-

In a bid to attract clients left out by AUM fees, IBDs are enabling advisors to take approaches first made popular in the full RIA channel.

December 1 -

Planners and experts dive into wirehouse pay, charging clients at a higher rate, emerging business models and other key issues.

December 1 -

For its next leader, Ohio National turned to a veteran executive with prior experience leading its independent broker-dealer.

November 25 -

James Booth’s seven-year fraud bilked investors out of nearly $5 million.

November 24 -

The No. 1 IBD is responsible for nearly half of the dozen mega-moves in its sector this year.

November 24 -

Necessary new approaches include better cultural understanding, more flexibility for new entrants and more outreach, advisors and executives say.

November 19 -

As the Federal Reserve strives to help the economy, wealth managers’ revenue takes a hit.

November 18 -

In a surprise announcement, Private Advisor Group tapped Moore as CEO nearly two years after he left Cetera for undisclosed medical reasons.

November 18 -

It’s one of the largest recruiting moves of the year in the independent broker-dealer sector.

November 16 -

Five firms agreed to pay $3 million to settle an SEC investigation into unsuitable sales of complex exchange-traded products.

November 16 -

The 40-advisor OSJ brings more than double the assets of any other new group unveiled across the IBD network in 2020.

November 11 -

But the regulator also ordered record payouts in 2020, including restitution through a self-reporting program that drew industry ire.

November 5 -

The private equity-backed firm’s bottom line has been less affected by coronavirus-related low interest rates than its rivals, Moody’s says.

November 4 -

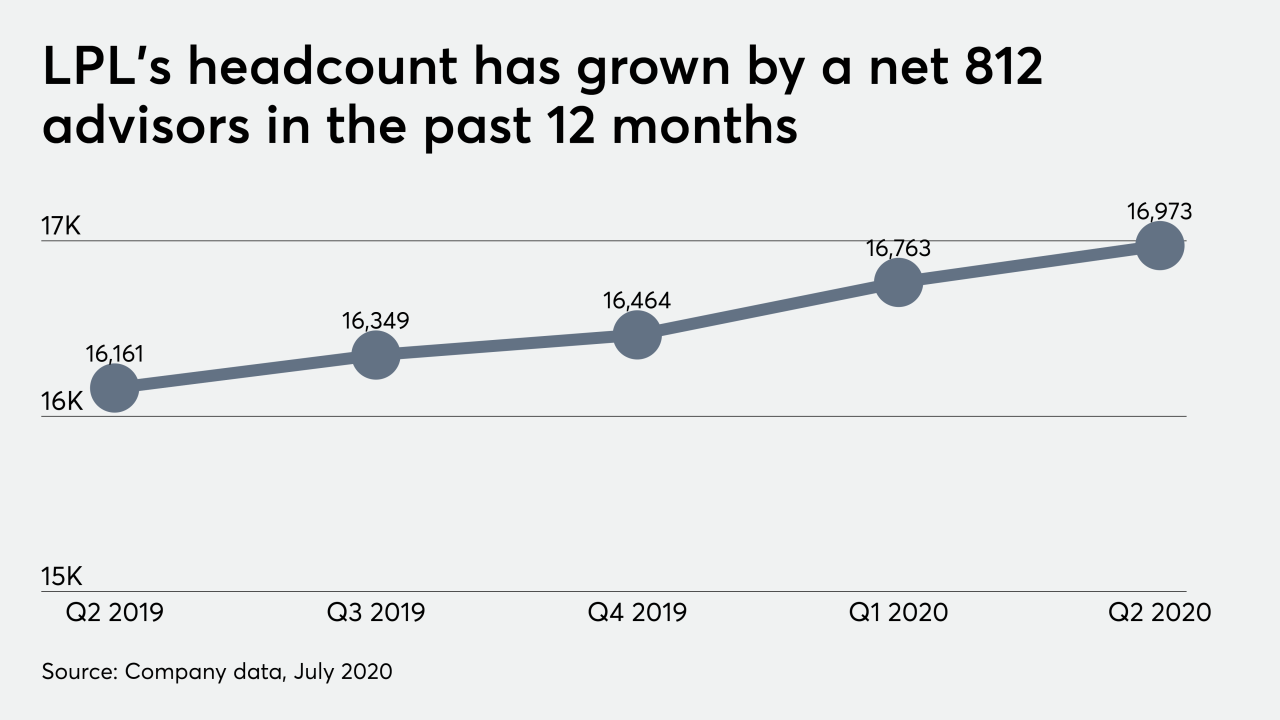

CEO Dan Arnold cites growth in traditional channels and in recently launched models that could bring even more opportunities.

November 3 -

Even with those challenges, rep productivity and client cash balances expanded in the third quarter.

October 30 -

CEO Jamie Price says the change will reduce potential conflicts of interest related to transaction fees and come with lower prices in wrap accounts.

October 29 -

The nation’s largest IBD made its first tech deal this year for a firm that has $120 billion in assets on its platform.

October 27 -

The No. 1 IBD is keeping up the recruiting momentum that’s sustaining record headcounts and billion-dollar moves.

October 23 -

The move represents the third largest out of the IBD channel in 2020, according to company recruiting announcements tracked by Financial Planning.

October 20 -

Genstar Capital Managing Partner Tony Salewski spoke openly with advisors about the firm’s investment strategy for the IBD network.

October 15