-

Funds focused on the sector lost more than $2.4 billion in August, the most since 2016.

September 2 -

Some of the biggest laggards have managed short-term gains of more than 40%.

September 1 -

Investors are trying to eliminate the cash drag in their portfolios, says Dan Suzuki, deputy CIO at Richard Bernstein.

August 31 -

Among some 500 large-cap U.S. mutual funds, those with at least one-third of manager positions held by women have beaten those with none, data show.

August 31 -

More than 600,000 ounces of the precious metal have been added to ETFs since mid-May.

August 28 -

“The reality is they were always supported by a large team,” according to CEO Jenny Johnson.

August 27 -

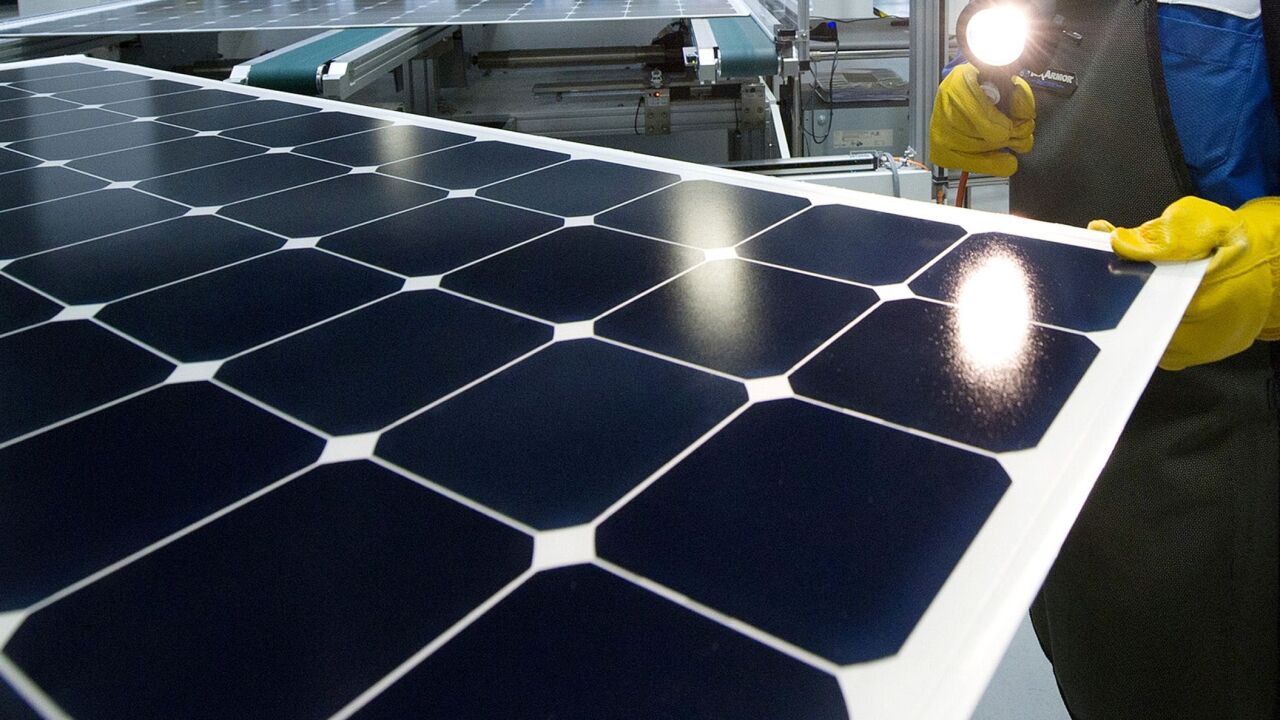

A range of factors have been cited for the clean-tech rally, including maturing wind and solar industries after a collapse in oil prices earlier this year.

August 26 -

More than half of these funds have fees higher than 75 basis points.

August 25 -

Fees for the category's best performing mutual funds and ETFs are much like the price of bullion: expensive.

August 17 -

Now, with a flood of day traders entering the market, a memorable moniker could be more valuable than ever.

August 17 -

If clients “looked just three months ago, these numbers would be glaringly different,” an expert says.

August 10 -

The firm has struggled to make money this year amid the market volatility sparked by the COVID-19 pandemic.

August 6 -

The funds have recorded $248 billion in net inflows in 2020, up about 5% from this time last year.

August 5 -

The alternative asset manager surpassed its previous peak from the fourth quarter of 2017.

August 4 -

The 20 top-performers have generated gains well over 50% in the first seven months of the year.

August 3 -

A combination of GLD’s higher fees and an almost relentless demand for the yellow metal have catapulted it from fourth on the revenue leader board in 2017.

August 3 -

Despite growing to about $1.1 trillion in AUM, senior executives made a series of bets to keep pace in a changing industry that have yet to pay off.

July 29 -

An iShares ETF investing in companies it says has “positive environmental, social and governance characteristics” has more than tripled gains of the S&P 500.

July 28 -

Despite besting the broader market over the long-term, those at the top have underperformed in the first half of 2020.

July 27 -

“The primary drawback of fewer hedge fund filings is lack of clarity around crowding risk,” strategists from the firm write.

July 23