-

First Federal Savings Bank of Champaign-Urbana moved its investment services business to LaSalle St. Securities in a bid to deepen relationships with the back-office staff supporting the business.

February 16 -

The firm is tapping a pool estimated by LPL to be as large as 1,200 brokers with $35 billion in client assets.

February 14 -

Robert Moore divided the firm's six IBDs into two channels, promoted a new COO and hired from a rival.

February 13 -

Private Advisor Group reported impressive growth even as other practices of its kind have left the No. 1 IBD.

February 12 -

Cetera, Advisor Group and Securities America are unveiling upgrades they hope will help advisors save time while growing their businesses.

February 12 -

Commission prioritizes retail investors as OCIE issues its must-read compliance letter.

February 8 -

Robert Moore’s view sets him apart from other executives who argue that new talent will replace low producers.

February 7 -

A disaffiliation fee of $4,500 applies to advisors leaving the IBD, but the policy could change.

February 6 -

Pole-vaulting advisor Mark Cortazzo’s practice marked at least the second hybrid in three months to leave the firm for Mutual Securities.

February 6 -

L&N Federal Credit Union was looking for a boutique-style firm following Invest's acquisition by LPL.

February 5 -

Executives from Pershing and Fidelity say smaller firms can find a home in the hybrid space.

February 5 -

More than $34 billion in client assets moved into the No. 1 IBD’s fold in the first part of the acquisition.

February 2 -

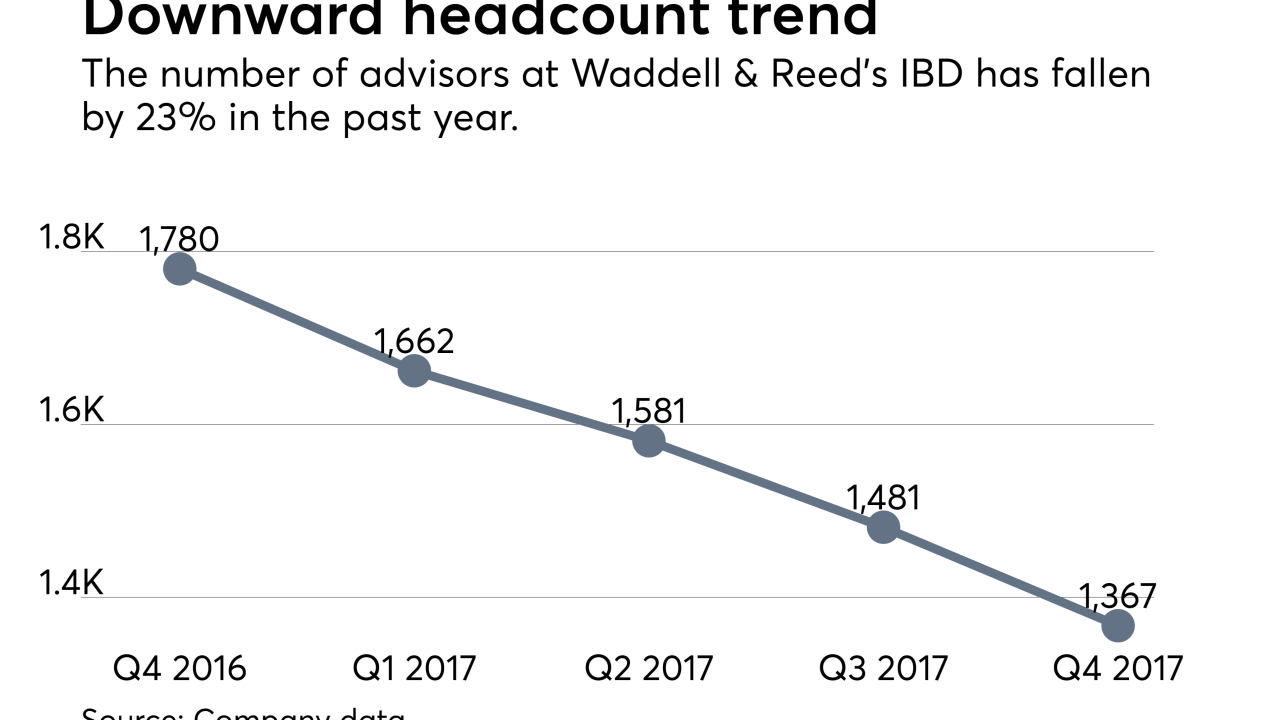

Headcount dropped by 413 brokers year-over-year, but productivity per FA jumped by 29%.

February 1 -

Securities Service Network is entering a space usually regarded in the industry as the specialty of HD Vest and 1st Global.

January 31 -

The four-member group previously generated about $2.5 million in annual revenue.

January 31 -

Call it the ultimate staycation. Planners offer advice on how to work from paradise.

January 31 -

Life Brokerage Financial has 80 advisors and 40 full-time staff and will join the firm next month.

January 30 -

Frequent recruitment adds to the firm’s bench after stemming an outflow of talent late last year.

January 30 -

The bank is removing hurdles to employee advisors switching channels among other recent initiatives.

January 30 -

Parker’s candid responses to Financial Planning’s rapid-fire queries on new digital tools, sexual harassment, Social Security planning, deal-making, how (not) to talk to clients about the stock market run-up and more.

January 29