Swirling

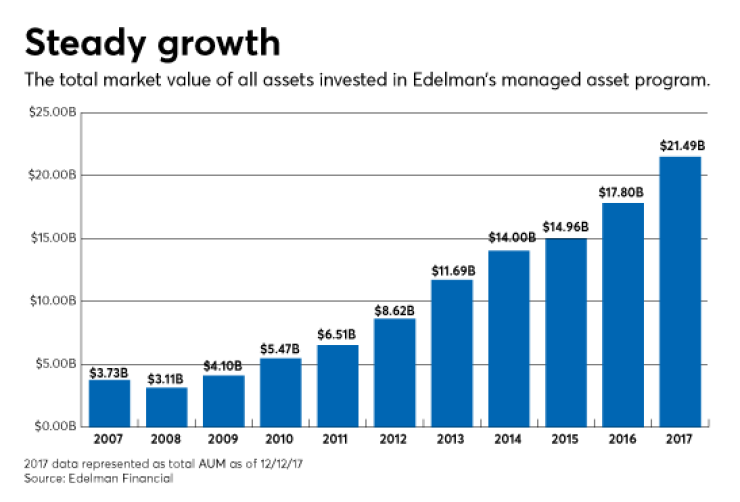

Parker’s insights are particularly influential: Edelman Financial has grown to 43 offices in 21 markets nationwide, and has more than $21 billion in assets under management.

But there’s no time to relax. “The competitive landscape is getting tougher,” Parker told Financial Planning.

His frank answers to a series of unexpected, rapid-fire questions have been edited.

FINANCIAL PLANNING: Is sexual harassment a problem in the financial advisory sector? If yes, what do we do about it?

How do we protect everyone and create a very safe and secure workplace?

RYAN PARKER: Sexual harassment is an issue in the world, so it means that it is

You have to have a really top-notch human resources group. But if you don’t, don’t do it yourself. Spend the money to bring someone in to do the training, to do the assessment. There are great techniques, tools and people out there who can help you. Take advantage of that, because sometimes you don’t know what you don’t know.

FINANCIAL PLANNING: What’s the best way for financial planners to

PARKER: Every custodian has built out a platform that an advisor could integrate to change the client onboarding workflow, whether it’s Orion, TD Ameritrade, Schwab. The first thing I would say is go to whomever your key custodian is and ask them how they can readily come in and enhance the workflow. Because to me it’s not about those being the tools — it’s really about the platform they use.

Don’t try to create Frankenstein’s monster by going out and trying to figure out 15 different APIs you can plug into within your own world, whatever its scale. Instead, look at a thoughtful process, and assess what tools are available, mainly through your custodian, and figure out how to incorporate your unique value into their standardized toolset?

FINANCIAL PLANNING: How should advisors get ready to advise clients on

PARKER: Go and find the most technical explanation that you can stomach, and use that as an opportunity to go and talk to someone who’s a commercial provider. The more educated you are about the basics, and the more you to have your own personal questions, the better it is when you go to Vanguard or Schwab or whatever. You’re going to be able to understand what they say.

If you just go in and get the generic tutorial, it’s not going to be relevant to you and to your practice. So study first, figure out what questions trigger you, and then go seek out someone in the industry who’s studied it, but do it through your own lens.

FINANCIAL PLANNING: Agree or disagree: Advisors must offer Social Security planning?

PARKER: Regardless of your client’s situation,

You absolutely have to have the conversation because if it goes away it’s an unfunded liability in your plan. If it gets better, it’s an upside to your plan. If it remains the same, it’s real and should be part of your plan. So, there’s no scenario where you shouldn’t be talking about the role Social Security will play.

It’s also a great opportunity to add value, because the actual Social Security rules and how you optimize it is really complicated. Most people don’t have the skill or the will to understand it. You, as an advisor, can help people avoid bad choices or under-informed decisions. Or, you can use it as a place to add value, not as a place to check a box.

FINANCIAL PLANNING: As M&A accelerates for RIAs, what could go wrong?

PARKER:

You end up in a bad place where, instead of creating bigger and better companies, you create Frankenstein’s monsters.

Otherwise, you end up in a bad place where, instead of creating bigger and better companies, you create Frankenstein’s monsters.

Done right, it’s a healthy, necessary part of how independent financial planning continues to take share in the industry. Done wrong — and it will be done wrong in some places — it will create some blow-off risk.

So if you’re an advisor looking to be acquired, look in the mirror and make sure you really know who the right suitor is. It’s much more than price.

If you’re the acquirer, really make sure that you have a very disciplined and very thoughtful process. That you’re not just jumping into the fray, because it’s the cool thing to do.

FINANCIAL PLANNING: How should advisors talk to clients about

PARKER: Don’t use the word “dramatic” with your clients for the first instance. And the second thing is, talk to clients now about what you’re going to do together when the market correction comes.