Raymond James swept up seven advisors managing $1.37 billion in client assets in a handful of recently announced moves — one of which came on the eve of UBS's exit from the Broker Protocol.

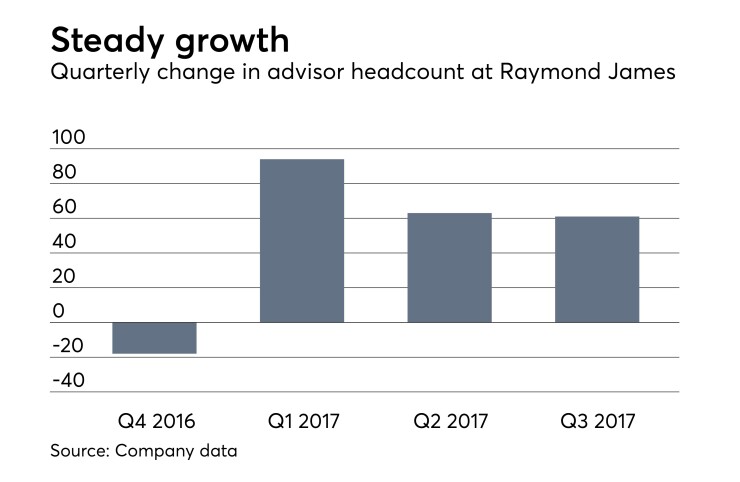

Like its fellow regional and independent broker-dealers, Raymond James has been on a

Among the new hires are Michael Zizmer and Newton Jones. While at UBS, they oversaw about $440 million and generated annual fees and commissions of more than $3.2 million, according to their new employer. They bolted from UBS and officially registered with Raymond James on November 30 — the day before the wirehouse exited the protocol, an industry trade agreement that permits brokers to take basic client contact information when switching firms.

"I believe our firm’s reputation for respecting the advisor-client relationship as well as our stance on honoring the broker protocol helped persuade Mike and Newton that Raymond James was the right firm for them to continue to grow their business," Tash Elwyn, president of Raymond James & Associates, said in a statement.

The Winter Park, Florida-based team manages mostly high-net-worth accounts, and their clients’ well-heeled needs were a deciding factor in the decision, they say. “The acquisition of Alex. Brown also gave us significantly more confidence that the high-net-worth platform we sought for clients would be there,” Jones says. The

Zizmer began his career at Merrill Lynch in 1988 and moved to UBS in 2008, according to FINRA BrokerCheck records. Jones followed his father, a 30-year Merrill Lynch executive, into the business at the wirhouse in 1996, according to a company release. Jones also moved to UBS in 2008, per BrokerCheck.

A team managing approximately $800 million in client assets joined Raymond James's independent channel from Wells Fargo Advisors Financial Network, according to Raymond James.

A massive acquisition, the possible end of the Broker Protocol and other issues will shape the industry in 2018.

The Normann Financial Group — consisting of Kel Normann, Eric Vernon, Murphy Paderick, and Miller Robins — generated approximately $4 million in annual productions, according to a company release.

"When evaluating firms, the most important thing to us was the firm’s commitment to its wealth management business,” Normann said in a statement.

The Sanford, North Carolina-based team joined Raymond James in October, according to FINRA BrokerCheck records.

Veteran financial advisor James Baber bolted for Raymond James’ employee channel from Janney Montgomery Scott, where he previously managed approximately $125 million in client assets, according to his new employer. He is joined by client associate Carla Graham and they operate as Baber Wealth Management.

Baber said he was motivated to make the move ― which occurred in late September, per BrokerCheck records ― partly because of investments Raymond James has made in its technology platform.

Baber, who is based in Richmond, Virginia, began his career in 1996 with Legg Mason. He joined Janney Montgomery Scott in 2011, per BrokerCheck.

Raymond James now has $704 billion in client assets and 7,300 independent and employee advisors, according to company.