-

The 40-advisor OSJ brings more than double the assets of any other new group unveiled across the IBD network in 2020.

November 11 -

But the regulator also ordered record payouts in 2020, including restitution through a self-reporting program that drew industry ire.

November 5 -

The private equity-backed firm’s bottom line has been less affected by coronavirus-related low interest rates than its rivals, Moody’s says.

November 4 -

CEO Dan Arnold cites growth in traditional channels and in recently launched models that could bring even more opportunities.

November 3 -

Even with those challenges, rep productivity and client cash balances expanded in the third quarter.

October 30 -

CEO Jamie Price says the change will reduce potential conflicts of interest related to transaction fees and come with lower prices in wrap accounts.

October 29 -

The nation’s largest IBD made its first tech deal this year for a firm that has $120 billion in assets on its platform.

October 27 -

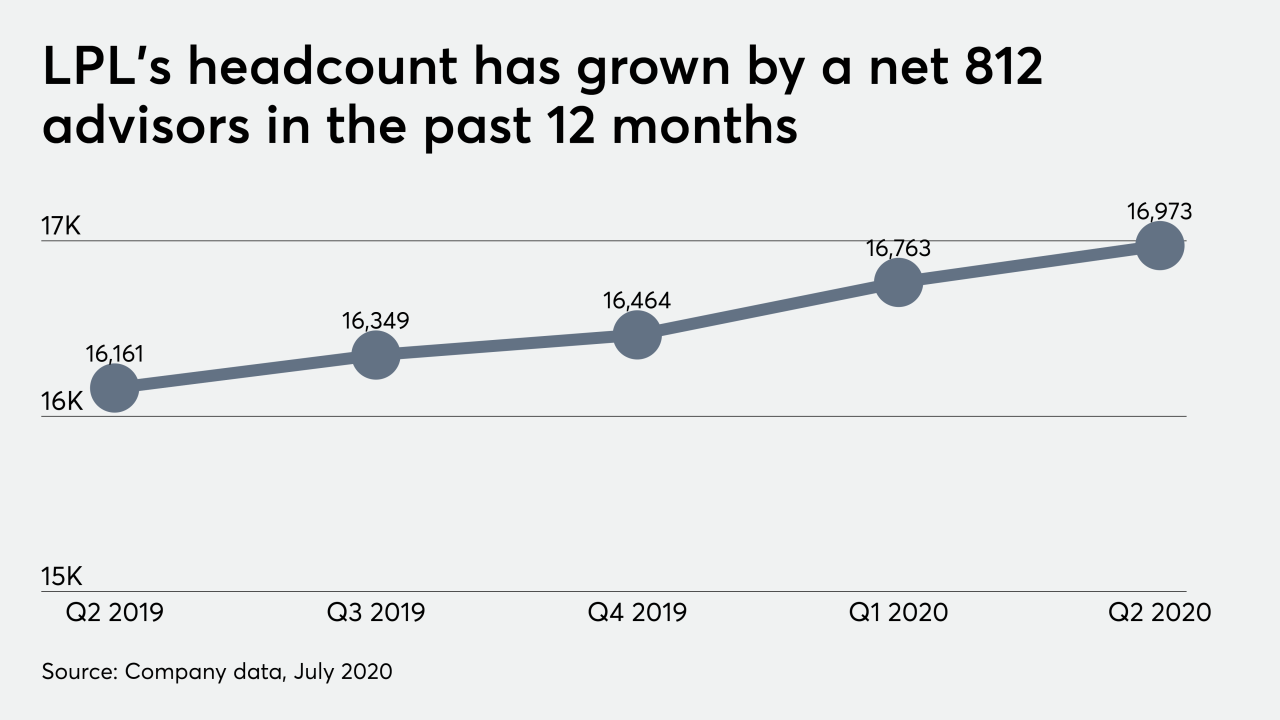

The No. 1 IBD is keeping up the recruiting momentum that’s sustaining record headcounts and billion-dollar moves.

October 23 -

The move represents the third largest out of the IBD channel in 2020, according to company recruiting announcements tracked by Financial Planning.

October 20 -

Genstar Capital Managing Partner Tony Salewski spoke openly with advisors about the firm’s investment strategy for the IBD network.

October 15 -

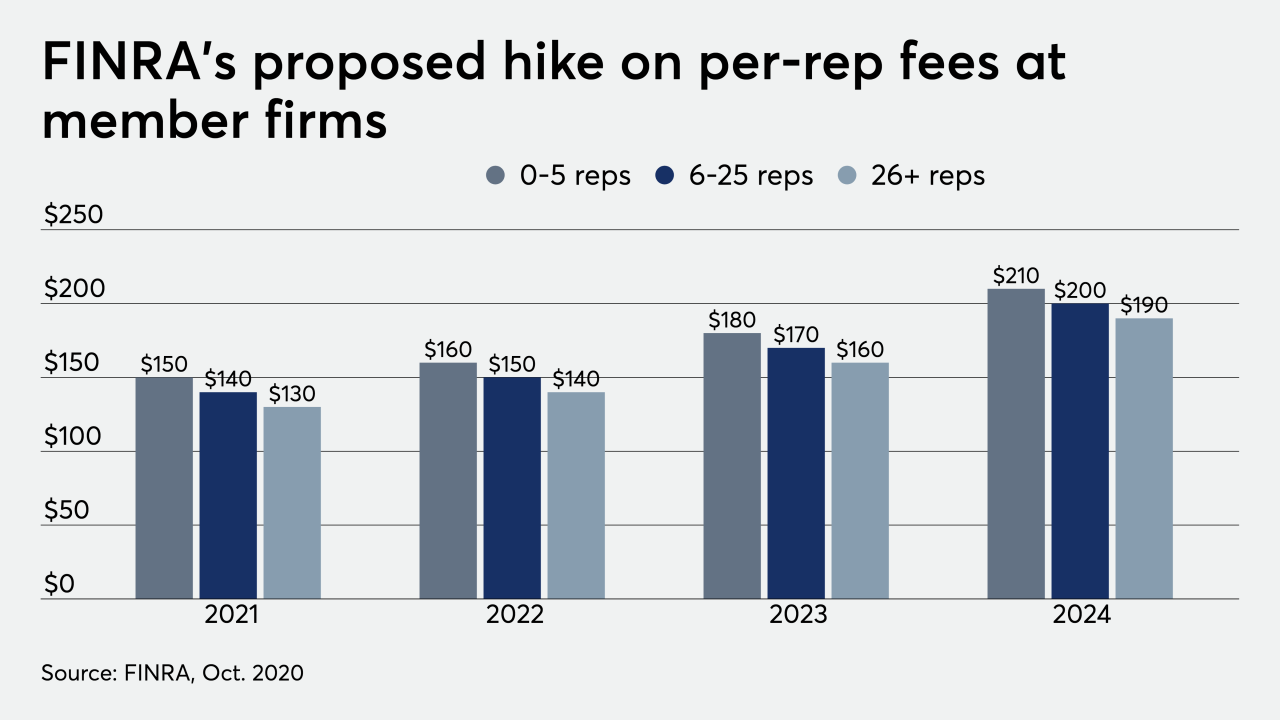

The regulator would generate an additional $225 million per year from the fee increases.

October 9 -

The No. 1 IBD’s 2,500-advisor bank channel will add 285 more reps when two massive investment programs affiliate next year.

October 9 -

The advisor allegedly carried out a 20-year scheme defrauding at least 15 clients through forgery and misrepresentations.

October 7 -

The advisor allegedly used an omnibus trading account to help himself and hurt his clients to the tune of tens of thousands of dollars, according to the regulator.

October 5 -

Demand from clients has some advisors reconsidering sustainable investing strategies.

October 2 -

The discrimination case revolves around allegations of disparate treatment in the firm’s agency distribution channels.

October 1 -

The firm is maintaining control but dropping its FINRA registration as the sector’s rising expenses and lower margins fuel consolidation.

September 30 -

Actions hit a nine-year high and restitution climbed to the highest total since 2013 — even before the rule’s heightened scrutiny.

September 25 -

Bleakley Financial Group also picked up an ex-hedge fund portfolio manager while expanding its national footprint.

September 22 -

The number is behind previous years, but the firm’s new head of business development says independence is more appealing amid the coronavirus.

September 21