-

Concerned about the wirehouse's "trajectory," Glen D. Smith sought out a business model his kids could join one day.

December 27 -

Kestra Financial’s James Poer offers advisors his three predictions for the new year.

December 22 Kestra Financial

Kestra Financial -

The No. 20 IBD unveiled a total of 15 practices joining its ranks in the fourth quarter.

December 21 -

H. Beck’s incoming president brings experience with her new firm’s earlier ownership structure and its custodian's platforms.

December 20 -

Advisors are jumping to firms with established infrastructure.

December 19 -

The five consultants spent a combined 55 years at the No. 1 IBD, and they set up shop near two of its main corporate offices.

December 18 -

LPL's acquisition of National Planning Holdings' assets alone resulted in 10 moves of $744 million or more of clients assets.

December 18 -

Exclusive: The No. 4 IBD unveiled a new bank-based team even as its competitor began revealing its retained firms under the acquisition.

December 15 -

The seven new hires joined both the independent and employee channels.

December 14 -

The IBD network says it has added 583 advisors so far this year.

December 14 -

Some brokerage firms are concerned that the tax overhaul could spur their employee advisors to set up their own shops or switch firms to lower their tax bills.

December 14 -

In a concession to the advisor, he can still respond to client emails and calls, even though he may not initiate contact.

December 13 -

The change builds on earlier policy shifts at Ameriprise, which previously pulled more than 1,500 funds from its platform.

December 13 -

Roughly 300 ex-NPH advisors have chosen smaller IBDs over LPL Financial after its massive acquisition.

December 13 -

Team of 9 advisors is latest to depart amid transition to LPL.

December 12 -

Some of the new recruits joined from Morgan Stanley just prior to the firm's Broker Protocol exit.

December 7 -

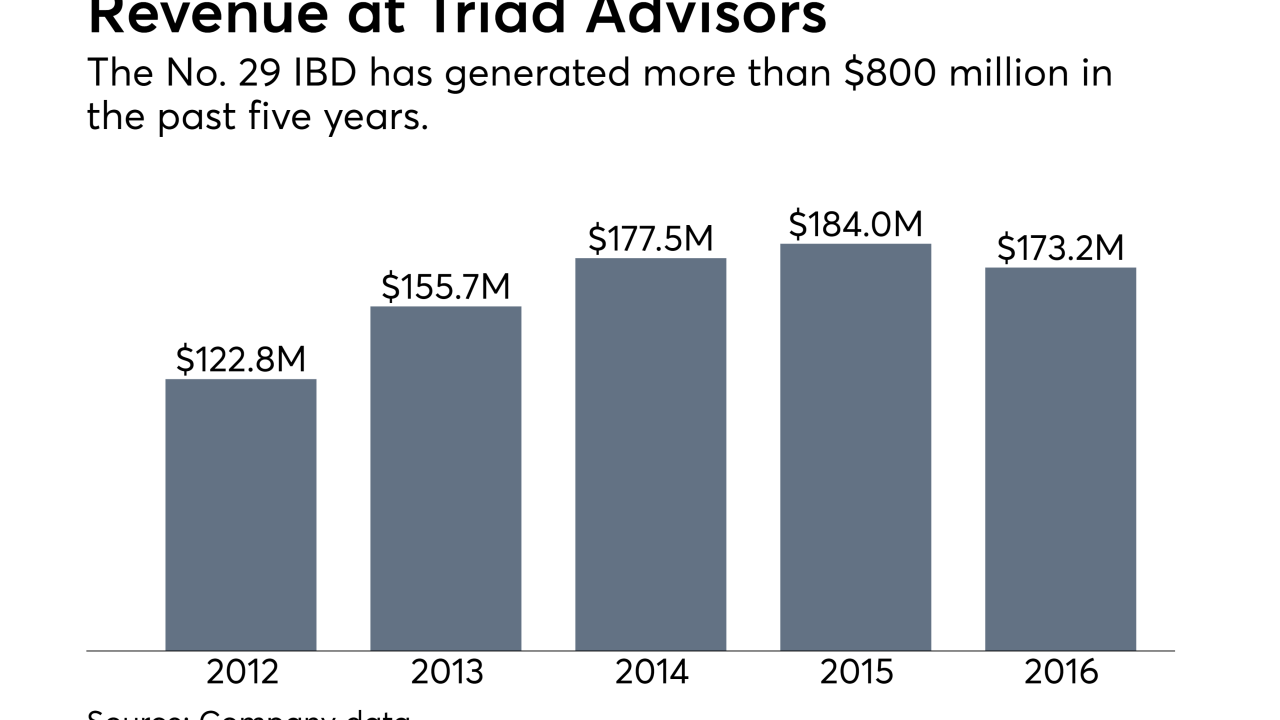

The No. 29 IBD has unveiled two significant recruiting moves in the past two months.

December 7 -

The buyer of the broker-dealer to some 1,200 hybrid advisors is not a private equity firm.

December 5 -

The IBD has boosted payouts for advisors as it trims lower producers from its ranks.

December 5 -

Both advisors are attracted by Ameriprise’s technology and investment options.

December 4