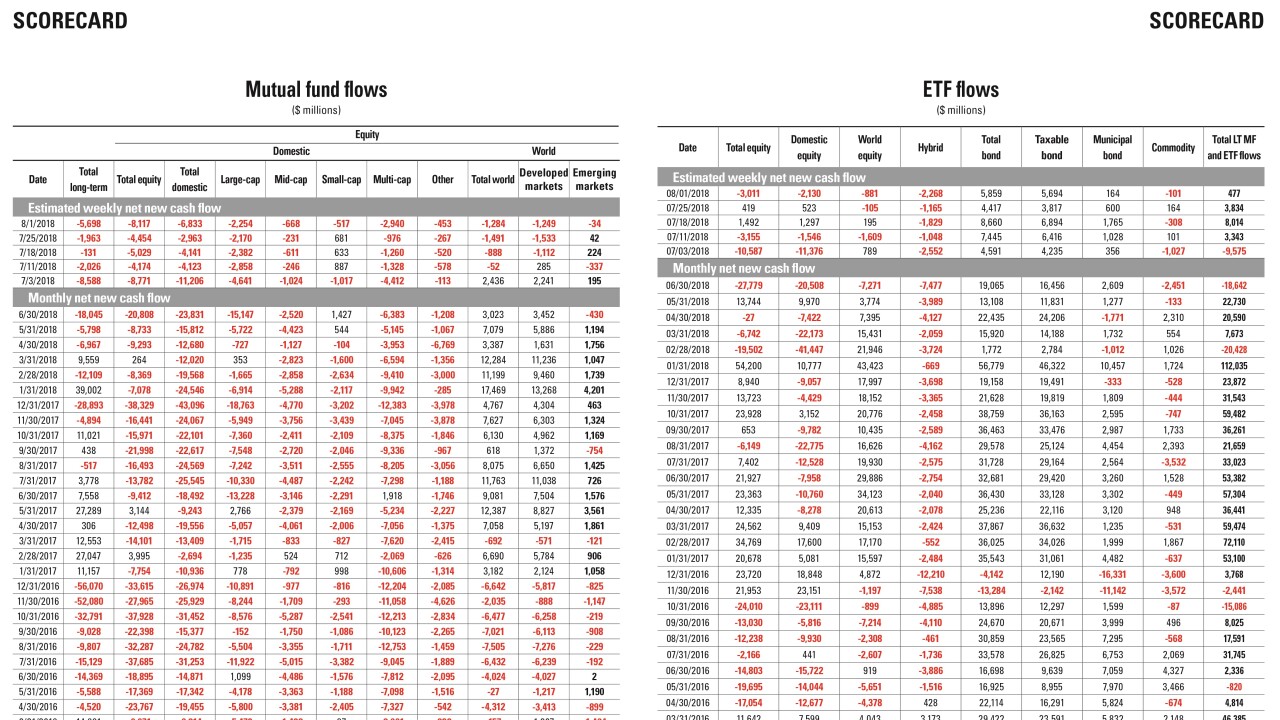

Data reported by the Investment Company Institute.

August 10 -

The shift in strategy comes as central banks move away from policies that have buttressed markets since the financial crisis.

August 8 -

The pool of money will primarily buy investments from so-called side pockets of illiquid stocks created before 2008.

August 6 -

AllianceBernstein’s Gershon Distenfeld is sounding the alarm bell on a strategy that’s grown increasingly popular with some of the world’s biggest bond funds.

August 1