-

Firms affiliated with the broker-dealer can access the software for free through AdviceWorks.

January 19 -

The founding partners of the 300-advisor OSJ will remain in their current roles for three years under the same structure as before the deal.

January 13 -

The IBD completed a stellar recruiting year by adding a team led by a 30-year veteran advisor.

January 6 -

The firm’s use of third-party compliance vendors came under scrutiny after an ex-rep pleaded guilty to bilking clients out of $5 million.

January 5 -

SEC cases that go beyond faulting firms for their failure to disclose conflicts of interest have drawn pushback from the industry.

December 30 -

The wealth manager whose parent firm also owns an insurer and asset manager settled its third case involving the same time period.

December 23 -

The allegations involving 12b-1 fees, cash sweeps and commissions also include violations of best execution rules.

December 23 -

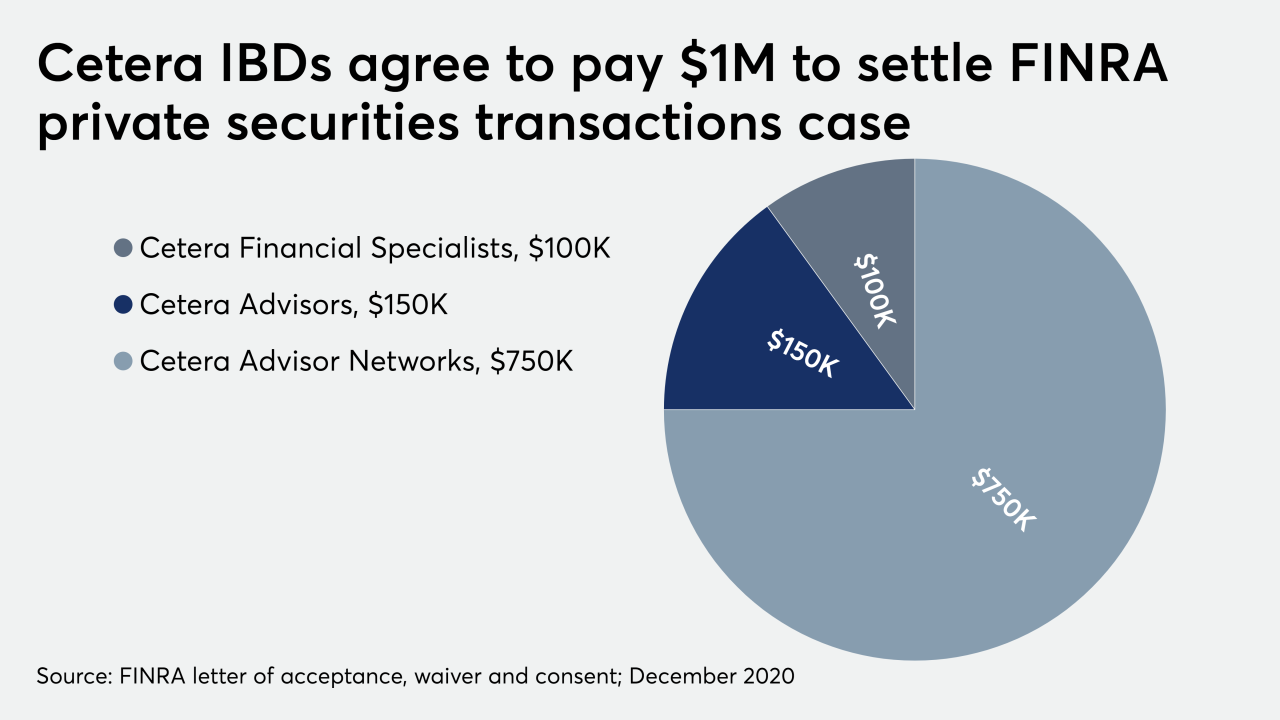

Despite pledges, the IBD network didn’t collect enough data for suitability reviews of the outside transaction for more than five years, according to the regulator.

December 22 -

LPL Financial and indie rivals like Raymond James, Wells Fargo FiNet and Kestra Financial completed at least 17 recruiting grabs of $800 million or more this year.

December 18 -

It’s one of the largest teams to quit a wirehouse this year.

December 14